Presentation 3-4

advertisement

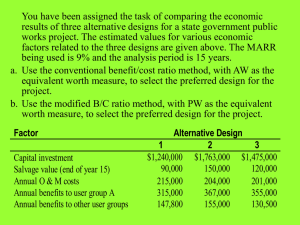

Lectures in Engineering Economy Prof. Corrado lo Storto DIEG, Dept. of Economics and Engineering Management School of Engineering, University of Naples Federico II email: corrado.lostorto@unina.it phone: 081-768.2932 Major issues What is MARR? What is the cost of capital? What is the relation between cost of capital and financing funds? How can we measure the cost of capital? MARR, IRR and the cost of capital Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Minimum requirements of acceptability (MARR) The interest rate or discount rate that should be used to estimate cash flows for several competing alternatives is the minimum attractive/acceptable rate of return (MARR). MARR is also called the cost of capital. The determination of MARR is generally controversial and difficult. An easy method to compute for determining what is alleged to be the minimum rate of return is to determine the rate of cost of each source of funds and to weight these by the proportion that each sources constitutes of the total. Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto MARR: example If 1/3 of the capital of a firm is borrowed at 6% and the remainder of its capital is equity earning 12%, then the alleged minimum rate of return is 1 2 6% + 12% = 10% 3 3 Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto MARR and capital budgeting MARR determination is a task of capital budgeting. Capital budgeting is a critical function that takes place at the highest level of management. It can be defined as: “The series of decisions by individual economic units as to how much and where resources will be obtained and expended for future use, particularly in the production of future goods and services”. However, many decisions at the lower level in the management hierarchy affect those proposals competing in the overall capital budget. For example, before a major project is considered in top management capital budgeting process, usually many sub-alternatives of design and technical specifications are considered and the related decisions have been made. Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto The scope of Capital Budgeting The scope of capital budgeting addresses 1. how the money is acquired and from what sources 2. how individual capital project opportunities (and combination of opportunities) are identified and evaluated 3. how minimum requirements of acceptability are set 4. how final project selections are made, and 5. how post-mortem reviews are conducted Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto MARR calculation There are different school of thought relatively to how MARR can be calculated. 1. if particular projects are to be undertaken using borrowed funds, then the minimum rate of return should be based on the rate of cost of those borrowed funds alone; 2. the minimum rate of return should be based on the cost of equity funds alone, on the grounds that a firm tends to adjust its capitalization structure to the point at which the real costs of new debt and new equity capital are equal (see E. Solomon “The management of corporate capital, The Free Press, NY); 3. Modigliani and Miller developed a theory that asserts that the average cost of capital to any firm is completely independent of its capital structure and is strictly the capitalization rate of future equity earnings; 4. another way to determine the minimum rate of return is to consider it as an opportunity cost in the “capital rationing” perspective. Capital rationing describes what is necessary when there is a limitation of funds relative to prospective proposals to use the funds. This limitation may be either internally or externally imposed. Its parameter is often expressed as a fixed sum of capital, but when the prospective returns from the investment proposals together with the fixed sum of capital available to invest are known, then the parameter can be expressed as a minimum acceptable rate of return, or cut-off rate. Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto MARR calculation Ideally, the cost of capital by the opportunity cost principle can be determined by ranking prospective projects according to a ladder of profitability and then establishing a cut-off point where the capital is used on the better projects. The rate of return earned by the last project before the cut-off point is the cost of capital or minimum rate of return by the opportunity cost principle. Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto MARR calculation 45 Prospective rate of return 40 35 30 25 20 15 10 5 0 1 2 3 4 5 Amount of money invested Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto MARR standards It is not uncommon for firms to set two or more MARR levels according to risk categories. 1. High risk (MARR=40%) New products, new business, acquisitions, joint venture 2. Moderate risk (MARR=25%) Capacity increase to meet forecasted sales 3. Low risk (MARR=15%) Cost improvements, make versus buy, capacity increase to meet existing order Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto MARR standard determination To determine MARR standards, the firm could rank prospective projects in each risk category according to the prospective rates of returns and investment amounts. After tentatively deciding how much investment capital should be allocated to each risk category, the firm could then determine the MARR for each risk category for a single category. In theory, it would be desirable that a firm invest additional capital as long as the return from the capital were greater than the cost of obtaining that capital. In such a case, the opportunity cost would be equal to the marginal cost of the last capital used. In practice, the amount of capital actually invested is more limited due to risk and conservative money policies. Hence, the opportunity cost is higher than the marginal cost of the capital. Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto MARR standard determination Since managers cannot truly know the opportunity cost for capital in any given period (such as a budget year), it is useful to proceed as if the MARR for the upcoming period were the same as in the previous period. In addition to the normal difficulty of projecting the profitability of future projects and acceptability to permit the approval of favored, even if economically undesirable, projects or classes of projects. Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Minimum Acceptable Rate of Return • Lower limit for investment acceptability • Criterion set by organization • Before-tax calculations • Depends on the cost-ofcapital (expense for acquiring funds) • Determined by: – Organization circumstances and goals – Project risk (high-risk requires higher return rate) Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Cost of Capital – What is it? Cost of capital is the risk-adjusted discount rate (k) to be used in computing a project’s NPV. Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Methods of Financing • Equity Financing – Capital is coming from either retained earnings or funds raised from an issuance of stock Capital Structure • Debt Financing – Money raised through loans or by an issuance of bonds • Capital Structure – Well managed firms establish a target capital structure and strive to maintain the debt ratio Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Debt Equity Equity Financing Flotation (discount) Costs: the expenses associated with issuing stock Types of Equity Financing: • Retained earnings • Common stock • Preferred stock Retained earnings + Preferred stock + Common stock Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Debt Financing Bond Financing: • Incur floatation cost • Pay only interests at the end of each period (usually semiannually) • Pay the entire principal (face value) in a lump sum when the bond matures Term Loan: • Involve an equal repayment arrangement. • May incur origination fee • Allow terms to be negotiated directly between the borrowing company and a financial institution Bond Financing + Term Loans Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Cost