417_Globalautos_063

Global Automotive

Presenter:

Industry----Frank

GM----Raymond

Toyota----Angela

Volvo---Lillian

Global Auto Sales

The growing importance of

Emerging Market

Surprise! Surprise!

QUICK EXPANSION

The production for the next 20 years will be more than what ’ s been made for the entire 110 years of auto industry history

BRIC, especially China has been, and will be the major driving force of global Auto industry

Expected to replace Japan as the second largest market

Continuous Growth in Global

Automobile Industry

Global Vehicle Ownership Estimation: Over 1 billion units in 2010

Major Countries

Click here

Major Manufactures

Major Manufacturer operating

Margin

Excess production capacity-NA

Industry Characteristics

---Major Cost

Labour & Pension plans****

N.A companies face a large amount of pension cost----approx. $1500 per vehicle

Jap companies have none pension cost

Material

Hundreds of pieces purchased from suppliers

Automakers absorb only part of the increase in material cost

Advertising

Cost Breakdown

---Typical American

Cost Breakdown

---Typical American

Industry Characteristics

---Sales cycle

Highly sensitive to aggregate economic performance

U.S economy will slow down from 3.2%

GDP growth to about 2%

The effect of democratic victory in congress??

Industry characteristics

---M/A, Alliance

Technology, R/D

Market penetration

Global cooperation

Industry characteristics

---M/A, Alliance

GM:---200 Garage Car makers in early days

---SAAB, Daewoo

---Isuzu, Subaru, Suzuki

Ford---Jaguar, Land Rover, Volvo,

----Mazda

Benz---Chrysler

Renault---Nissan

Porter ’ s Five Forces

Threat of New entrants

Emergence of foreign competitors with

Capital, skills technology and management

Chinese & India brands within their own countries

Suppliers

Had little power before

Been hit hard in Major Automaker cost cutting

Globalization

merger and acquisition

Increased tension b/w suppliers and

Automakers

Supply Chain (traditional)

Tier 3

Raw

Material

Tier 2

Small parts

Tier 1 components

OEM

Design& assemble

Supply Chain (emerging)

Raw

Material

Supplier

Component specialist

Global

Standardized–

Systems

Manufacturer

Systems

Integrator

Merger of suppliers

Outsourcing production

---to more suppliers

Percent of Car Value outsourced

Suppliers

--Cost cutting requirement of Automakers

Suppler (cont)

A major suppler Collins & Aikman halted delivery to Ford on Oct 19 th

Caused temporary shut down of one of the biggest assembly line of Ford

Foreseeable---

One of the largest supplier

Dana has been added to the list (April 2006)

Substitutes

Public transportation on the rise

Rivalry

Fierce competition

High competition cost

Low return

Historically avoid price competition

More and More price competition

Buyers

Historically, the automaker power went unchallenged

As the market saturate, more options made available, buyers have significant amount of power

Increasing Models and

Decreasing Scale, US Market

Regulation

Regulations

Emission standard***

Safety standard

European Union : “ACEA agreement” seeks 25% reduction in vehicle CO emissions levels by 2008

(from 1995 levels). Agreement may be extended an additional 10% by 2012.

Japan : requires 23% reduction in vehicle CO emissions by 2010 (from 1995 levels).

2

Australia : voluntary commitment to improve fuel economy by 18% by 2010.

Canada : has proposed a 25% improvement in fuel economy by 2010.

China : Introduced new fuel economy standards in

2004; weight-based standards to be introduced in 2 phases (2005 and 2008).

California : CARB approved GHG emissions reductions for automobiles, currently under legislative review.

New York : Clean Cars Bill proposing to follow

California standards is currently in committee. Several other NE states have indicated they will follow CA’s lead.

Comparison of Fuel Economy and

GHG Emission Standards

55

EU

50

Japan

45

40

35

30

China

25

US

20

2002 2004 2006 2008

An and Sauer, 2004 for the Pew Center on Global Climate Change

2010

Australia

Canada

2012 2014

California

2016

Aggregate Value Exposure

Estimated cost per vehicle to meet “most likely” carbon constraint scenarios in US, EU and Japan

8

$700

$600

$500

$400

$300

$200

$100

$0

BMW DC Ford

25x difference in Value Exposure across the industry

GM VW Nissan Toyota PSA Renault Honda

90

80

70

Management Capacity for

Low-Carbon Technologies

Measure of OEMs’ capacity to develop and commercialize main lowcarbon technologies: hybrids, diesels & fuel cells

100

9

60

50

40

Toyota DC Renault-

Nissan

Honda Ford GM VW BMW* PSA

In addition

Political issues

Trade barrier tariff

Energy crisis

OPEC

Political & Natural reasons

Technology development

Hybrid, Fuel cells, Hydrogen, Electronic, ethanol.

