Chapter 15 Bonus Quiz

advertisement

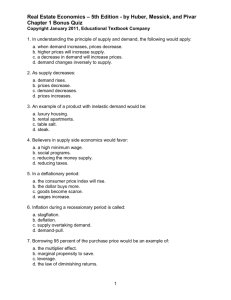

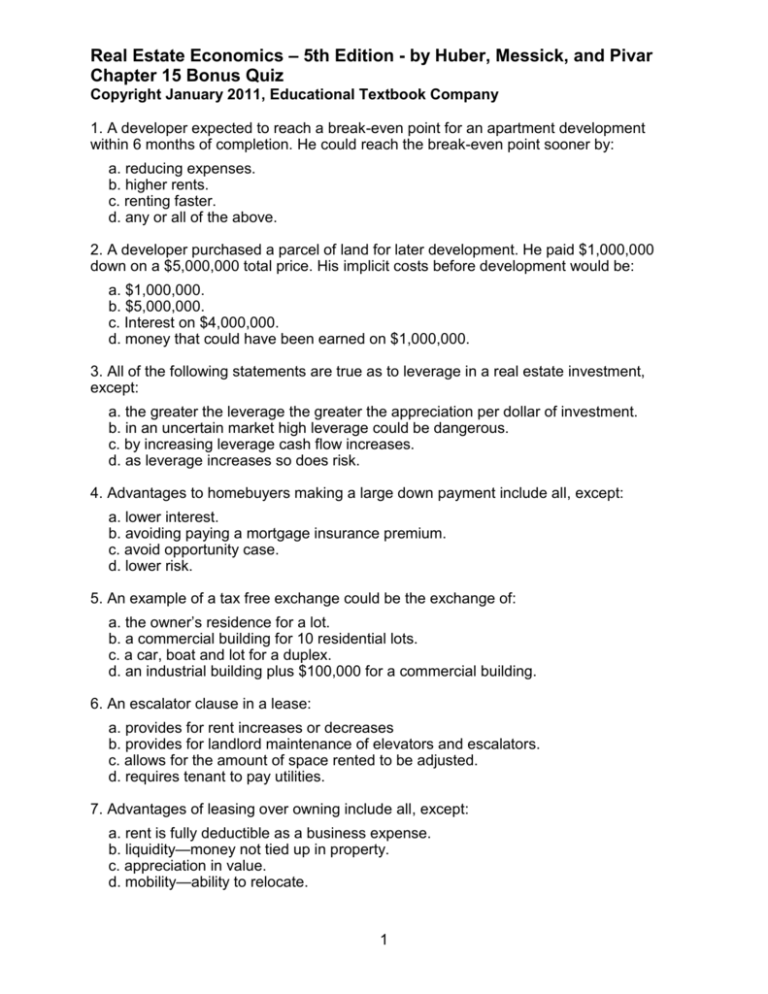

Real Estate Economics – 5th Edition - by Huber, Messick, and Pivar Chapter 15 Bonus Quiz Copyright January 2011, Educational Textbook Company 1. A developer expected to reach a break-even point for an apartment development within 6 months of completion. He could reach the break-even point sooner by: a. reducing expenses. b. higher rents. c. renting faster. d. any or all of the above. 2. A developer purchased a parcel of land for later development. He paid $1,000,000 down on a $5,000,000 total price. His implicit costs before development would be: a. $1,000,000. b. $5,000,000. c. Interest on $4,000,000. d. money that could have been earned on $1,000,000. 3. All of the following statements are true as to leverage in a real estate investment, except: a. the greater the leverage the greater the appreciation per dollar of investment. b. in an uncertain market high leverage could be dangerous. c. by increasing leverage cash flow increases. d. as leverage increases so does risk. 4. Advantages to homebuyers making a large down payment include all, except: a. lower interest. b. avoiding paying a mortgage insurance premium. c. avoid opportunity case. d. lower risk. 5. An example of a tax free exchange could be the exchange of: a. the owner’s residence for a lot. b. a commercial building for 10 residential lots. c. a car, boat and lot for a duplex. d. an industrial building plus $100,000 for a commercial building. 6. An escalator clause in a lease: a. provides for rent increases or decreases b. provides for landlord maintenance of elevators and escalators. c. allows for the amount of space rented to be adjusted. d. requires tenant to pay utilities. 7. Advantages of leasing over owning include all, except: a. rent is fully deductible as a business expense. b. liquidity—money not tied up in property. c. appreciation in value. d. mobility—ability to relocate. 1 8. Advantages in owning rather than renting include all, except: a. deductibility of rent payment. b. protection against rent increases. c. depreciation of improvements. d. appreciation in value. 9. A business can raise capital and reduce debt in its balance sheet by: a. a tax free exchange. b. a sale leaseback. c. leasing the land and building. d. use of leverage. 10. The reason most buildings are not built to last 200 years is that: a. the style will change. b. the area may change. c. uses will change. d. buyers are not eager to pay extra for longer life structures. 11. A property should be demolished if: a. the improvements do not contribute to income. b. another structure would provide greater gross income. c. the property is vacant. d. rents are declining. 12. You decide to build the type of structure that you can produce more efficiently than your other possible choices. This is an example of the principle of: a. change. b. comparative advantage. c. competition. d. anticipation. 13. An owner receives an offer. The owner accepts with a change in the proposed date for closing. The owner: a. has excepted the offer. b. rejected the offer. c. made a counter offer. d. both b and c. 14. What law only applied to race? a. Civil Rights Act of 1866 b. Civil Rights Act of 1968 c. Americans with Disabilities Act d. Equal Credit Opportunity Act 15. A broker never showed homes in the subdivision he lived in to African Americans although he had numerous listings that met the criteria of many inquiries from African Americans. This is an example of: a. redlining. b. block busting. c. steering. d. coercion. 2 Real Estate Economics – 5th Edition - by Huber, Messick, and Pivar Chapter 15 Bonus Quiz Answers Copyright January 2011, Educational Textbook Company 1. d (p) 2. d (p) 3. c (p) 4. c (p) 5. b (p) 6. a (p) 7. c (p) 8. a (p) 9. b (p) 10. d (p) 11. a (p) 12. b (p) 13. d (p) 14. a (p) 15. c (p) 3