% Mstar Asset Category 3-Month YTD

advertisement

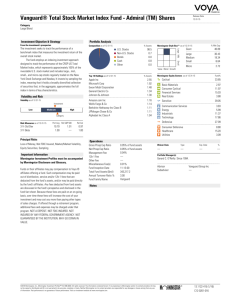

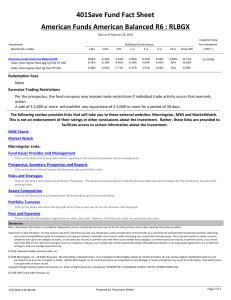

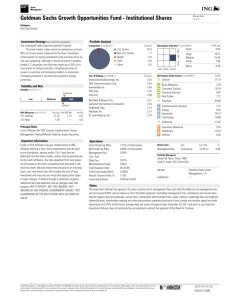

University of South Alabama Mutual Fund Performance Information Average Annual Returns (%) as of December 31, 2015 Asset Category Fund Name Foreign Large Growth American Funds Europacific Growth R6 Foreign Large Blend Vanguard Total Intl Stock Index Admiral Small Growth Janus Triton N Small Blend Vanguard Small Cap Index Adm Small Value DFA US Targeted Value I Mid-Cap Blend Vanguard Mid Cap Index Adm Mid-Cap Value Vanguard Selected Value Inv Large Growth American Funds AMCAP R6 Large Blend JPMorgan Disciplined Equity R6 Vanguard 500 Index Admiral Large Value Vanguard Windsor™ II Admiral™ Target Date American Funds 2015 Trgt Date Retire R6 American Funds 2025 Trgt Date Retire R6 American Funds 2035 Trgt Date Retire R6 American Funds 2045 Trgt Date Retire R6 American Funds 2055 Trgt Date Retire R6 Moderate Allocation American Funds American Balanced R6 Intermediate-Term Bond Janus Flexible Bond N Vanguard Total Bond Market Index Adm Inflation-Protected Bond DFA Inflation-Protected Securities I Money Market Invesco Short Term Inv Gov&Agcy Instl Stable Value VALIC Fixed-Interest Option Ticker 3-Month Return YTD Return 1-Year Return 3-Year Return 5-Year Return 10-Year Return Expense Ratio % Mstar Rank Cat 12 Mo % Mstar Rank Cat 3 Yr % Mstar Rank Cat 5 Yr RERGX 2.97 -0.48 -0.48 5.45 3.99 4.84 0.49 66 36 43 ** VTIAX 2.74 -4.26 -4.26 1.84 1.31 2.86 0.14 ** ** JGMNX 6.22 1.47 1.47 15.02 12.76 11.57 0.68 15 14 6 VSMAX 3.11 -3.64 -3.64 12.60 10.43 7.95 0.09 ** ** ** DFFVX 2.01 -5.72 -5.72 11.55 9.17 6.74 0.37 46 27 24 VIMAX 3.44 -1.34 -1.34 14.90 11.52 7.90 0.09 ** ** ** VASVX 3.41 -3.80 -3.80 13.27 11.05 7.74 0.44 37 22 17 RAFGX 5.61 1.11 1.11 16.00 12.79 7.80 0.37 72 40 29 JDEUX VFIAX 5.65 7.04 -2.16 1.36 -2.16 1.36 15.02 15.09 12.56 12.53 7.81 7.30 0.35 0.05 65 ** 19 ** 12 ** VWNAX 4.46 -3.14 -3.14 12.12 11.09 6.22 0.28 40 48 24 RFJTX RFDTX RFFTX RFHTX RFKTX 2.35 3.51 4.86 5.09 5.13 -0.62 0.13 0.59 0.64 0.63 -0.62 0.13 0.59 0.64 0.63 7.04 9.75 10.69 10.89 10.88 6.96 8.63 9.13 9.24 9.23 N/A N/A N/A N/A N/A 0.36 0.40 0.42 0.44 0.47 18 3 1 1 1 1 1 1 1 4 1 1 1 1 1 RLBGX 5.12 2.03 2.03 10.81 10.18 7.05 0.29 3 2 1 JDFNX VBTLX -0.78 -0.60 0.33 0.40 0.33 0.40 1.77 1.33 3.97 3.13 5.62 4.47 0.44 0.07 31 ** 20 ** 16 ** DIPSX -1.12 -1.22 -1.22 -2.52 2.66 N/A 0.12 19 32 2 AGPXX 0.01 0.03 0.03 0.02 0.02 1.27 0.13 N/A N/A N/A N/A N/A N/A N/A 0.31 28 18 12 Plan Averages: ** Peer group rankings (Lipper or Morningstar) are not an appropriate relative performance measurement for a passively managed index fund, as they do not separate indices from actively managed funds within each category. Since the investment objective of this fund is to replicate the returns of the index, tracking error (showing variance from the index) is a more appropriate return measurement. An investment in a money market fund is not insured by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund. The performance data quoted represents past performance. Current performance may be higher or lower than the performance stated due to recent market volatility. Past performance does not guarantee future result. Investment values will fluctuate and there is no assurance that the objective of any fund will be achieved. Mutual fund shares are redeemable at the then-current net asset value, which may be more or less than their original cost. Bear in mind that investing involves risk, including the possible loss of principal. lease visit www.valic.com for month-end performance. The principal value of an investment is not guaranteed at any time including at or after the target maturity date. Performance data prior to the inception date of the new class of funds is hypothetical and reflects historical returns of an existing share class at net asset value adjusted to reflect the additional 12b-1 fees relating to the new class of funds. Mutual funds are classified according to Morningstar. Several of these funds, returns were achieved during favorable market conditions. There can be no assurance that the funds will continue to achieve substantially similar performance as they previously experienced. The investment return