Etc

System feature & design

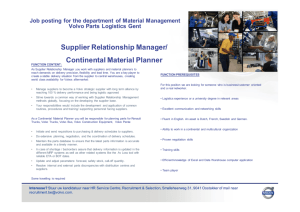

Key success factors

Pension fund management

How well the company digest what ’ s been eaten

Supplier relationship management

Risk management (i.e. exchange exposure risk, commodity price risk) design, marketing of new models

New technology development

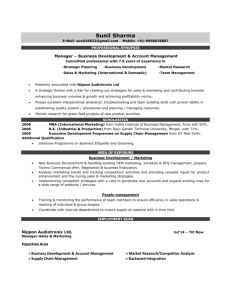

General Motors

Symbol: GM

Exchange(s): NYSE

Industry: Consumer Products (Automotive)

As of Nov 7, 2006

Dividends Per Share : 1.00

Number of Shares: 565,610,000

1 Year Chart

30% increase within 1 year

5 Year Chart

20% decrease within 5 years

Company Profile

The world's largest automaker has been the global industry sales leader for 75 years employs about 327,000 people around the world manufactures its cars and trucks in 33 countries

Engaged in automotive production and marketing and financing and insurance operations largest operating presence in North

America

EXECUTIVE

PROFILES

G. Richard Wagoner, Jr.

GM Chairman & Chief Executive Officer

Since June 2000

BA in economics from Duke University

MBA from Harvard Business School

Frederick (Fritz) A. Henderson

GM Vice Chairman and Chief Financial Officer

BBA from the University of Michigan

MBA from Harvard Business School

Robert A. Lutz

GM Vice Chairman, Global Product Development

BA in production management from the University of California-Berkeley

MBA from the University of California-Berkeley degree of doctor of management from Kettering

University

Brands

Buick

Cadillac

Chevrolet

Fleet & Commercial

Operations

Holden

Vauxhall

GMC

GM Daewoo

HUMMER

Pontiac

Saturn

Saab

Opel

GMAC Financial Services

A finance company offers automotive, residential and commercial financing and insurance

GM's OnStar subsidiary

a provider of vehicle safety, security and information services use (GPS) satellite and cellular technology to link the vehicle and driver to the OnStar Center advisors offer real-time, personalized help 24 hours a day,

365 days a year

Global Partnerships

majority shareholder in GM Daewoo Auto &

Technology Co. of South Korea

Product, powertrain and purchasing collaborations with Suzuki Motor Corp. and Isuzu Motors Ltd. of

Japan

Advanced technology collaborations with

DaimlerChrysler AG

BMW AG of Germany

Toyota Motor Corp. of Japan

Vehicle manufacturing ventures with

Toyota

Suzuki

Shanghai Automotive Industry Corp. of China

AVTOVAZ of Russia

Renault SA of France

Market

GM's largest national market is the

United States, followed by China,

Canada, the United Kingdom and

Germany

GM in 2005

One of the most difficult years

Reported loss of $10.6 B

The size of GM’s 2005 loss, most of which related to its North American operations

Global Sales

GM had its second highest sales volume globally last year, with nearly 9.2 million vehicles sold

More than half of GM’s sales globally came

OUTSIDE the United States

In the Asia Pacific region , GM sold more than 1 million vehicles

GM became the No. 1 car manufacturer in China along with their joint venture partner

Significant growth in Latin America, Africa and the Middle East region , with sales up 20 percent

Eighth consecutive year of sales leadership in region such as: Chile, Ecuador, Venezuela, South

Africa and the Middle East

GM Europe cut its losses significantly

GM Production Schedule

GM Car Deliveries

Challenges and Weakness

Due to:

1.

huge legacy cost burden

2.

3.

4.

inability to adjust structural costs in line with falling revenue global overcapacity falling prices

5.

6.

7.

8.

a) rising health-care costs higher fuel prices reducing demand for some of the highest-profit product global competition international exchange rates tend to help

Japanese and Korean imports

Rising retiree health care costs and Other

Post Employment Benefit (OPEB) fund deficit prompted the company to enact a broad restructuring plan

For every active GM employee in the

United States last year, GM supported 3.2

retirees and surviving spouses

GM’s health-care bill in 2005 = 5.3B

Financial Burden

Health care and pensions.

