Experience of the use of smarter connection arrangements for

advertisement

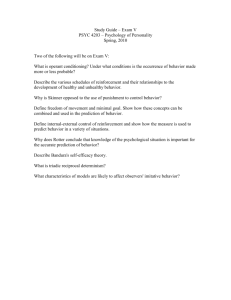

Options for allocating and releasing distribution system capacity: Deciding between interruptible connections and firm DG connections Karim L. Anaya1,2, Michael G. Pollitt2 Abstract: The aim of this study is to quantify the trade-off between selecting a distributed generation (DG) smarter connection with limited export capacity and a more expensive firm DG connection with a guarantee of full export capacity. The study is part of the analysis of a customer funded network innovation project in the UK. A cost-benefit analysis of the different connection options for connecting DG customers in a specific constrained area in the UK is performed. The study not only requires the identification of the main cost drivers and revenues (including embedded benefits and those allowed by regulation) for getting a new DG connection but also illustrates the interaction (operational and contractual) between the different parties involved (generators, distribution network operators, electricity suppliers, and demand) .This study provides empirical evidence, under a number of scenarios - of the potential savings when a smart connection option is available. The results suggest that in general small wind DG customers will always have advantage in selecting a smarter connection over the large one. We also examine the type of connection that would be preferred by solar PV DG customers and Anaerobic Digestion (AD) DG customers. The study also shows that lower curtailment levels tend to substantially reduce the value of firm connections. 1 Corresponding author. Email: k.anaya@jbs.cam.ac.uk The authors are with the Energy Policy Research Group (EPRG), University of Cambridge, Trumpington Street, Cambridge, CB2 1AG, England. E-mail: k.anaya@jbs.cam.ac.uk, m.pollitt@jbs.cam.ac.uk. 2 1 1. Introduction The 2009 EU Renewable Energy Directive has established specific energy targets for 2020 which have accelerated the connection of more renewable generation to the distribution network. In the UK, it is expected that 15% of energy consumption will be from renewable sources by 2020 (DECC, 2011a). The transition to low carbon networks requires the implementation of innovative technical solutions and commercial practices in order to meet growing demand for electricity but also to avoid or reduce high investment costs that are ultimately borne by customers (or taxpayers). The support of different initiatives that encourage the cost effective expansion of renewable distributed generation (DG) 3 will contribute importantly to a smooth transition. Distribution Network Operators (DNOs) play an important role in this transition by facilitating the efficient integration of renewable generation into the distribution networks and by testing innovative connection models that involve smart technical solutions and novel commercial arrangements. These models may require the interruption of the generation output (non-firm connections) under specific curtailment rules. This will allow the offer of faster and cheaper DG connections. Different studies have evaluated the potential impact of the integration of DG to the distribution grid, especially those related to electrical losses, network reinforcement deferral, security of supply and ancillary services (Gil and Joos, 2006; Mendez et al., 2006; Harrison et al., 2007; Passey et al., 2007; Wang et al., 2009; Hung and Mithulananthan, 2012). From these studies and in terms of electrical losses, it is observed that DG influences the trend in electrical losses and produces benefits to DNOs depending on the DG penetration, capacity factor and generation mix, dispersion and reactive power control. However, following Hung and Mithulananthan (2012), there is a point when losses start to increase due to the reverse power flow that occurs when connecting large amounts of DG capacity to given points within the distribution system. Mendez et al. (2006) observe that the increase in annual electrical losses is subject to the level of DG penetration which is represented by the amount of DG energy injected into the network to the feeder capacity, taking into consideration the respective capacity factor. Thus, it is expected that different technologies have different electrical losses variation curves. Wang et al. (2009) examine the deferral of reinforcement with improvements in security of supply and suggest that the incorporation of DG at the planning stage (by DNOs) can produce important economic benefits for them. Other studies have allocated a specific value to the network investment deferral benefit. For instance, Gil and Joos (2006) and Siano et al. (2009), suggest a range of average reinforcement cost that varies between US$200 and US$ 500/kW in the US4. This variation not only depends on the capacity but also on the length of the feeder. Harrison et al. (2007) looking at the UK, consider a different but similar range of costs, around £250/kW, and propose two scenarios: (1) 100% of annual deferral benefits retained by the DNO and (2) annual deferral benefits split between DNO (60%) and developer (40%). Other studies evaluate and estimate the benefits for DNOs associated with DG incentives5 (Siano et al., 2009; Harrison et al., 2007). The DG incentives applied in these studies are composed of a capacity charge and an O&M charge. Results from these studies suggest that in general other benefits such as those related to losses reduction (losses incentives) and network reinforcement deferral outweigh those from the DG incentives. From the previous studies, we observe that the majority of studies are focused on the impact (i.e. lower electrical losses, network reinforcement deferral) produced to the distribution grid (DNOs) by connecting more DG. However the impact of introducing innovative commercial arrangements for the profitability of DG investments themselves induced by offering flexible DG connections (i.e. cheaper cost connections with interruptible capacity) is not evaluated. Thus, in contrast with the previous studies, this one aims to evaluate the different approaches that DNOs may exercise for releasing capacity and connecting more DG in a cost effective manner and how these approaches may affect the DG project profitability. A cost-benefit analysis (CBA) is performed in order to estimate the net benefits of offering interruptible or smart connections (non-firm) vs conventional non-interruptible (firm) connections (subject to traditional reinforcement in the case of network constraints). 3 In this study we refer to distributed generation as those generating units connected within the distribution grid (up to 132 kV in Great Britain). It may involve renewable and non-renewable energy generation. Distributed generation is also known as embedded generation, decentralised generation or dispersed generation. 4 Based on 5-year average investment data (period 1995-1999) from the Federal Energy Regulatory Commission (FERC). 5 Further details about DG incentives are provided in Section 2.2. 2 A specific case study is analysed focussing on UK Power Networks’ recent proposal for connecting more DG under the Flexible Plug and Play (FPP) trial6. This case study refers to a specific constrained area with a particular network configuration. Even though the study doesn’t quantify the benefits that DNOs could capture by connecting more DG in their respective networks (we do this in a later paper), we believe that this first exercise is very useful to attract the attention of potential DG customers searching for new business opportunities that require the use of smart solutions. At the same time this study contributes to a better understanding of the operational and contractual issues that potential DG customers may face when deciding between interruptible and firm connections. Following Boehme et al. (2010), the option of firm connection is more reasonable for non-variable energy sources due the sustainability of the maximum output for extended periods. In the case of variable energy sources, the option of non-firm connections is more applicable to them due to the nature of these sources (i.e. unpredictability, intermittency). The paper is structured as follows. Section two discusses the network access regulation and incentive schemes applied to DG in Great Britain. Section three provides a brief description of the FPP trial. Section four focuses on the data collection, assumptions and scenarios for the CBA. Section five shows the results of the CBA. Section six discusses the conclusions of this study. 2. DG Access Network Regulation and Incentives in Great Britain 2.1 Connection costs and system charges DG customers in Great Britain that seek for a connection face two kinds of costs. The first one is the sole-use asset and the second one (if reinforcement is needed) is a proportion of shared use assets up to one voltage level above point of connection. The remaining costs of reinforcement of shared use assets are incurred by Distribution Use of System (DUoS) charges to all customers, which represent around 18% of an average household electricity bill (Ward et al., 2012). This kind of connection policy is classified as ‘shallowish’. The proportion of shared use assets that DG customers are subject to is determined by the cost apportionment rules defined in the Common Connection Charging Methodology (CCCM). The CCCM is part of the Statement of Methodology and Charges for Connection document that DNOs publish on their websites. In terms of system charges, low voltage (LV) and most high voltage (HV) consumers and DG customers are subject to the use of system charges under the Common Distribution Charging Methodology (CDCM). Extra high voltage (EHV) 7 and some HV consumers and DG customers at higher voltages are subject to the use of system charges under the Extra High Voltage Distribution Charging Methodology (EDCM). A small DG customer can incur additional costs if the connection may have an impact on the National Electricity Transmission System. A specific study classified as a State of Works (SOW) is required for this purpose. In general, DG customers that seek a connection are subject to the use of system charges applied by the DNOs for the use of the distribution system. However, large generators that want to connect to the transmission network (or those that wish to export to the GB Transmission system but who are not directly connected to this) have to pay the use of system charges associated with the transmission system (Transmission Network Use of System – TNUoS - charges) and the balancing market (Balancing Services Use of System – BSUoS - charges). 