Risk Premium - User Web Areas at the

advertisement

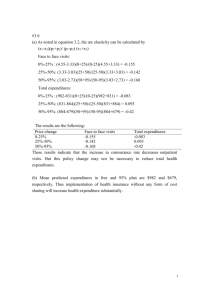

Microeconomics 2 John Hey Chapters 23, 24 and 25 • • • • CHOICE UNDER RISK Chapter 23: The Budget Constraint. Chapter 24: The Expected Utility Model. Chapter 25: Exchange in Markets for Risk (for contingent goods). • (cf. Chapters 20, 21 and 22: and compare chapter 25 with chapter 8.) • Remember the Health Warning: this is one of John H’s research areas... • Remember also the message from Chapter 8: exchange is almost always mutually beneficial. Expected Utility Model (ch 24) • This is a model of preferences. • Suppose a lottery yields C which takes values c1 with probability π1 and c2 with probability π2 (where π1 + π2 = 1). • Expected Utility theory says this lottery is valued by its Expected Utility: ... Eu(C) = π1 u(c1)+ π2 u(c2) • where u(.) is the individual’s utility function. • In intuitive terms the value of a lottery to an individual is the utility that the individual expects to get from it. EU and a risk-averter • A risk-averter’s utility function over consumption u(.) is concave; the more risk-averse the more concave. • A risk-averter’s indifference curves in (c1,c2) space are convex; the more risk-averse the more convex. • A risk-averter’s Certainty Equivalent for some gamble is less than the Expected Value of the gamble; the more risk-averse the smaller; the riskier the gamble the smaller. • A risk-averter’s Risk Premium for some gamble is positive; the more risk-averse the bigger; the riskier the gamble the bigger. • A risk-averter is always willing to pay to get rid of risk; the more riskaverse the more he/she will pay; and the riskier the risk the more he/she will pay. • With fair insurance, a risk-averter will always choose to be fully insured. EU and a risk-neutral • A risk-neutral’s utility function over consumption u(.) is linear. • A risk-neutral’s indifference curves in (c1,c2) space are linear. • A risk-neutral’s Certainty Equivalent for some gamble is always equal to the Expected Value of the gamble. • A risk-neutral’s Risk Premium for some gamble is always zero. • A risk-neutral would not pay to get rid of risk; nor would he/she pay any money to accept some risk. EU and a risk-lover • A risk-lover’s utility function over consumption u(.) is convex; the more risk-loving the more convex. • A risk-lover’s indifference curves in (c1,c2) space are concave; the more risk-loving the more concave. • A risk-lover’s Certainty Equivalent for some gamble is always greater than the Expected Value of the gamble; the more riskloving the smaller; the riskier the gamble the larger. • A risk-lover’s Risk Premium for some gamble is negative; the more risk-loving the more negative; the riskier the gamble the more negative. • A risk-lover is always willing to pay to get risk; the more riskloving the more he/she will pay; and the riskier the risk the more he/she will pay. Chapter 25 • We consider the exchange of risk between two individuals. • We use the same framework as in Chapters 8 (the Edgeworth Box) and 22. • We get the same results: • ...exchange is almost always beneficial. • ...competitive exchange is efficient... • ...but does not necessarily imply actuarially fair prices (this is new). Exchange of risk • The Maple file contains lots of examples asking if exchange is possible and, if so, what form it takes. • First example: 2 individuals A and B; both risk-averse, B more than A; both start with same risk (75,50); both states equally likely. • But first I want to revise Price-Offer curves, as I get the feeling that there may be some confusion. • A Price-Offer curve of an individual is the locus of points to which the individual would want to move for different prices. • Let us go to Maple, first Lecture 8, then Lecture 25... Competitive equilibrium in this first case Starting positions Finishing Positions Trades Individual A Individual B If State 1 occurs 75 75 If State 2 occurs 50 50 Individual A Individual B If State 1 occurs 83 67 If State 2 occurs 45 55 Individual A Individual B If State 1 occurs 8 -8 If State 2 occurs -5 5 Chapter 25 • There are lots of other examples in the Maple file. • Smell them and get intuition. • They are very entertaining. • You are not expected to know the detail... • ...just the principle. Chapter 25 • Goodbye!