Chapter 9 Sources of Government Revenue Section 1 p. 223 Terms:

advertisement

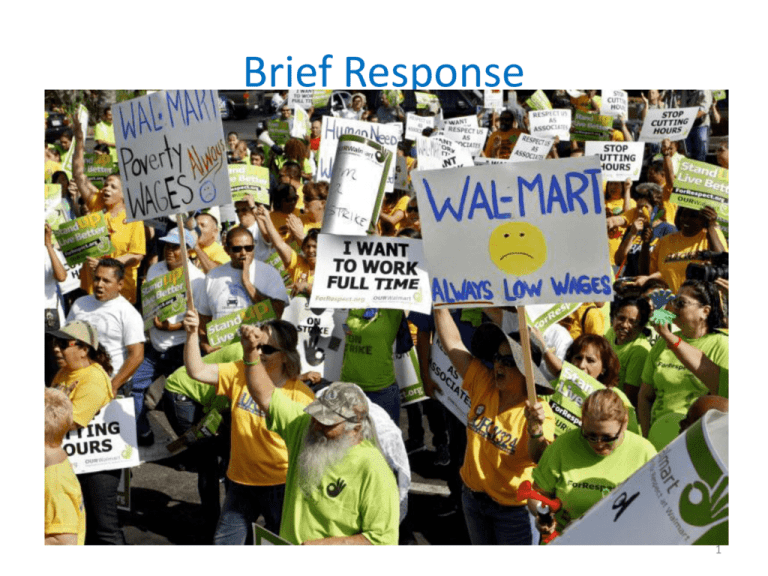

Brief Response • Wal-mart is a profitable business with many outlets that require a lot of floor employees. Their selling-point is low prices. • Which group do you think is the majority of their labor force, full-time employees or parttime employees? Explain. (2) – Wal-mart uses a majority of part-time workers. • This keeps costs of labor down. • Saves Wal-mart on legal labor benefits (also keeping costs down). • This keeps employees from demanding their rights (joining unions). 1 Chapter 9 Sources of Government Revenue Section 1 p. 223 Terms: • Sin tax • 224 a relatively high tax • Raise revenue – Used to fund treatment and prevention • Discourage an undesirable product – Liquor – Tobacco – Gambling • Incidence of a tax • 225 the final burden of the tax Tax loopholes • 226 exceptions or oversights in the tax law that allow select individuals and businesses to avoid paying taxes. • Raise a question of fairness. Individual income tax • 226 tax on a person annual earnings (salary, wages, tips, etc.) • A complex tax • Many rules apply to – how much is taxable – How much is deductible Sales tax • 226 levied on most consumer products • Simple tax – Paid on time of purchase – Uniform for all products • CA = as high as 9.25% (after vote to approve emergency hike for education), official is still 7.5% • Exemptions include: – Basic foods (not processed) – Child care – medicine Benefit principles of taxation • 227 those who benefit from government goods and services should pay in proportion to the amount of benefits they receive • A guiding principle of taxation. – Ex: Gas tax paid only by users at gas stations • Pays for interests of users of gasoline • Highways Ability-to-pay principle of taxation • 228 the belief that people should be taxed according to their ability to pay. • Recognizes – That society cannot measure the benefits derived from government spending. – The assumption is that people with higher incomes suffer less discomfort paying taxes than people with lower incomes. Proportional tax • 229 imposes the same percentage of taxation on everyone, regardless of income. – A 15% tax would mean • $10,000 income, tax would be $1500 • $100,000 income, tax would be $15000 Proportional tax • On your other worksheet (start a new one if you have no more room (keep them together) – Why doesn’t the US use a proportional income tax? Explain (consider the tax burden for each income group) (2) Proportional tax • Why doesn’t the US use a proportional tax? Explain. (2) (consider the tax burden for each income group) – Answer: it is not a fair rate as it takes what little money lower income people have, reducing their buying power. The wealthy class can afford the tax as they still have tens of thousands of dollars to spend after taxes. (ability-to-pay principle of taxation) – While both groups use the tax-dollar government goods and services, business uses them at an accelerated rate. (benefit principles of taxation) Average tax rate • 229 total taxable income divided by the total income • Constant, regardless of income – If income increases, the percentage stays the same. – Current for my tax bracket: • US: @15% • CA: @10% Progressive tax • 229 imposes a tax with a higher rate of taxation on person with higher income. • Marginal tax rate • Applies a levy to the next dollar of taxable income • The rate increases as the amount of taxable income increases • 2014 (single). Break out your calculators; I’ll call you. – $10,000 income, tax is $1,050 = ______% tax? • .105 – $20,000 income, tax is $2,550 = ______% tax? • .1275 – $98,000 income, tax is $20,623 = ______% tax? • .21 • Points where tax percentage increases are called “brackets” Regressive tax • A tax that imposes a higher tax burden on lower income people as it takes the same percentage rate of taxation as that on high incomes. • Sales tax is harder on lower income people than higher income people. – CA = 9.25 – (considering the single tax earner, again): – $10,000 income finds it harder to save precious money when shopping making the cost of living proportionally higher than that of a $98,000 income earner who has more money to spend after the sales tax. Section 2, p. 231 Terms: • Payroll withholding system • 232 requires the employer to automatically deduct income taxes from an employee’s paycheck. – W-2 form starts the process – W-2 statement informs employee • total annual gross income, • net income, • taxes withheld. Internal Revenue Service (IRS) • 232 Branch of the US government that collects taxes. • Part of the Department of the Treasury Tax return • 232 an annual report filed by the employee to the IRS – Total income – Deductions – Taxes withheld