File

advertisement

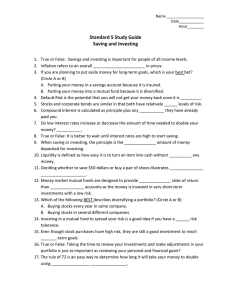

Saving and Investing Unit 1 Lesson 5 Introduction People work hard to increase their take-home pay, but often they don’t take time to plan and use their money wisely. Smart money management means carefully planning for its use today as well as in the years to come, either through saving or long-term investing. Introduction For many young adults, the opportunity cost of starting a savings program with a small income seems challenging. And, for those who choose to save, the number of options available can be overwhelming. This lesson will clear up some of the confusion by introducing various methods of saving, such as savings accounts, stocks, and mutual funds. Introduction This lesson focuses on PYF – Planning your future. At Finance Park, students will be required to save and track investments. PYF shows students how long-term investing can fund future needs and wants, such as automobiles, housing, college, and retirement. Key Terms Budget An itemized summary of probable expenditures and income for a given period. Opportunity Cost The next best alternative given up when making a choice. Invest To commit money in order to gain a profit or interest. Key Terms Mutual Fund A business that pools people’s money for investment in stocks or bonds of various corporations. Savings Account An interest-bearing account where people put money aside for future use. Stock A share of a corporation sold to the public. Planning Your Future The pie chart shows typical expenditure categories in a budget. It is extremely important that everyone uses a budget. Planning Your Future To spend your money wisely, it is important to create and follow a monthly budget. Also important to smart spending is planning for the future. You will be more successful in saving, investing, and budgeting if you know what you want your money to do for you. What are your goals? Do you want to save money for something you need or something that you want? Do you plan to use your money soon or to spend it sometime in the future? PAGE 22 Planning Your Future Following a budget for everyday expenses is essential to spending your hard-earned money wisely. Including saving and investing in your budget helps to ensure you’ll meet your goals. The key to success is careful planning and sticking to that plan. The first step to achieving your goals is to define them. Answering the following questions may prove helpful in developing a smart plan and ultimately reaching your goals. PAGE 22 Planning Your Future What are your goals? Do you want a new bike or a car? Do you want to live on your own someday? Do you want to go to college? It is essential that you clearly define your goals to understand what you are planning. How much money will you need to achieve your goals? Are your goals attainable? When will you need the money? Will you need some right away or perhaps several years in the future? Knowing when you plan to use the money will help you determine how you will need to raise it. PAGE 22 Planning Your Future One you have answered the questions, you are ready to create your saving and/or investing plan. Did you find that you need the money soon? If so, a savings account may need to be part of your plan. Putting money into a savings account is a safe way to save money and earn a modest interest rate. You have quick access to your money in a savings account. PAGE 22 Planning Your Future Are you saving for college or furnishings for your apartment someday? If so, investing your money for the longer term may be an option. Stocks and mutual funds allow you to invest your money and earn, over time, a higher rate or return than money placed in a savings account. Stocks and mutual funds are not as safe as your savings account; the money you put into these investments is not insured like your money in the savings account. You can lose part or all of the money you invest. However, stocks and mutual funds can pay you a greater return on your investment than the interest earned on your savings account. If you can wait to use the money and take the risk of investing, stocks or mutual finds may be the option for you. Identifying your goals, understanding the best way to reach your goals, creating a plan, and staying with your plan are essential steps to ultimately getting what you want out of your money. PAGE 22 Writing Assignment Page 23 Determine a goal, research its cost, and create the best plan for raising the money necessary to reach it. Page 37 Complete the Word Map. Time Is On Your Side The larger the amount of money you save regularly, the more savings you will have at the end of the time period. The higher the interest rate you are paid, the more savings you will have at the end of the time period. The more time you have to save, the more savings you will have at the end of the time period. The more you increase the amount, interest, or time the greater your savings. Page 24 Time Is On Your Side 1.) If you saved $14 per week at 5% interest, how much will you have at the end of 10 years? 2A.) If you saved $19.20 per week for five years at 5% interest, how much will you have? 2B.) After 20 years? 3A.) If you saved $19.20 per week for five years at 10% interest, how much will you have? 3B.) After 20 years? 4.) Describe a wise savings plan in terms of the three critical variables of amount, interest, and time. Page 24 Time Means Money If you saved $19.20 a week: At 7% interest for 10 years, you would save: At 9% interest for 15 years, you would save: $38,632 At 8% interest for 5 years, you would save: $31,722 At 6% interest for 20 years, you would save: $14,484 $6,161 At 9% interest for 20 years, you would save: $56,029