Do Nothing

advertisement

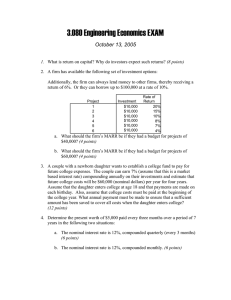

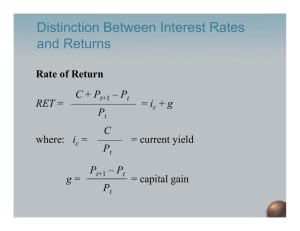

FINAL EXAM REVIEW Fall 2014 Nominal and Effective Interest Rates Payment Period Compounding Period Mortgages and Car Loans MARR and WACC Present Worth and Annual Worth Capitalized Cost Cost Projects with Unequal Lives Revenue Projects with Unequal Lives Internal Rate of Return Modified Internal Rate of Return Incremental ROR Analysis Bond Yields True Cost of a Loan Benefit/Cost Ratio Incremental B/C Analysis Breakeven Analysis Depreciation Nominal & Effective Interest Nominal Interest Rate Example = APR r=i×m Effective Interest Rate Example = APY ie = (1+ i)n – 1 PP CP When using (P|A,i%,n), etc. i and n must agree w.r.t. time ie = (1+ i)n – 1 Mortgages and Car Loans Monthly payment amount is B0 (A|P,i%,n) Remaining balance at any time (including Time 0) is equal to the PW of the remaining payments. Capitalized Cost Present worth when n = (P|A,i%,) = 1/i (A|P,i%,) = i Revenue Projects “Do Nothing” is an Option “Implicit Reinvestment Assumption” Study Period = Longest Project Life Choose project with highest PW Implicitly assumes profits reinvested at MARR Cost Projects “Do Nothing” is NOT an Option “Repeatability Assumption” Study Period = LCM of Project Lives Choose option with least negative AW or lowest EUAC Implicitly assumes cash flows are repeated to LCM Internal Rate of Return The interest rate that makes the PW = 0 Modified Internal Rate of Return 1. 2. 3. 4. Draw the net cash flow diagram Compound all positive cash flows to Time n Discount all negative cash flows to Time 0 Solve for the external rate of return: F = P (1 + ERR)n Incremental ROR Analysis Start with lowest-cost project (which is “do nothing” for revenue projects) and accept a more expensive project only if i* or EROR > MARR Bond Yields Yield to Maturity Purchase price depends on market Coupon rate and YTM are both APRs Coupons paid twice a year (usually) Bond redeemed for face value at maturity Calculate the IRR of the cash flows Zero-Coupon Bonds Bond purchased at a deep discount Bond redeemed for face value at maturity True Cost of a Loan Calculate the IRR of the cash flows Benefit/Cost Ratio 𝑃𝑊 𝐴𝑊 𝐶𝐶 𝐵/𝐶 = = = ≥1 𝑃𝑊 𝐴𝑊 𝐶𝐶 Benefit/Cost Ratio 𝐵𝑒𝑛𝑒𝑓𝑖𝑡𝑠 − 𝐷𝑖𝑠𝑏𝑒𝑛𝑒𝑓𝑖𝑡𝑠 𝐶𝑜𝑛𝑣𝑒𝑛𝑡𝑖𝑜𝑛𝑎𝑙 𝐵/𝐶 = 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝐶𝑜𝑠𝑡𝑠 − 𝑂&𝑀 𝐶𝑜𝑠𝑡𝑠 𝐵𝑒𝑛𝑒𝑓𝑖𝑡𝑠 − 𝐷𝑖𝑠𝑏𝑒𝑛𝑒𝑓𝑖𝑡𝑠 − 𝑂&𝑀 𝐶𝑜𝑠𝑡𝑠 𝑀𝑜𝑑𝑖𝑓𝑖𝑒𝑑 𝐵/𝐶 = 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝐶𝑜𝑠𝑡𝑠 Incremental B/C Analysis Start with lowest-cost project (based on the denominator of the B/C formula) and accept a more expensive project only if B/C 1 Breakeven Analysis One Project Set PW = 0 and solve for x Two Projects Set PWA = PWB and solve for x Straight-Line Depreciation 𝐵𝑉 = 𝐵 − 𝐷𝑗 = 𝐵 − 𝑡 𝐷𝑗 𝐵−𝑆 𝐷𝑗 = 𝑛