Personal Finance

advertisement

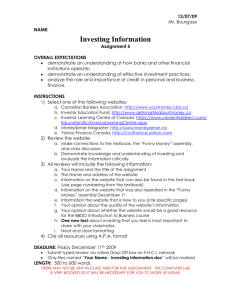

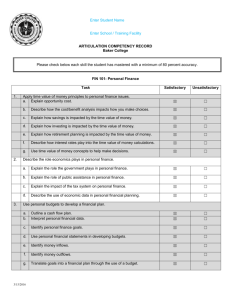

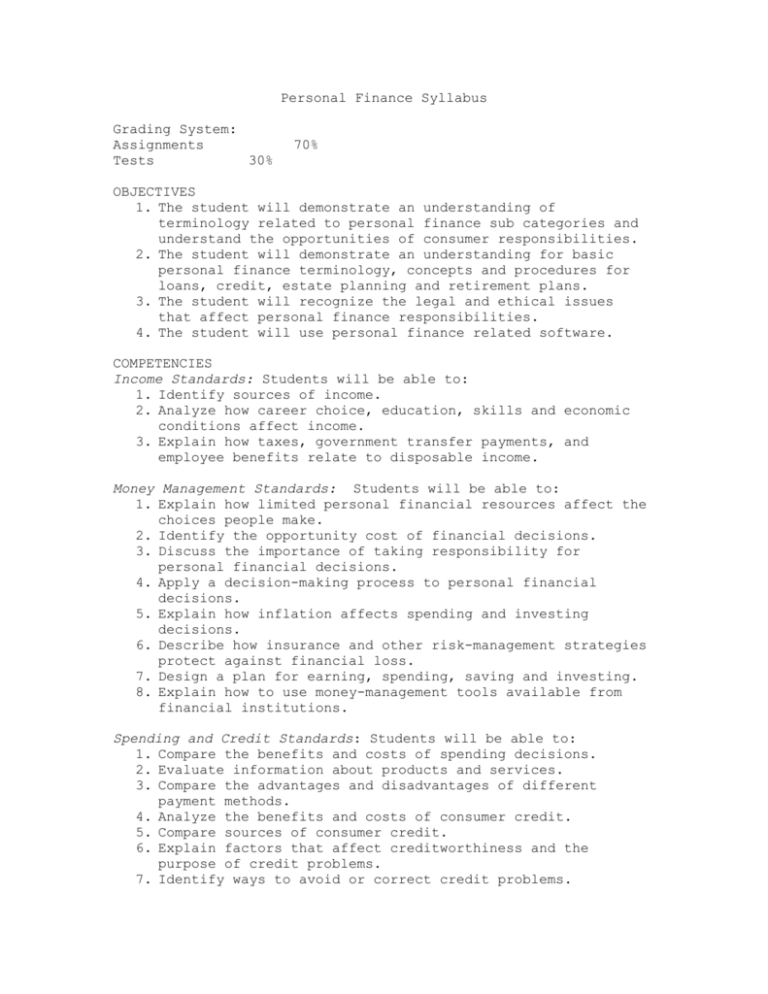

Personal Finance Syllabus Grading System: Assignments Tests 30% 70% OBJECTIVES 1. The student will demonstrate an understanding of terminology related to personal finance sub categories and understand the opportunities of consumer responsibilities. 2. The student will demonstrate an understanding for basic personal finance terminology, concepts and procedures for loans, credit, estate planning and retirement plans. 3. The student will recognize the legal and ethical issues that affect personal finance responsibilities. 4. The student will use personal finance related software. COMPETENCIES Income Standards: Students will be able to: 1. Identify sources of income. 2. Analyze how career choice, education, skills and economic conditions affect income. 3. Explain how taxes, government transfer payments, and employee benefits relate to disposable income. Money Management Standards: Students will be able to: 1. Explain how limited personal financial resources affect the choices people make. 2. Identify the opportunity cost of financial decisions. 3. Discuss the importance of taking responsibility for personal financial decisions. 4. Apply a decision-making process to personal financial decisions. 5. Explain how inflation affects spending and investing decisions. 6. Describe how insurance and other risk-management strategies protect against financial loss. 7. Design a plan for earning, spending, saving and investing. 8. Explain how to use money-management tools available from financial institutions. Spending and Credit Standards: Students will be able to: 1. Compare the benefits and costs of spending decisions. 2. Evaluate information about products and services. 3. Compare the advantages and disadvantages of different payment methods. 4. Analyze the benefits and costs of consumer credit. 5. Compare sources of consumer credit. 6. Explain factors that affect creditworthiness and the purpose of credit problems. 7. Identify ways to avoid or correct credit problems. 8. Describe the rights and responsibilities of buyers and sellers under consumer protection laws. Saving and Investing Standards: Students will be able to: 1. Explain the relationship between saving and investing. 2. Describe reasons for saving and reasons for investing. 3. Compare the risk, return, and liquidity of investment alternatives. 4. Describe how to buy and sell investments. 5. Explain how different factors affect the rate of return of investments. 6. Explain how agencies that regulate financial markets protect investors. Managing Your Personal Finances Fifth Edition Contents: Unit 1 Career Decision Chapter 1 Choosing your Career Chapter 2 Planning Your Career Chapter 3 Getting the Job Chapter 4 Adapting to Work Chapter 5 Work Laws and Responsibilities Unit 2 Money Management Chapter 6 Pay, Benefits, and Working Conditions Chapter 7 Federal Income Tax Chapter 8 Budgets and Financial Records Chapter 9 Checking Accounts and Other Banking Services Unit 3 Financial Security Chapter 10 Saving for the Future Chapter 11 Investing For Your Future Chapter 12 Investing in Stocks Chapter 13 Investing in Bonds Chapter 14 Investing in Mutual Funds, Real Estate, and Other Choices Unit Unit Chapter 15 Retirement and Estate Planning 4 Credit Management Chapter 16 Credit In America Chapter 17 Credit Records and Laws Chapter 18 Responsiblities and Costs of Credit Chapter 19 Problems With Credit 5 Resource Management Chapter 20 Personal Decision Making Chapter 21 Renting a Residence Chapter 22 Buying a Home Chapter 23 Buying and Caring for a Vehicle Chapter 24 Family Decisions Unit 6 Risk Management Chapter 25 Introduction to Risk Management Chapter 26 Property and Liability Insurance Chapter 27 Health and Life Insurance Unit 7 Consumer Rights and Responsibilities Chapter 28 Role of Consumers in a Free Enterprise System Chapter 29 Consumer Protection Chapter 30 Dispute Resolution