Link - Filippo Rebessi

advertisement

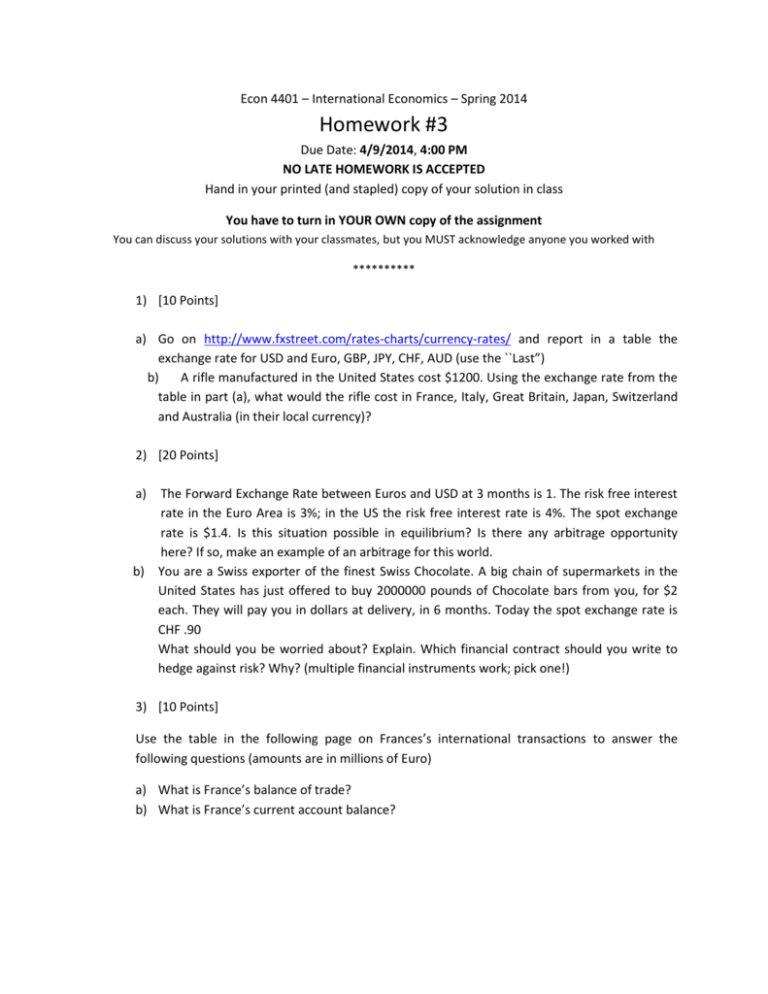

Econ 4401 – International Economics – Spring 2014 Homework #3 Due Date: 4/9/2014, 4:00 PM NO LATE HOMEWORK IS ACCEPTED Hand in your printed (and stapled) copy of your solution in class You have to turn in YOUR OWN copy of the assignment You can discuss your solutions with your classmates, but you MUST acknowledge anyone you worked with ********** 1) [10 Points] a) Go on http://www.fxstreet.com/rates-charts/currency-rates/ and report in a table the exchange rate for USD and Euro, GBP, JPY, CHF, AUD (use the ``Last”) b) A rifle manufactured in the United States cost $1200. Using the exchange rate from the table in part (a), what would the rifle cost in France, Italy, Great Britain, Japan, Switzerland and Australia (in their local currency)? 2) [20 Points] a) The Forward Exchange Rate between Euros and USD at 3 months is 1. The risk free interest rate in the Euro Area is 3%; in the US the risk free interest rate is 4%. The spot exchange rate is $1.4. Is this situation possible in equilibrium? Is there any arbitrage opportunity here? If so, make an example of an arbitrage for this world. b) You are a Swiss exporter of the finest Swiss Chocolate. A big chain of supermarkets in the United States has just offered to buy 2000000 pounds of Chocolate bars from you, for $2 each. They will pay you in dollars at delivery, in 6 months. Today the spot exchange rate is CHF .90 What should you be worried about? Explain. Which financial contract should you write to hedge against risk? Why? (multiple financial instruments work; pick one!) 3) [10 Points] Use the table in the following page on Frances’s international transactions to answer the following questions (amounts are in millions of Euro) a) What is France’s balance of trade? b) What is France’s current account balance? Transaction Merchandise Imports Merchandise Exports Service Imports Service Exports Investment Income Receipts Investment Income Payments Gifts (Net Unilateral Transfers) Amount 93000 92000 15000 20000 43000 25000 -1000 4) [10 Points] This part of the homework requires you to use FRED. http://research.stlouisfed.org/fred2/categories/32951 a) Create ONE picture with Current Account (Excludes Exceptional Financing) for China, USA and Germany (they have to be all on the same graph). [5 points] b) Many economic commentators think that Germany and China should engage in expansionary policies (either through monetary or fiscal policy), to solve the problem of “Global Imbalances” (i.e. the US current account balance being very negative and Germany and China’s C.A.B. being very positive). Looking at the graph you created, do you think that would help? Explain. [5 points]