* Number of U.S. retirees and surviving spouses who received pension plan benefits

** Est. number of U.S. employees, dependents, retirees and surviving spouses covered by health benefits

Delphi Chapter 11 proceedings

Delphi is an automotive parts company spun-off from GM

GM recorded a charge of $5.5 billion

($3.6 billion after tax) as an estimate of contingent exposures relating to the

Chapter 11 filing of Delphi Corporation

GM receiving only a portion of amounts owed by Delphi to GM obligations in excess of amounts recognized by GM in 2005 in connection with benefit guarantees

Consolidated Results

GM North America

GM North America

The loss due to:

declines in sales of higher margin large cars

Unfavorable material costs

Increased health-care expenses

Advertising and sales promotion cost increases restructuring charge

GM Europe

GM Europe

In February 2005, GM successfully bought itself out of a put option with Fiat for $2 billion USD

Restructuring charges negative pricing unfavorable exchange rates

Pricing declines

GM LATIN AMERICA/AFRICA/MID-EAST

GM LATIN AMERICA/AFRICA/MID-EAST

significant industry growth in 2005

19% increase in vehicle unit sales net sales and revenues improved by approximately 34%

Lost due to:

quarter impairment charges of $99 million for assets

A full valuation allowance charge

GM Asia Pacific

GM Asia Pacific

General Motors is the top-selling foreign auto maker in China unit sales in the Asia Pacific region increased approximately 6.3% the fastest growing automotive region

Unit sales increase by 20%

Lost due to:

Write-down of GM’s investment in FHI (Fuji Heavy

Industries ) asset impairment charges

restructuring activities

Continue to take advantage of the strong position and growth in China, leverage its capabilities at

GM Daewoo, and execute the turnaround at GM’s

Holden unit

GMAC

GMAC

goodwill impairment charges lower net interest margins

North America Turnaround Plan

Four-point turnaround plan

Keep raising the bar in the execution of great cars and trucks

Revitalize sales and marketing strategy.

Significantly improve cost competitiveness

Address health-care and pension legacy cost burden.

Turnaround Plan – Plant and labor reduction

cease production at 12 U.S. plants by 2008 reduce manufacturing workforce by 30,000 positions (cumulative reduction to 38 percent ) reduce our retiree health-care obligations by about $15 billion cap the company’s contribution to salaried retiree health-care costs modify pension benefits for salaried and executive employees reduced salaries of our top executives reduced our dividend by 50 percent

Expected to result in annual cost reductions totaling

$7 billion

Consolidated Balance Sheets - Assets

Consolidated Balance Sheets –

Liabilities and Stockholders’ Equity

Available Liquidity

Cash flows from continuing operating activities

Cash flow from continuing financing activities

Q3 financial Highlights

2006 Q3 Highlights

Record Q3 revenue of $48.8B

Adjusted EPS $0.93

$529 million Adjusted Net Income r

$1,643 million improvement vs. Q3 ’05

Adjusted results

Significant improvements continue in GME and GMLAAM

Lower results at GMAC

Cash balance of $20.4B at quarter-end,

Favorable results in Corporate Other largely driven by reduced

Goals

Automotive operations improved by $1.5B on an adjusted basis, on strength of cost actions in

GMNA and continued momentum in other regions

On track to achieve $9B structural cost target on a running rate basis by the end of 2006 – and continuing to work on goal to reduce to 25% of revenues by 2010

Key priority is to finalize negotiations with Delphi

Continue to be on track to close the GMAC transaction in Q4

Automotive liquidity remains strong at $20.4B, but continued focus on improving operating cash flow

Key Success Factors

1)

2)

3)

4)

5)

Continued demand for GM’s most profitable products and the maintenance of a strong product mix

The introduction of innovative new products on a timely cadence, through the integration of global architectures, engineering, and procurement efforts

The implementation of measures for reducing structural costs, offsetting legacy and health-care burdens

Maintenance of sufficient balance sheet strength and liquidity

Other factors affecting GM’s Financing and Insurance

Operations (FIO) reportable operating segment results, including interest rates, credit ratings, and demand for mortgage financing.

Issues to consider

GM is the healthiest of the Big Three !!!

ability to compete with Asian automakers ???

Jerry York !!!

GM's accounting subject of inquiry market share in China ???

GM vs. Toyota??

cash flow problems??

High structure cost?

Sustainable?