and principal value will fluctuate so an investor's shares, when redeemed, may be worth more or less than their original cost. Data Source: Morningstar Morningstar measures risk-adjusted returns and ratings reflect historical risk-adjusted performance. The overall rating is a weighted average based on a fund's three-, five- and ten-year star rating. These ratings are subject to change every month. The Overall Morningstar Rating for a fund is derived from a weighted average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. Morningstar Rating is for the A share class only/ other classes may have different performance characteristics. Past performance is not a guarantee of future results. ©2015 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is not a guarantee of future results. Generally, higher potential returns involve greater risk and short-term volatility. For example, small-cap, mid-cap, sector and emerging funds can experience significant price fluctuation due to business risks and adverse political developments. International (global) and foreign funds can experience price fluctuation due to changing market conditions, currency values, and economic and political climates. High-yield bond funds, which invest in bonds that have lower ratings, typically experience price fluctuation and a greater risk of loss of principal and income than when investing directly in U.S. government securities such as U.S. Treasury bonds and bills, which are guaranteed by the government for repayment of principal and interest if held to maturity.Fund shares are not insured and are not backed by the U.S. government, and their value and yield will vary with market conditions. Mortgage-related funds' underlying mortgages are more likely to be prepaid during periods of declining interest rates, which could hurt the fund's share price or yield and may be prepaid more slowly during periods of rapidly rising interest rates, which might lengthen the fund's expected maturity. Investors should carefully assess the risks associated with an investment in the fund. VALIC declares a portfolio interest rate monthly for the Fixed-Interest Option. That declared portfolio interest rate is guaranteed until the end of that month and is credited to all new and old deposits as well as credited interest. The contractual lifetime minimum guaranteed interest rate is 1.5%; however, VALIC guarantees -- for calendar year 2015-- a minimum portfolio interest rate of 2.15%. All interest is compounded daily at the declared annual effective rate. VALIC's interest-crediting policy is subject to change, but any changes will not reduce the current rate below the contractually guaranteed minimum or money already credited to the account. All guarantees are backed by the claims-paying ability of The Variable Annuity Life Insurance Company. To view or print a prospectus for a currently offered fund, visit www.valic.com and access “Prospectuses and Other Materials.” Click on the appropriate link in this section. Click on "Funds" at the left-hand side of the screen, and the funds available for your plan will be displayed. The prospectus contains the investment objectives, risks, charges, expenses and other information about the respective investment companies that you should consider carefully before investing. Please read the prospectus carefully before investing or sending money. You can also request a copy by calling 1-800-428-2542. Securities and investment advisory services offered through VALIC Financial Advisors Inc., member FINRA, SIPC and an SEC-registered investment advisor. * Policy Form GFUA-504, a group fixed annuity issued by The Variable Annuity Life Insurance Company. VALIC represents The Variable Annuity Life Insurance Company and its subsidiaries, VALIC Financial Advisors, Inc. and VALIC Retirement Services Company. While this review and suggestions have been designed to enhance performance while maintaining current plan pricing, specific fund modification requests should be submitted to the Fund Selection and Pricing teams at least 8 weeks prior to targeted implementation date to confirm fund availability, pricing, and other implementation details in order to assure a smooth program transition. For Plan Sponsor Use Only. Not for Public Distribution. Page 1 of 1