of Capital Cost of Equity (ie) – Opportunity cost associated with using shareholders’ capital Cost of Capital (k) – Weighted average of ie and id Cost of Debt Cost of capital Cost of Debt (id) – Cost associated with borrowing capital from creditors Cost of Equity Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Calculating the Cost of Equity Cost of Retained Earnings (kr) Cost of issuing New Common Stock(ke) Cost of Preferred Stock (kp) Cost of equity: weighted average of kr ke, and kp Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Cost of Retianed Earnings Cost of Issuing New Stock Cost of Issuing Preferred Stock Method 1: Calculating Cost of Equity Based on Financing Sources ie (cr / c e )k r (c c / c e )k e (cp / c e )k p Where Cr = amount of equity financed from retained earnings, Cc = amount of equity financed from issuing new stock, Cp = amount of equity financed from issuing preferred stock, and Ce = Cr + Cc + Cp Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Example: Determining the Cost of Equity Source Amount Interest Rate Fraction of Total Equity Retained earnings $1 M 20.50% 0.167 New common stock $4 M 22.27% 0.666 Preferred stock $1 M 10.08% 0.167 ie (0.167)(0.205) (0.666)(0.2227) (0.167)(0.1008) 19.96% Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Method 2: Calculating Cost of Equity based on CAPM • The cost of equity is the risk-free cost of debt (20 year U.S. Treasury Bills around 7%) plus a premium for taking a risk as to whether a return will be received. • The premium is the average return on the market, S&P 500, (i.e., 12.5%) less the risk-free cost of debt. This premium is multiplied by beta, a measure of stock price volatility. • Beta quantifies risk and is an approximate measure of stock price volatility. It measures one firm’s stock price compared (relative) to the market stock prices as a whole. • A number greater than one means that the stock is more volatile than the market on average; a number less than one means that the stock is less volatile than the market on average. Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Method 2: Calculating Cost of Equity based on CAPM The following formula quantifies the cost of equity (ie). i e rf [rM rf ] where rf = risk free interest rate (commonly referenced to U.S. Treasury bond yield) rM = market rate of return (commonly referenced to average return on S&P 500 stock index funds) Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Terminology relative to Common Stock 1.Common Stock: Ownership shares in a publicly held corporation 2.Secondary Market: Market in which already issued securities are traded by investors 3.Dividend: Periodic cash distribution from the firm to the shareholders Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Valuing Common Stocks • Key concept: expected return rate • Expected Return Rate: The percentage yield that an investor forecasts from a specific investment over a set period of time • “Market Capitalization Rate” Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Market Capitalization Rate • • • DIVt: dividend during year t Pt: stock price at end of year t Using a single-period model: DIV1 P1 P0 r P0 • • • DIV1/P0: Dividend yield P1-P0: Capital gain (P1-P0)/P0: Capital appreciation r DIV1 P1 P0 P0 P0 Market capital - Dividend ization rate yield Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Capital appreciati on Valuing Common Stocks Example: Company X stock is selling at $100 a share. Expected dividends over the next year $5. Expected price in a year $110. DIV1 P1 P0 5 110 100 r .15 15% P0 100 Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Valuing Common Stocks Example: Company X stock. Expected dividends over the next year $5. Expected price in a year $110. Given that equally risky investments have a capitalization rate of r=15%, what is the price of the stock today? P0 Equilibrium condition of capital markets: All securities in the same risk class are priced to offer the same expected rate of return DIV1 P1 1 r $5 $110 P0 $100 1 .15 Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Dividends vs. Capital Gains Beginning of 1st yr: investor buys at P0 based on • dividends for 1st yr, and • sell price at end of 1st yr DIV1 P P0 1 1 r 1 r End of 1st yr: another investor is willing to buy at P2 P1 Combining the two: P0 DIV2 P 2 1 r 1 r DIV1 DIV2 P2 1 r 1 r 2 1 r 2 Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Dividends vs. Capital Gains DIV1 P 1 1 r 1 r DIV3 DIVt DIV1 DIV2 ... t 1 r 1 r 2 1 r 3 t 1 1 r P0 Question: Which of the following is the value of a stock is equal to? 1.The discounted PV of the sum of next period’s dividend plus next period’s stock price, or 2.The discounted PV of all future dividends Answer: Both Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Dividend Discount Model • Finite horizon of H periods: H P0 t 1 DIVt PH , H 1,2,... t H 1 r (1 r ) • Infinite horizon: P0 t 1 DIVt 1 r t • Criticism against model: “shortsighted investors do not care about long-run stream of dividends” • But: an investor who wants to cash out early must find another investor who is willing to buy Dividend-discount model holds even if investors have short-term horizons Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Valuation of Different Types of Stocks Comment: “Growth” typically refers to EPS (earnings per share) The examples assume that DIV grow at the same rate as EPS 1. Zero Growth DIV1 DIV2 DIV3 ... P0 DIV1 DIV1 ... 2 1 r 1 r P0 DIV1 r [Perpetuity Formula] 2. Constant Growth (rate g) DIV1 , DIV1 (1 g), DIV1 (1 g)2 , ... P0 DIV1 DIV1 (1 g) ... 2 1r 1 r P0 DIV1 rg [Growing Perpetuity Formula] Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Dividend Discount Model 1. Where does g (growth rate) come from? 2. Where does r (return rate) come from? Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Where Does g Come From? • Growth: earnings next year are higher than this year • Payout Ratio: fraction of earnings paid out as dividends • Net investment necessary for growth • Plowback or Retention Ratio: fraction of earnings retained by the firm • Part of this year’s earnings are retained (not paid out as dividends) and reinvested • Growth rate Plowback Return on retained g earnings ratio Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Formula for Firm’s Growth Rate • DIV: dividends per share • EPS: earnings per share Payout Plowback DIV 1 ratio ratio EPS • ROE: return on equity Return on retained earnings Plowback Return on retained g ratio earnings DIV g 1 ROE EPS ROE Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Where Does r Come From? Two methods: 1. Risk analysis 2. Dividend discount model r DIV1 g P0 Dividend Discount Model: • Assume constant growth DIV1 DIV1 P0 r g rg P0 • DIV, P0: publicly available information • g: estimate Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Example: Estimating Growth and Return Rates Example: Krueger Enterprises has 1 million shares outstanding. Firm just reported earnings of $2 million. It plans to retain 40% of earnings. Historical ROE has been 16%, a figure that is expected to continue in the future. The stock is selling at $10. What is the rate of return? • Growth rate Plowback ROE (0.40)(0.16) 6.4% g ratio • Earnings a year from now $2,000,000(1 0.064) $2,128,000 • Dividends $2,128,000(1 0.40) $1,276,800 • Dividends per share DIV1 $1,276,800 $1.28 1,000,000 • Return rate r DIV1 $1.28 g 0.064 19.2% P0 $10 Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Estimating Growth and Return Rates Assumptions/Approximations: • Return on retained earnings equal to historical ROE • Plowback ratio remains the same • Constant growth Extreme Cases: • No-dividend firm • g close to r : infinite-growth Suggestions: 1. Estimate r for an entire industry – averaging reduces estimation error 2. A high estimate of the growth rate (g close to r): • might be correct for the next few years • cannot be sustained forever firm Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Example: Dividends vs. Growth Opportunities Example: Krueger Enterprises forecasts to pay a $5.00 dividend next year, which represents 100% of its