will be exhausted sooner than thought due to the economic

advertisement

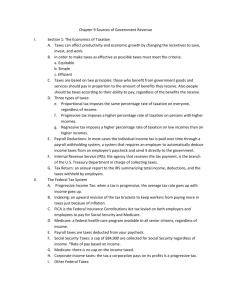

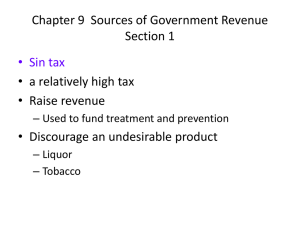

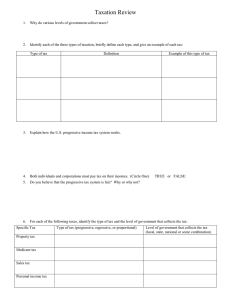

Chapter 9 Vocabulary Terms ►Sin tax ►A high tax designed to raise revenue and reduce consumption of a socially undesirable product such as liquor or tobacco. ► The highest court in Texas has upheld a special "sin tax" imposed on "sexually oriented" businesses, which the state openly says it hopes will discourage "secondary behaviors" allegedly associated with those going to watch unclothed dancers. ► The Texas Supreme Court on Friday said the $5-perpatron fee was constitutional and did not violate the free speech rights of club owners. ► "The fee in this case is clearly directed not at expression in nude dancing but at the secondary effects of nude dancing when alcohol is being consumed," said Justice Nathan Hecht. Such "social ills" were identified by the state as rape, sexual assault, prostitution and disorderly conduct. ►Tax loopholes ►Exceptions or oversights in the tax law that allow some people and business to avoid paying taxes. ►Fairness issue ►Most people oppose b/c of the fairness issue. ► Play Video – Reagan Called for an End ►Sales tax ►A general tax levied on most consumer purchases. ►Paid at the time of purchase. ►Everyone who buys the product is taxed. ►Individual income tax ►Tax on people’s earnings. ► ►Benefit principle of taxation ►Those who benefit from government goods and services should pay in proportion to the amount of benefits they receive. ►You pay a tax on gas that is built in to the price. ►People who drive more than others pay more gas taxes. ►Therefore, some people pay for more of the upkeep of our nation’s highways. ►Ability to pay principal of taxation ►The belief that people should be taxed according to their ability to pay, regardless of the benefits they receive. ►Individual income tax, which requires individuals with higher incomes to pay more than those with lower incomes. ► Play video – Future President ►Proportional tax ►Imposes the same percentage rate of taxation on everyone, regardless of income. ►Progressive tax ►Tax that imposes a higher percentage rate of taxation on persons with higher income. ►$1,000 on $10,000 ►$4,000 on $20,000 ►$30,000 on $100,000 ► Play video – Tax the Rich Feed the Poor + Feed the Poor ►Regressive tax ►Tax imposes a higher percentage rate of taxation on low incomes than on high incomes. ► People in lower-income brackets are statistically more likely to become addicted to tobacco. This is due to many factors, from lack of overall education to cigarette marketing strategies. When these lowerincome folks not only pay the cost of their cigarettes, but also bear the excessive taxation associated with them, the final cost can take a substantial percentage of their income. People who earn higher wages pay a lower percentage of their overall income. This is the nature of the regressive tax, and it is not fair. ►Payroll withholding system ►A system that requires an employer to automatically deduct income taxes from an employee’s paycheck and send it directly to the government. ►Internal Revenue service (IRS) ►Branch of the U.S. Treasury Department in charge of collecting taxes. ► Play Video – What Happens if You don’t File ►Tax return ►An annual report to the IRS summarizing total income, deductions, and taxes withheld by employers. ► Play Tax Video – How to Fill Out W-4 ►FICA ►Federal Insurance Contributions Act tax levied on both employers and employees to pay for Social Security and medicare. ► The country's benefit programs for the elderly – Medicare and Social Security – will be exhausted sooner than thought due to the economic downturn, the Social Security and Medicare Boards of Trustees said today. ► Medicare's Hospital Insurance Fund is projected to exhaust its funds in 2024, five years sooner than last year's estimate, and Social Security will be exhausted in 2036, a year earlier than previously thought, the trustees announced. ►Medicare ►Federal health-care program available to all senior citizens, regardless of income. ►Pay roll taxes ►Taxes (FICA and Medicare) deducted from your paycheck. ►Excise tax ►Tax on the manufacture or sale of selected items, such as gasoline and liquor. ►Regressive because lowincome families spend larger portions of their incomes on snuff, liquor, legal betting. ►Estate tax ►Tax the government levies on the transfer of property when a person dies. ► Play video – Whoopi Goldberg ►Gift tax ►Tax on donations of money or wealth and is paid by the person who makes the gift. ►Used to make sure wealthy people do not try to avoid taxes by giving away their estates before their deaths. ►Property ►A tax tax on possessions such as real estate.