Recommendation

HOLD

Toyota Motor Corporation

Company Snapshot

Industry: Consumer Products (Automotive)

Ticker Symbol: TM

Listed on: NYSE

Stock Price: US$ 123.460

Net Change: US$ 2.250

52-Week High: US$ 124.000

% Change: 1.86%

EPS: 7.90

Data as of 08-Nov-06

52-Week Low: US$ 89.800

P/E: 15.60

Dividend Payout: 17.25%

ROA: 8.19%

ROE: 13.5%

# of shares outstanding: 3,609,997,492 shares

Chart - 1 year (daily)

Chart – 5 years (monthly)

Financial Highlights

Company Overview

Established in 1937

Producing vehicles in 26 countries

Marketing vehicles in more than 170 countries and regions

Toyota

’ s Brands: Toyota, Lexus, Daihatsu, and

Hino

Sold ~ 8millions vehicles in 2006

More than 280,000 employees

Management Team

Chairman of the Board/Director (since 2006)

Fujio Cho (69 years old )

Joined Toyota in 1960

Director of Aioi Insurance Co., Ltd

Director of Central Japan Railway Company

Director of Toyota since September 1988

President

Katsuaki Watanabe (63 years old)

Joined Toyota directly from college in 1964

Director of Mitsubishi Securities Co., Ltd.

Director of Toyota since September 1992

Executive VP/Director (since 2005)

Mitsuo Kinoshita (60 years old)

Joined Toyota in 1968

Director of Toyota since June 1997

Vice Chairman of the Board of Gamagori Marine

Development Co. Ltd.

Current Business

Automotive Operations

Japan

North America

Europe

Asia and other regions

Financial Services Operations

Auto sales financing

Retail sales of corporate bonds

Investment trusts

Asset development services for individuals

Housing loans

Insurance

Other Business Operations

Manufactured housing

Advertising & e-Commerce services

Industrial & aerospace equipment

Marine equipment

Telecommunications services

Sports teams and golf courses

Consolidated Segment Information

Revenues segmented by business operations:

Revenues by Business Operations

Yen in millions

2006

By Business Operations:

Revenues:

Automotive

Financial Services

All Others

Operating Income:

Automotive

Financial Services

All Others

19,338,144

996,909

1,190,291

1,694,045

155,817

39,748

Automotive Operations

Revenues:

¥

19,338.1 billion (+13.0%)

Operating income:

¥

1,694.0 billion (+16.6%)

Causes:

Currency exchange rate fluctuations

Increases in vehicle production and sales

Cost reduction activities

Minus the higher expenses resulting from business expansion

Vehicle Production and Sales

Sales and Production Distribution

Products Distribution

Manufacturing Companies Distribution

Vehicle Production and Sales

Market Shares

Vehicle Sales Projection by Region

Financial Services Operations

Financial Services Operations

(cont’d)

Revenues:

¥

996.9 billion (+27.6%)

Causes:

Higher financing volume from increasing vehicle sales

Toyota has the highest credit rating in

S&P

’ s and Moody

’ s

Operating income:

¥

155.8 billion (

–

22.4%)

Causes:

Valuation losses on interest rate swaps

Accounting adjustment in 2005 for loan origination costs by a sales finance subsidiary in the US

Other Business Operations

Revenues:

¥

1,190.3 billion (+15.5%)

Operating income:

¥

39.7 billion (+17.8%)

Causes:

Favorable production and sales in the housing business

Consolidated Segment Information

Revenues segmented by region:

Revenues by Region

Yen in millions

2006

By Region:

Revenues:

Japan

North America

Europe

Asia

Other Regions

Operating Income:

Japan

North America

Europe

Asia

Other Regions

¥ 7,735,109

7,455,818

2,574,014

1,836,855

1,435,113

¥ 1,075,890

495,638

93,947

145,546

67,190

Threats

Hikes in crude oil price

Hikes in raw materials price

Fluctuations in currency exchange rates and interest rates

Structural changes in demand for automobiles

Change governmental regulations in automotive industry

Political instabilities

Fuel shortages or interruptions in transportation systems

Natural calamities, wars, terrorism

Competitive Strengths

Superior Quality

Brand Image: safe, environmental friendly

Cost competitive

R&D - Technology leader

Fuel-efficient vehicles

Solid financial base

Personnel development

Cost Reduction Strategies

Solution to Hike in Oil Price

Hybrid Vehicles

Prius has become the top selling hybrid car in America.