earnings. This will provide investors with a 12% expected return. Instead, the firm decides to plow back 40% of the earnings at the firm’s current return on equity of 20%. What is the value of the stock before and after the plowback decision? • No Growth: P0 DIV1 $5 $41.67 r 0.12 • With Growth: g (0.4)(0.2) 8% DIV1 $5(0.6) $3 P0 DIV1 $3 $75 r g 0.12 0.08 Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Practice Problem – Cost of Equity Alpha Corporation needs to raise $10 million for plant modernization. Alpha’s target capital structure calls for a debt ratio of 0.4, indicating that $6 million has to be financed from equity. Alpha is planning to raise $6 million from the financial market Alpha’s Beta is known to be 1.8, which is greater than 1, indicating the firm’s stock is perceived more riskier than market average. The risk free interest rate is 6%, and the average market return is 13%. Determine the cost of equity to finance the plant modernization. Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Solution ? Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Calculating the Weighted (after-tax) Cost of Capital k i d C d i eC e V V Cd= Total debt capital(such as bonds) in dollars, Ce=Total equity capital in dollars, V = Cd+ Ce, ie= Average equity interest rate per period considering all equity sources, id = After-tax average borrowing interest rate per period considering all debt sources, and k = Tax-adjusted weighted-average cost of capital. Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Example: calculation of the Cost of Capital • Given: Cd = $4 million, Ce = $6 million, V= $10 millions, id= 6.92%, ie=19.96% • Find: k 0.0692(4) 0.1996(6) k 10 10 14.74% Comments: This 14.74% would be the (marginal) cost of capital that a company with this financial structure would expect to pay to raise $10 million. Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto The marginal cost of capital The marginal cost of capital is defined as the cost of obtaining another dollar of new capital. The marginal cost rises as more and more capital is raised during a given period. Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto The CAPM approach The CAPM approach involves the following steps: 1. Estimate the risk free rate rf (i.e., the Treasury Bill rate) 2. Estimate the stock’s beta coefficient, b, which is an index of systematic (or nondiversifiable) market risk 3. Estimate the rate of return on the market portfolio (such as the Standard & Poor’s 500 Stock Composite Index or Dow Jones 30 Industrials) 4. Estimate the required rate of return on the firm’s stock using the CAPM equation k e rf b rm - rf Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto The CAPM approach: example Assuming that rf is 7%, b is 1.5, and rm is 13%, then k e rf b rm - rf = 7% + 1.5 13% - 7% = 16% This 16% cost of common stock can be viewed as consisting of a 7% risk free rate plus a 9% risk premium which reflects that the firm stock price is 1.5 times more volatile than the market portfolio due to factors affecting nondiversifiable or systematic risk. Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Calculating Cost of Capital using CAPM • Cost of Debt Cost of debt = debt interest rate (1 - tax rate) • Cost of Equity Cost of Equity = Risk free return + Risk Premium =Rf [RM Rf ] where Rf risk free return (U.S. Treasury Bills) RM Average rate of return on market = stock price volatility Cost of Capital = (cost of debt) x (% of capital from debt) + (cost of equity) x (% of capital from equity) Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Return Rates 1. Minimum Acceptable Rate of Return (MARR) Lowest level of return that makes an investment acceptable 2. Internal Rate of Return (IRR) Discount rate that makes PW of an investment zero 3. External Rate of Return (ERR) Return Rate that can be obtained for an investment under current economic conditions Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Internal Rate of Return Internal (or discounted cash flow) Rate of Return: Interest rate at which the PW of the cash flow generated by the project is zero Caution! 