VALIC Background

advertisement

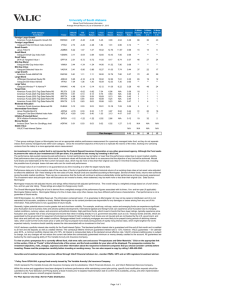

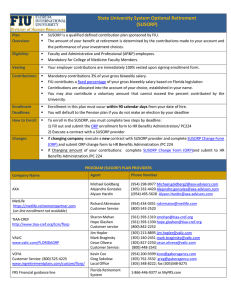

Communication, Education and Investment Management for the Tennessee Optional Retirement Program SAVING : INVESTING : PLANNING March, 2010 VALIC Points to Consider SAVING : INVESTING : PLANNING ► ► ► ► 2 VALIC Background Participant Services Investment Management Contact Us VALIC Background ► VALIC advantages ■ ■ ■ ■ More than $58 billion in assets Service for 2 million investors 2,000 FINRA licensed financial advisors 50 years of experience managing tax-qualified retirement plans ■ Organizational stability and financial strength ■ High levels of participant retention and plan sponsor satisfaction ► Frequent communication of investment information ► Increased participant understanding of asset allocation ► Consistent objective investment advice 3 SAVING : INVESTING : PLANNING Participant Services SAVING : INVESTING : PLANNING Spectrum of Client Care Exceptional Technology Targeted Communication Materials Literature Personal Service (New)Custom Web Site Easy account access Webcasts Transactional E-mail Online financial planning and educational tools Video Custom messaging Plan-specific details 4 Client Care Center 24-hour automated voice response system Client Service Professionals available Mon-Fri, 8 am - 9 pm ET 150 CSPs Spanish-speaking staff AT&T language line (all languages, real-time translation) (New)Retirement Education Center Local Financial Advisor Flexible alternative to in-person consultation Individual counseling Retirement planning Retirement planning Asset allocation modeling At-retirement counseling At-retirement counseling Investment advisory services Targeted education programs Available Mon - Fri, 8 am - 8 pm ET Sat, 10 am - 5 pm ET Seminars, workshops and employee orientation meetings Asset allocation modeling Investment advisory services Investment Management SAVING : INVESTING : PLANNING Objective Fund Selection & Monitoring Complete open architecture Fund Line Up picked from Universe with no proprietary mutual of 100 mutual fund families with fund requirements more than 5,200 mutual funds Flexible Best in Class Fund Line Up You may transfer your existing 23 New Low Cost Mutual Funds plus balances to the new platform. VALIC Fixed Account. Name Brand All contributions will be directed to Fund Managers such as Vanguard, the new platform effective 7/1/2010 PIMCO, Wells Fargo, and American Funds. 5 Investment Management SAVING : INVESTING : PLANNING New General Account Fixed Interest Option ► ► ► ► ► ► Current rate: 3.6%* Guaranteed minimum for 2010: 3.00% Life of contract: 2.00% Portfolio-based method of determining interest rate Daily interest-rate crediting A VALIC fixed annuity (policy no. GFA-504) *VALIC declares a portfolio interest rate monthly for the Fixed-Interest Option. That declared portfolio interest rate is guaranteed until the end of the month and is credited to all new and old deposits as well as credited interest. The contractual lifetime minimum guaranteed interest rate is 2.00%; however, VALIC guarantees – for calendar year 2009 – a minimum portfolio interest rate of 3.25%. All interest is compounded daily at the declared annual effective rate. VALIC’s interest-crediting policy is subject to change, but any changes will not reduce the current rate below the contractually guaranteed minimum or money already credited to the account. Guarantees are subject to the claims-paying ability of the insurance company. 6 Contact Us SAVING : INVESTING : PLANNING ► 14 Advisors State Wide ► Visit www.valic.com ► Call 800-44-VALIC 7