Toyota now has three hybrid vehicles in its lineup:

Prius

Highlander

Camry

The popular minivan Toyota Sienna is supposed to join the hybrid lineup by 2010.

Financial Statements

Semiannual Cash Flows Statement

Selected Financial Summary (Cont’d)

Semiannual Report

Released on

Nov. 7, 2006

Semiannual Report

Released on

Nov. 7, 2006

Semiannual Report

Released on

Nov. 7, 2006

Semiannual Report

Released on

Nov. 7, 2006

Semiannual Report

Released on

Nov. 7, 2006

Future Strategies

Enhancing technology development capabilities centered on environmental technology

Increasing production through the advancement of localization

Expand Production Capacity

Future Strategies by Region

Recommendation

Volvo Group

Company Snapshot

Data as of Nov-02-06

Last : US$ 62.420

Net Change : US$ -0.240

% Change : -0.38%

Open 62.240

Bid 0.010

High 62.690

Low 61.930

Volume 19,506

52 Week

High

63.290

52 Week

Low

40.800

Ask 2,000,0

00

EPS 4.64

P/E 13.5

Yield 0.00

Div.

0.00

# Shares 404.8M

Company Snapshot

3 year weekly chart 5 year weekly chart

Stock Analysis (Volvo VS Market)

2 Year 1 Year

Competitor

Market Cap

Employees

Qtrly Rev Growth

Revenue

Gross Margin

EBITDA

Oper Margins

Net Income

EPS

P/E

P/S

Volvo

26.60B

81,860

10.20%

35.93B

22.83%

4.58B

8.13%

1.93B

4.761

(404.8M)

13.80

0.73

Paccar

14.90B

21,900

18.80%

15.86B

15.43%

2.42B

12.61%

1.43B

5.651

(248.30M )

10.62

0.93

Management Team

Leif Johonsson

43,538 Series B shares and 50,000 employee stock options

President and CEO

Master of Engineering

With Volvo since 1997

Jorma Halonen

2,000 Series B shares and 25,000 employee stock options

Executive Vice President

Bachelor of Science in Economics

With Volvo since 2001

Company Overview

Establish: 1927

Employees: more than 80,000

Product & Service:

Company Overview

A global group :

Conducts sales in about 185 countries

Has production facilities in 18 countries

Most of the Volvo Group’s sales are to markets in Western

Europe and North America

Brands:

Production Facilities

Sales by Business Area

Volvo Trucks (67%)

Volvo Penta (4.2%)

Volvo Buses(7.2%)

Construction & Equipment(15%)

Volvo Aero (3.3%)

Sales by Business Area (Cont)

Sales by Market Area

Business Strategy

Customer oriented

Develop the dealer networks & improve service to customers

Strong product portfolio

Invest in future technologies such as alternative drivelines and supplementary fuels & offer various applications

Capitalize on economies of scale

Volvo Powertrain: provides engines and other driveline components

Volvo Parts: optimizes inventory management and distribution of parts

Volvo Logistics: handles optimal logistics solutions for materials flow

Key Drivers

Cyclical industry

Intense competition

Unstable prices for commercial vehicles

Operations exposed to currency fluctuations

Profitability depends on successful new products

Relies on suppliers

Government regulation

Quarterly Income Statement

3/2005 – 3/2006

(1 SEK=0.1398 USD)

Key Operating Ratios

Nine Month Ended Report

Sep 30 2006

(1 SEK=0.1398 USD)

2005 Financial Highlights

Net sales increased by 14%

Income for the year increased by 32%

Earnings per share increased by 37%

Proposed dividend SEK 16.75 per share

2005 Financial Highlights (Key Ratio)

Consolidated Income Statement

(1 SEK=0.1398 USD)

Sales & Margin

Operating Income / R&D Cost

Consolidated Cash Flow Statement

(1 SEK=0.1398 USD)

Cash Flow Statement 2005

Capital Expenditures

Current & past Future

Consolidated Balance Sheet

(1 SEK=0.1398 USD)

Change in Net Financial Position

Dividend Payout

Recent News

Strategic decision on closure of Volvo Aero’s operations in Bromma

Volvo initiates a Traffic Accident Research Centre in China

Volvo Aero Norway to be supplier to the

General Electric Engine for the Joint Strike

Fighter

Volvo Trucks laying off 600 at Powertrain Plant in Hagerstown

Volvo Aero expands in US

Recent News (cont)

Volvo Construction Equipment invests in China

Plans bus body cooperation in India

AB Volvo increases its holding in Nissan Diesel