1. IRR calculation 2. Interpretation of IRR for evaluation of mutually exclusive projects Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Calculation of the IRR (Single Project) • Find discount rate i, such that the PW of the cash flow is equal to zero • Polynomial equation on i • Existence of multiple solutions i* PW (i ) 0 C0 CN C1 C2 ... 0 (1 i )1 (1 i ) 2 (1 i ) N • Cn: receipt (positive), disbursement (negative), or net benefit (receipt minus disbursement) at period n • C0: initial cost Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Multiple IRR’s Descartes' “Rule of Signs” There can be as many different solutions to a polynomial equation, as the number of changes of sign in the polynomial PW (i ) 0 C0 CN C1 C2 ... 0 1 2 N (1 i ) (1 i ) (1 i ) Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Simple and Non-simple Investments 1.Simple Investment: only one change of sign Period Cash Flow 0 Period Cash Flow -1000 0 -1000 1 -200 1 200 Yes 2 500 2 -500 Yes 3 500 3 500 Yes 4 500 4 500 Unique IRR Sign Change 2.Non-Simple Investment: multiple changes of sign Yes Possibly multiple IRR’s Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Sign Change IRR Calculation: Single Simple Investment $150,000 i $650 0 1 5 $80,000 Exercise: Buying land $80,000 $650( P / A, i,5) $150,000( P / F , i,5) 0 Method 1: Manual trial-and-error Answer: IRR=14.04% PW(i) 0.00% $73,250.00 50.00% -$59,118.11 25.00% -$29,099.97 10.00% $15,602.21 20.00% -$17,774.47 15.00% -$3,244.59 12.00% $7,457.13 14.00% $136.80 14.50% -$1,575.95 14.10% -$209.34 14.05% -$36.50 14.04% -$1.87 14.03% $32.77 i low i up 0.00% 50.00% 25.00% 10.00% 20.00% 15.00% 12.00% 14.00% 14.50% 14.10% 14.05% 14.04% 14.03% Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto IRR Calculation: Single Simple Investment Exercise: Buying land $80.00 $80,000 $650( P / A, i,5) $150,000( P / F , i,5) 0 PW(i) 0.00% $73,250.00 50.00% -$59,118.11 25.00% -$29,099.97 10.00% $15,602.21 20.00% -$17,774.47 15.00% -$3,244.59 12.00% $7,457.13 14.00% $136.80 14.50% -$1,575.95 14.10% -$209.34 14.05% -$36.50 14.04% -$1.87 14.03% $32.77 i low i up 0.00% 50.00% 25.00% 10.00% 20.00% 15.00% 12.00% 14.00% PW(i) (thousands) i $60.00 $40.00 $20.00 $0.00 0% 10% 20% 30% 40% -$20.00 -$40.00 -$60.00 i 14.50% 14.10% 14.05% 14.04% 14.03% Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto 50% 60% IRR Calculation: Single Simple Investment $150,000 $650 0 1 $80,000 Ex. 5.1: Buying land 5 i PW(i) $80,000 $650( P / A, i,5) $150,000( P / F , i,5) 0 Method 2: Manual trial-and-error using factor tables and interpolation 14% (14+x)% 15% $137.00 0 -$3244.10 x 1 x 137 3244.10 x 0.04 Answer: IRR=14.04% Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto IRR Calculation: Single Simple Investment $150,000 $650 0 5 1 $80,000 Exercise: Buying land $80,000 $650( P / A, i,5) $150,000( P / F , i,5) 0 Capital O&M Other Salvage, Period Investment Revenue Expenses Expenses Other Inc. 0 -80000 0 0 0 0 1 0 1500 -850 0 0 2 0 1500 -850 0 0 3 0 1500 -850 0 0 4 0 1500 -850 0 0 5 0 1500 -850 0 150000 Inflation Rate: 0.00% IRR=14.04% Method 3: Computer program • Excel: IRR() function • Numerical solution of equation Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Cash Flow -80000 650 650 650 650 150650 IRR Comparisons – SI (Simple Investments) Exercise: Subassemblies of product purchased for $71 apiece. Demand 350 units/yr. for 3 yrs. Equipment to produce: initial cost $21,000, no salvage. Production costs $18,500 1st yr, $12,250 each of last two yrs. Buy or make? “Buy” annual cost: 350($71)=$24,850 “Make” annual net savings: C1=$24,850-$18,500=$6350 C2=$24,850-$12,250=$12,600 C3=$24,850-$12,250=$12,600 Period Method: Find IRR Compare to MARR Cash Flow 0 -$21,000 1 2 3 $6350 $12,600 $12,600 IRR: i* that solves $21,000 $6350 $12,600 $12,600 0 (1 i ) (1 i ) 2 (1 i)3 i*=20.91% Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto IRR Comparisons – SI Ex. 5.3 (cont): $12.00 $10.00 $8.00 PW(i) (thousands) IRR=20.91% Comparison to MARR: MARR<=20.91%: Accept MARR>20.91%: Reject $6.00 $4.00 $2.00 $0.00 -$2.00 -$4.00 0% 10% 20% 30% 40% MARR < IRR (Accept) MARR > IRR (Reject) -$6.00 i PW (i ) $21,000 $6350 $12,600 $12,600 (1 i ) (1 i ) 2 (1 i)3 Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto IRR Comparisons of Mutually Exclusive Investments – SI Mutually Exclusive projects Projects with equal lives Incremental IRR comparisons Incremental IRR: equivalent to PW and AW methods Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto IRR Comparisons of Mutually Exclusive Investments – SI Example: Projects X and Y PW comparison at 10%: PWX $1000 Year 0 1 2 3 4 PW(10% ) IRR X Project Y X-Y -$1,000 $100 $350 $600 $850 -$1,000 $1,000 $200 $200 $200 $0 -$900 $150 $400 $650 $411.52 23.27% $361.25 34.26% $50.27 12.81% [$100 $250( A / G ,10,4)]( P / A,10,4) $411.52 PWY $1000 [$1000 $200( P / A,10,3)]( P / F ,10,1) $361.25 Individual IRR’s: MARR=10%. IRR X 23.27% Which should be chosen? IRRY 34.26% Incremental IRR: IRR X Y 12.81% Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto IRR Comparisons of Mutually Exclusive Investments – SI Incremental IRR Comparison: 1.IRRX-Y>MARR: choose X $10 $8 3.IRRX-Y=MARR: X and Y equivalent $6 In example: IRRX-Y=12.81%>10% choosing X over Y provides incremental IRR of 12.81% -higher than 10% MARR PW(i) (hundreds) 2.IRRX-Y<MARR: choose Y $4 $2 $0 0% -$2 10% 20% 30% Y X Neither -$4 Rate of Return, i X Y Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto 40% X-Y 50% Exercise: IRR Comparisons of Mutually Exclusive Investments – SI Example (cont): What would have happen if we used Y-X for the incremental IRR comparison? Year X 0 -$1,000 1 $100 MARR=10% 2 $350 3 $600 4 $850 Project Y -$1,000 $1,000 $200 $200 $200 1. 2. 3. 4. 5. IRRY-X<0 IRRY-X<MARR IRRY-X=-IRRX-Y IRRY-X=IRRX-Y None of the above ? Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto IRR Comparisons of Mutually Exclusive Investments – SI Example (cont): $300 0 1 2 3 4 PW(10% ) IRR X -$1,000 $100 $350 $600 $850 -$1,000 $1,000 $200 $200 $200 $411.52 23.27% $361.25 34.26% X-Y $0 -$900 $150 $400 $650 $200 Y-X $0 $900 -$150 -$400 -$650 $50.27 -$50.27 12.81% 12.81% $100 PW(i) Year Project Y $0 0% 10% 20% 30% -$100 -$200 -$300 Return Rate, i Answer: IRRY-X=IRRX-Y PWX-Y(i) = -PWY-X(i), all i PWX-Y(i)=0 and PWY-x(i)=0 have the same roots X-Y Y-X Which is better: X or Y? Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto 40% 50% Caution: Lending or Borrowing? Year Project Y X $300 X-Y Y-X $200 PW(10% ) IRR -$1,000 $100 $350 $600 $850 -$1,000 $1,000 $200 $200 $200 $411.52 23.27% $361.25 34.26% $0 -$900 $150 $400 $650 $0 $900 -$150 -$400 -$650 $50.27 -$50.27 12.81% 12.81% $100 PW(i) 0 1 2 3 4 $0 0% 10% 20% 30% -$100 -$200 -$300 Return Rate, i Rules for IRR X-Y Y-X 1. Lending: IRR > cost-of-capital (i.e., MARR) Y-X: borrowing 2. Borrowing: IRR < cost-of-capital (i.e., MARR) X-Y: lending (pure investment) Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto 40% 50% IRR Comparisons: Lending or Borrowing? $50.27 12.81% $0 $900 -$150 -$400 -$650 $8 PW(i) (hundreds) $0 -$900 $150 $400 $650 Y-X $10 $6 $4 $2 $0 0% -$2 10% ERR<IRRX-Y 20% 30% ERR>IRRX-Y Rate of Return, i Y 50% $8 $6 $4 $2 $0 -$2 -$4 -$4 X 40% -$50.27 12.81% $10 PW(i) (hundreds) X-Y X-Y X-Y: lending • ERR<12.81%: accept X-Y Prefer X over Y • ERR>12.81%: reject X-Y Prefer Y over X 0% 10% ERR<IRRY-X 20% 30% ERR>IRRY-X Rate of Return, i X Y Y-X Y-X: borrowing • ERR<12.81%: reject Y-X Prefer X over Y • ERR>12.81%: accept Y-X Prefer Y over X Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto 40% 50% Incremental IRR Comparisons Rule: Compare alternatives in increasing order of required investment Works in most cases of interest But not always! “Lending or borrowing?” Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Rule for Incremental IRR Comparisons Example: Two designs for a product. 