Operating Leverage

advertisement

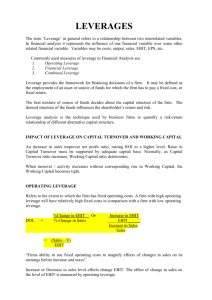

Operating Leverage The concept of operating leverage refers to the process of replacing people with machines. Contrary to popular notions of life-time employment that developed during the 1950s, the normal business processes requires that firms continuously improve efficiency. This we learned from economics. For most of the 1950s through the 1970s firms had little incentive to follow this practice since U.S. labor was relatively cheap. With the growing power of the unions this changed. A situation was created where global competitors were able to improve productivity at a faster rate than U.S. firms. Replacing people with machines was not allowed by unions. Management’s hands were tied by the very system that they had created. Even today, the idea of using operating leverage is politically incorrect – but essential to survival. To measure operating leverage you can use a number of approaches. The basic idea is to see if the firm is making capital investments to improve productivity. One approach takes us back to the idea of economies of scale. Measure capital investment as a percentage of sales over time. Then use an appropriate measure of productivity. If the firm is using operating leverage you should see capital investments increasing over time and productivity improving over time. Measuring productivity seems to be a problem for some, so I suggest a couple of ways. First, get a text book on operations management. Second, look at total sales divided by number of employees. The ratio should be increasing. This is a poor measure at best, but a good one given the lack of data sources. A third approach – taken from an operations text book – is to use this formula: DOL (degree of operating leverage) = percentage change in EBIT / percentage change in sales. Note that this is not raw numbers, but %ages! Operating leverage results from the existence of fixed costs in the firm’s income stream. The degree of operating leverage is the numerical measure of the firm’s operating leverage. Whenever the percentage change in EBIT resulting from a given percentage change in sales is greater than the percentage change in sales, operating leverage exists. This means that as long as DOL is greater than 1, there is operating leverage. Do this over a 5 year period. You should see a positive change in the degree of operating leverage. Don’t be frightened by the strange numbers that will occur – stick with the theory.