Jan 29 Name: A basket of consumption commodities in Canada cost

advertisement

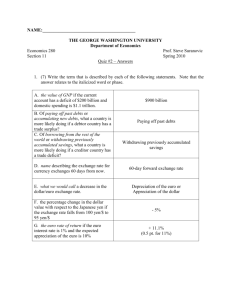

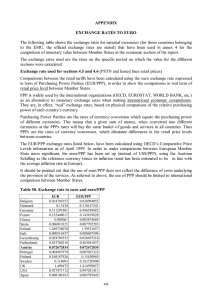

Jan 29 Name: 1. A basket of consumption commodities in Canada cost C$100 in 1970 in Canada, whereas by 1990 the same had gone to C$392. In the US, the price of an identical basket rose from $100 to $336. In 1970 the dollar/looney exchange rate was 1, whereas by 1990 the exchange rate was 1.16 C$ per US$. What would it cost a Canadian to buy the US consumption basket in 1990? What would it cost in US $ to buy Canadian basket. See the example in the textbook. 2. The price of a tuxedo in Paris is 1000 Euros while in NY it is $900. The exchange rate is 1.14 $/euro. How many NY tuxedos one can buy at the price of one Parisian tuxedo? 1140/900 3. What is the exchange rate implied by the Law of One Price? 0.9$/euro 4. The price of a consumption basket is 110$ in the US and 100 Euros in Germany. If the exchange rate is 1.14$/euro, what is the US/Germany real exchange rate. By what percentage Euro must appreciate /depreciate for the purchasing power parity (PPP) to hold? The real exchange rate is = E$/euro P_Germany/P_US = 1.14*100/110 = 1.14/1.1. Euro must depreciate from 1.14 $/euro to 1.1$/euro for the PPP to hold. Which means the rate of dollar depreciation (negative sign would mean appreciation) should be (1.141.1)/1.14 = -0.04/1.14= -3.15% 5. If the US price level rises by 5% in one year while Japanese price level remains the same, what is the PPP implication for the $/Yen exchange rate? What if the Japanese inflation is 3%? The rate of dollar/yen exchange rate depreciation = inflation in US – inflation in Japan. In the first case it is 5%, in the second it is 2%. 6. A Big Mac costs 28 pesos in Argentina – In US the average is 4.7$. The exchange rate is 3.25 peso/$. What should be the exchange rate predicted by PPP? See the chart given in class.