10-yr study period. MARR=10% $350 $300 PW at 10% IRR Design C -$300,000 $66,000 C-A -$130,000 $22,000 $100,361 22.47% $105,541 17.68% $5,180 10.92% $250 PW(i) (thousands) Initial Cost Net Benefit/yr Design A -$170,000 $44,000 $200 $150 $100 $50 $0 0% IRRA>10%: Design A acceptable IRRC-A>10%: Design C preferred over Design A Conclusion: with MARR=10%, use Design C 5% 10% 15% 20% -$50 -$100 Return Rate, i A C Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto C-A 25% 30% It works…but not always! Example: MARR=10% Wrong: • PWX(10%)=$511.52 Project Y Year X 0 1 2 3 4 -$900 $100 $350 $600 $850 -$1,000 $1,000 $200 $200 $200 -$100 $900 -$150 -$400 -$650 27.73% 34.26% 19.92% IRR Y-X • PWY(10%)=$361.25 What went wrong? Y-X is borrowing • Sum of cash flows: -$400 • Current balance for each period: Least investment: X IRRX>10%: Accept X IRRY-X>10%: Choose Y over X Year X 0 1 2 3 4 -$900 $100 $350 $600 $850 Project Y Y-X -$1,000 $1,000 $200 $200 $200 Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto -$100 $900 -$150 -$400 -$650 CB(Y-X) -$100 $780.08 $785.50 $542.01 $0.00 IRR calculation: Single non-simple investment • Non-Simple: multiple sign changes in cash flow • PW(i)=0 might have multiple roots i* • Pure or Mixed Investments • CB(i*)t: Current balance at period t, with discount rate i* 1.Pure Investment – CB(i*)t<=0, all t – all project receipts reinvested internally to cover expenditures – IRR=i* 2.Mixed Investment – CB(i*)t>0, some t – how are positive cash flows reinvested? – IRR not known Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto IRR Calculation: Single Non-Simple Investment Ex. 5.4: Cash flows in table 0 1 2 3 4 5 6 Cash Flow $ 3,000 0 -10,000 2,000 2,000 2,000 2,000 $1,000 $800 $600 PW(i) Year $400 $200 $0 0% PW (i) $3000 $10,000( P / F , i,2) -$200 $2000( P / A, i,4)( P / F , i,2) 0 -$400 10% 20% 30% 40% Return Rate, i Two roots: 1. i*=9.58% 2. i*=50.84% Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto 50% 60% IRR Calculation: Single Non-Simple Investment Ex. 5.4: Cash flows in table Year Cash Flow 0 1 2 3 4 5 6 $ 3,000 0 -10,000 2,000 2,000 2,000 2,000 PW (i) $3000 $10,000( P / F , i,2) $2000( P / A, i,4)( P / F , i,2) 0 Two roots: 1. i*=9.58% Interpretation IRR=9.58%: positive balances invested at rate 9.58% IRR=50.84%: positive cash flows invested at rate 50.84% Realistic to assume IRR=i*? Real Practice: Positive balances invested externally Real IRR depends on external rate of return (ERR) Typically ERR=MARR 2. i*=50.84% Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Non-Simple Investments Explicit Investment Rate Method: • ERR to limited part of cash flow • Minimal “disturbance” • Eliminate sign changes Historical External Rate of Return (HERR) Method: • ERR to all positive cash flows Project Balance Method (PBM): • ERR to positive balances Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Summary Methods of financing: 1. Equity financing uses retained earnings or funds raised from an issuance of stock to finance a capital. 2. Debt financing uses money raised through loans or by an issuance of bonds to finance a capital investment. Companies do not simply borrow funds to finance projects. Wellmanaged firms usually establish a target capital structure and strive to maintain the debt ratio when individual projects are financed. Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Summary The selection of an appropriate MARR depends generally upon the cost of capital—the rate the firm must pay to various sources for the use of capital. The cost of the capital formula is a composite index reflecting the cost of funds raised from different sources. The formula is k i d C d i eC e , V V where V C d C e Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Summary The marginal cost of capital is defined as the cost of obtaining another dollar of new capital. The marginal cost rises as more and more capital is raised during a given period. Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto Summary MARR: • Lower limit for investment acceptability • Criterion set by organization • Before-tax calculations • Depends on the cost-ofcapital (expense for acquiring funds) • Determined by: – Organization circumstances and goals – Project risk (high-risk requires higher return rate) Engineering Economy/cost of capital and MARR/ 2005 /prof. corrado lo storto