by employers • Must be submitted by April 15th if employee owes any more taxes. – If employer paid more taxes, the employee will receive a payment from the government. Tax information • When a person is hired, they fill out a W-2 form. – This starts withholding of tax on weekly or monthly pay. • Actually tax filing begins with the Form 1040 for most people and businesses. – If your employer or you withheld more money than you should be taxed you get a refund – If your employer or you withheld too little money, then you will pay more taxes. Tax Form Project • Use the worksheets and forms to help you complete the US 1040 and CA 540 tax forms for this year. • You will only have the deductions on the tax form as we have no access to the tax books that allow you more. • Use the following: – Consider yourself a “single” income earner – On-line tax table for US 2014 (school web-page--Econ Unit III: macroeconomics). – Tax forms given to you – W-2 form given to you Tax Form Project • • • • • Turn in: 14 front 16 back 1 W-2 attached in proper place Total = 31. Indexing • 233 an upward revision of the tax brackets to keep workers from paying more in taxes just because of inflation. FICA • 233 Federal Insurance Contributions Act – Tax levied on both employers and employees to pay for Social Security and Medicare • Medicare • A federal health-care program available to all senior citizens – Regardless of paying the tax for Social Security and medicare • Payroll tax – Revenue deducted from a person’s paycheck by the government. • FICA Corporate tax • 235 a corporation pays an income tax as if it were an individual. • Based on profits • Brackets as of printing were: – 15% up to $50,000 – 25% $50,001 to $75,000 – 34% $75,001 to $18.3 million – 35% $18.3 million and over. Excise tax • 235 A tax on the manufacture or sale of selected items – – – – – – – Gasoline Liquor Telephone service Tires Legal betting Coal Luxury goods • A regressive tax as lower-income people pay more of their income than higher income people. Luxury good • 235 good or service where demand for the good rises faster than income, when income grows. – Vehicles over $40,000 – Large pleasure boats – Private planes – Jewelry – Furs • Phased out by Congress in 2002 Estate tax • 235 tax levied on the transfer of property when a person dies. • Usually on property OVER $2 million. • Aka, “death tax” Gift tax • 235 tax on large amount of money or wealth “donated” by a person to others to avoid paying larger income taxes. Customs duty • 236 tax on imported goods or goods brought in by travelers from other countries. – Automobiles – Jewelry – Metals • Until 1913, the main source of revenue of the United States – Replaced by income tax that year. User fees • 236 Charges for the use of a good or service. • Ex: National park fees Hwk Assessments, Class Work, to Know Assessments: Checking for Understanding CH 9, S1 • • • • • 1 Resource allocation Behavior adjustment Productivity and growth Incidence of a tax CH 9, S1 • 3 • They affect – resource allocation – Consumer behavior – The nation’s productivity and growth CH 9, S1 • • • • 4 Equity Simplicity Efficiency CH 9, S1 • • • • 5 (just list them) Benefit principle Ability-to-pay principle CH 9, S1 • 6 • Proportional: – Same percentage rate of taxation on everyone • Progressive: – Imposes higher percentage rate on person with higher incomes • Regressive: – Imposes a higher percentage rate on lower incomes as compared to high incomes. Assessments: Checking for Understanding CH 9, S2 • • • • 1 Individual income taxes FICA taxes Corporate income taxes CH 9, S2 • 3 • It imposes a higher percentage rate of taxation on persons with higher income. CH 9, S2 • • • • • 4 (text: 2005) 15% 25% 34% 35% • 2014 US tax brackets (single payer) CH 9, S2 • • • • • • 5 Excise taxes Estate taxes Gift taxes Customs duties User fees for the use of a good or service. image, p. 224 • Question • Total government receipts grew from 500% of the 1940 level to over 700% Image, p. 225 • Question • The demand for medicine is generally inelastic • The consumer will bear the greater burden of a tax on medicine. images, p. 227 • question • The amount each pays depends on how much income each earns images, p. 228 • Question • Progressive tax image, p. 232 • Borrowing decreased and taxes increased Image, p. 233 • • • • $6,810.00 Solution: $3,910 + .25 ($40,000 – $28,400) = $3,910 + $2,900 = $6,810 image, p. 234 • Question • A regressive tax • Because the Social Security portion of FICA is capped at a certain income level – The higher the income, the lower the FICA tax. image, p. 235 • Question • Goods or services for which the demand rises faster than income when income grows. Brief Response • What are the purposes of government collecting taxes and other revenue? (5)