Sources of Government Revenue

advertisement

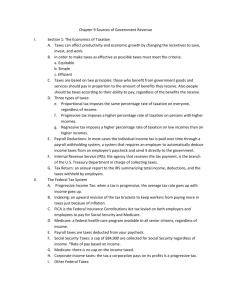

• • • • • • • • • • • Sources of Government Revenue The Economics of Taxation : Economic Impact of Taxes Taxes/Other government revenues affect: – Resource allocation, – Consumer behavior, – Nation’s productivity – Growth Economic Impact of Taxes : Resource Allocation Affects _____________________________________ A TAX placed on a good at the factory = ___________________________________ Supply curve shifts to the left If demand stays the same = _______________________________________________ Economic Impact of Taxes: Behavior adjustment TAXES affect the economy – Encourage or discourage certain activities – __________________________________ high percentage tax that raises revenue while reducing consumption of a socially undesirable product Economic Impact of Taxes: Productivity and Growth Taxes affect productivity and economic growth: – Change ______________________________________________________ Why people favor lower taxes…. Economic Impact of Taxes: The Incidence of a Tax “Final Burden of the Tax” I.e. Utility company: – Raise rates: ___________________________________________ • (easy if demand is__________________________) – Rates are regulated = • _____________________________ receive smaller dividends; postpone raises • (more _________________________________ = producer will absorb the tax) Criteria for Effective Taxes TAXES are effective when they are: – Equitable – Simple – Efficient • • • • • • • Criteria for Effective Taxes Criterion 1: _____________________________________________ – Taxes should be IMPARTIAL and JUST – Fairness is subjective – Taxes are considered __________________________________ – Fewer loopholes: exceptions, deductions, and exemptions Criterion 2: Simplicity – Tax LAWS should be _______________________________to understand – Individual income taxes: the taxes on peoples earnings • ___________________________________ = dislike – Sales tax: general tax levied on most consumer purchases; • __________________________________________ • Anyone purchases = pay tax Criterion 3: Efficiency – Easy to administer and successful at __________________________________ – Individual income tax – Less efficient: toll booths – ________________________________________ Two Principles of Taxation __________________________________________: those who benefit from government and services should pay in proportion to the amount of benefits received – Gas tax (built in) pay more if you drive more Two limitations: – Many gov’t services provide the greatest benefits to those who can least afford to pay for them – Benefits are hard to measure _____________________________________________: people should be taxed according to their ability to pay, regardless of the benefits they receive. Two factors – Recognizes that societies cannot always ________________________________ – Assumes that people with higher incomes suffer less discomfort paying taxes than people with lower income Types of Taxes • ________________________: imposes same percentage rate of taxation on everyone • _________________________: imposes a higher percentage rate of taxation on people with high incomes than on those with low incomes • ____________________________________ imposes a higher percentage rate of taxation on low incomes than on high incomes Figure 9.3 The Federal Tax System IRS (Internal Revenue Service) part of the Treasury Department Individual Income Taxes • Fed. Gov’t collects __________________ of its revenue from Individual income taxes • Paid over time through payroll withholding system • Before _____________ each year, an employee must file a tax return: an annual report to the IRS summarizing total income, deductions, & taxes withheld by employers • Progressive tax • Progressive Tax that ranges from 15% -39.6% – Individuals earning higher incomes _____________________________ tax rates FICA: What is FICA? And why does it take part of my paycheck? • • • • FICA stands for Federal Insurance Contributions Act FICA tax includes ______________________ (6.2% of wages) &__________________ (1.45% of wages) _________________________________ source of Gov’t revenue Social Security is a proportional tax up to $65,400 (the capping point) and then it is regressive • • • • • _________________________ is not capped; it’s proportional at all levels of income Total FICA tax = 7.65% Corporate Income Taxes _____________________________ category of federal taxes Corporation is recognized as a separate entity Rates vary from 15% -35% (slightly progressive) Other Federal Taxes • • • ________________ tax on the manufacture or sale of certain items, such as gasoline and liquor ________________ tax the gov’t levies on the transfer of property when a person dies __________________: tax on gift of money/wealth paid by person making gift State and Local Tax Systems State Government Revenue Sources • • • • ______________________________________ - money from federal gov’t Sales tax - general tax on consumer purchases Employee Retirement Contributions Individual Income Taxes (not all states) STATE SALES TAX States with the Highest Sales Tax: • Mississippi • Rhode Island • Washington • Texas • Illinois States Without a State Sales Tax: • Alaska • Delaware • Montana • New Hampshire • Oregon Advantages of Sales Tax • _____________________________________ to raise large sums of money • • • • • • • Difficult to avoid because it affects large numbers of consumers Relatively ________________________________ - merchant collects at point of sale Local Property Taxes _______________________________ source of revenue for local governments Real Property: includes real estate, buildings, & anything permanently attached _____________________________________ includes tangible items, not permanently attached. Intangible Personal Property: property with invisible value, such as stock, bond, patent, check Examining Your Paycheck Payroll withholding statement: the summary statement attached to a paycheck that summaries income, tax withholdings, and other deductions