2 per page - David M. Schulz

advertisement

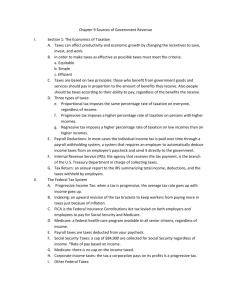

Economics, Principles and Practices – Unit 3, Chapter 9, Sections 1 – 3; pgs 228-255; 2 per page Vocabulary sin tax incidence of a tax sales tax tax return ability-to-pay principle of taxation progressive tax marginal tax rate evolved Internal Revenue Service FICA payroll tax estate tax gift tax intergovernmental revenue property tax implemented considerably accelerated depreciation investment tax credit flat tax value-added tax (42 total) tax loophole individual income tax benefit principle of taxation proportional tax average tax rate Medicare regressive tax validity payroll withholding system indexing corporate income tax excise tax customs duty user fee tax assessor natural monopoly payroll withholding statement alternative minimum tax capital gains concept controversial Comprehension Questions 1. How does the government get its money? 2. What must taxes be in order to be effective? 3. What does it mean to say that taxes must be equitable? 4. What two principles are taxes in the United States based on? 5. Give an example that illustrates the benefit principle of taxation. 6. Give an example of the ability-to-pay principle of taxation. 7. What are the three general types of taxes that exist in the United States today? 8. Why was the first federal income tax enacted in 1861? 9. What are the main sources of government revenue? 10. Where do States get their revenues from? 11. What are the main revenue sources for local governments? 12. What was one consequence of tax reform? 13. Where can you find out about the income taxes you pay? 14. Use the tax table shown in Figure 9.7 on page 249. How much in taxes would an individual with $40,000 of taxable income pay? 15. What fact virtually guarantees that there will be future attempts to simplify the tax code? Written Answer Write a paragraph with a minimum of six sentences to explain what you have learned in this lesson. Be sure to include a topic sentence, four detail sentences, and a concluding sentence.