University of South Alabama USA HealthCare Management, LLC VALIC Frequently Asked Questions

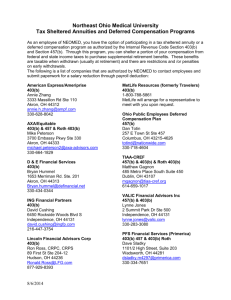

advertisement

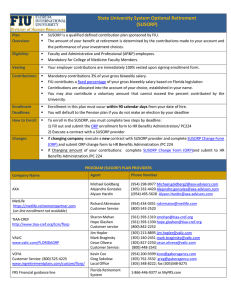

University of South Alabama USA HealthCare Management, LLC VALIC Frequently Asked Questions 1. What are the upcoming changes affecting the University of South Alabama Retirement Plans? The University of South Alabama has approved VALIC to offer a mutual fund based program to participants in both the 403(b) and 457(b) plans, along with USA HealthCare Management 403(b) Matching Plan, effective April 1, 2016. These mutual funds provide a wide array of offerings from well-known investment providers. 2. What does this mean for me? Effective April 1, 2016, you may elect to contribute to the VALIC mutual fund program and select from VALIC’s list of investment options. There are three methods in which to enroll: Online - You will have to enroll into the retirement plan and elect VALIC investment options by going on www.valic.com. You click “Enroll in your retirement plan” on the right side of your screen and have your group Access ID ready. • • • University of South Alabama 403(b) Tax Deferred Plan Access Code 03619001 University of South Alabama 457(b) Deferred Comp Plan Access Code 03619004 USA HealthCare Management 403(b) Matching Plan Access Code 71513001 By phone – call our Enrollment Center at 888-569-7055 between 7:30 a.m. and 7:00 p.m. (CT). • University of South Alabama 403(b) Tax Deferred Plan Access code 03619001 • University of South Alabama 457(b) Deferred Comp Plan Access Code 03619004 • USA HealthCare Management 403(b) Matching Plan Access Code 71513001 In Person – Your VALIC financial advisor can meet with you and walk you through the enrollment process. Notify your Human Resources Office if you wish to schedule an appointment with the local VALIC advisors. Once you complete the enrollment process, your account will be established with VALIC. 3. When electing the VALIC mutual fund program, do I need to still have a paper Salary Reduction Agreement (SRA)? Yes. You will have to enroll through www.valic.com to set up an account but you will have to still fill out a paper SRA. Please obtain the paper SRA, fill it out and return it to the Human Resources office to start your payroll deductions. 4. Will loans be available with the VALIC mutual fund based program? Yes, a fee of $50.00 will be charged as an initial set-up cost with a $50.00 annual fee for administration. In addition, the interest rate charged for participant loans on the mutual fund platform is different from the interest rate charged on the annuity platform. All loan interest repaid will be credited to the participant’s account. The method of repaying your loans will change to Automatic Clearing House (ACH) debit, which you can establish through a financial institution of your choosing. Please consult with your VALIC financial advisor for more information. 5. Who can I contact if I have questions about any of the mutual funds or this transfer process? If you have any questions about the new enhancements to the USA retirement plans you may contact your local VALIC financial advisors: Loyce St. Clair Les Parnell email: loyce.st.clair@valic.com email: les.parnell@valic.com You can call the local District office at 251-625-4894 to speak to your VALIC Financial advisor. 6. How often will I receive an account statement? VALIC mails account statements to your address on record no later than 15 business days after the end of each calendar quarter. These account statements include helpful information about your account balance, your investment elections and transaction history for all of your accounts with VALIC. 7. May I participate with both VALIC and TIAA-CREF plans simultaneously? Yes, you may divide your contributions any way you designate. 8. What are the VALIC fees and expenses should I elect to participate? The annual VALIC administrative fee is .52% and will be assessed as 0.13% each quarter. The fee will be assessed pro rata across all accounts. Any revenue reimbursements received by VALIC from the mutual fund investments will be passed directly through as a credit against VALIC’s administrative fee, possibly lowering the fee from the above stated percent. Example of the annual VALIC administrative fee: Annual investment of $1,000 x 0.0052 = $5.20 The expenses associated with each individual mutual fund are in addition to the administrative fee and may be found online at www.valic.com or via a mutual fund prospectus. Investors should carefully consider the investment objectives, risks, fees, charges and expenses before investing. This and other important information is contained in the prospectus, which can be obtained from your financial professional or at www.valic.com/eprint. Enter your Group ID in the Login field and click Continue. You can also request a copy by calling 1-800-428-2542. Read the prospectuses carefully before investing.