2.2 Subsidies and incentives to connect DG in Great Britain There are different initiatives in Great Britain that encourage the connection of renewable generation to the distribution networks. The most relevant for this study are discussed in the following paragraphs. a. Feed in Tariff (FIT): This scheme was introduced in 2010 and is focused on small renewable generation (no more than 5 MW). A guaranteed price is provided to DG customers for a fixed period. There are two kinds of tariffs: the tariff for every kWh of electricity generated and the export tariff for every kWh of electricity 6 The FPP project is funded by the Low Carbon Network (LCN) Fund programme managed by the Great Britain energy regulator (OFGEM) that encourages DNOs to implement new technologies and innovative operational and commercial arrangements. For further details about the FPP project see: http://www.ukpowernetworks.co.uk/internet/en/innovation/fpp/ 7 LV: less than 1kV, HV: 1kV-22kV, EHV: above 22 kV (ENA, 2011) 3 b. c. d. 3. exported (surplus energy) to the distribution network. The tariffs vary depending on the size of project, technology and date of installation. The technologies covered are solar photovoltaic (PV), wind turbines, water turbines, anaerobic digestion (biogas energy) and micro combined heat and power (micro-CHP). The tariffs are retail price index (RPI) linked and payments are guaranteed between 10 and 20 years depending on the technology. Renewables Obligation (RO): This scheme was introduced in 2002 and represents the main financial support for renewable generation over 5 MW (and some projects between 50kW and 5 MW). Under this scheme, suppliers are required to purchase Renewables Obligation Certificates (ROCs) issued by accredited renewable generators in order to meet their obligations. If these obligations cannot be met, suppliers have the option to make a buy-out payment to cover the number of pending ROCs. Banding was introduced in 2009 in order to support DG facilities based on the type of renewable technology. This scheme will close to new DG on 31 March 2017. DG will continue to receive financial support during the project lifetime (20 years). In 2037 this scheme will be totally replaced by a new Contract for Difference Feed-in Tariff (CfD FIT) scheme. Levy Exemption Certificates (LEC): Introduced in April 2001. These are electronic certificates that are used to demonstrate the amount of electricity that has been generated and supplied to non-domestic customers (industrial and commercial supply). OFGEM is responsible for issuing the certificates to generators or suppliers and for accrediting qualifying renewable generators. Electricity suppliers negotiate the purchase of these certificates with renewable generators in order to claim for the Climate Change Levy (CCL) Exemption on non-domestic supply. DG Incentives: These were introduced in 2005 and are payable to DNOs8. The aim was to facilitate the DG connections by incentivising DNOs to connect more DG efficiently and economically (OFGEM, 2009). It has already been decided that from 2015 this scheme will not be retained (OFGEM, 2013b). The principle of grandfathering will be applicable to current DG incentives. The Flexible Plug and Play trial Under the Flexible Plug and Play (FPP) trial, UK Power Networks, the largest DNO in the UK with around 8.1m customers, is looking at different options for connecting more DG. Developers are seeking connections at constrained parts of the network that operate within the trial area in the East of England (known as the ‘March Grid’). A total of six developers with total generating capacity of 26.2 MW are already engaged with the FPP trial (UK Power Networks, 2013). Connections in constrained areas increase the conventional connection costs which may jeopardise the project viability because of the need to pay for system reinforcement or for a longer sole use connection. The constrained area is driven by the excessive reverse power that flows on the existing 45 MVA transformers (132/33kV) and only interruptible connections are now possible in this area without any major reinforcement works (i.e. a primary transformer upgrade). Due to this fact, UK Power Networks has proposed the use of smart solutions (e.g. Active Network Management-ANM) and innovative commercial arrangements in order to be able to connect more DG customers in a cheaper and faster way (without the need of network reinforcement). This approach requires the interruption of the generation output (non-firm connections) under specific rules known as “Principle of Access” (POA) without any compensation to the DG customers of the DNO. This is similar to the Orkney ANM Project, implemented by Scottish and Southern Energy Power Distribution in the UK, in which compensation for interruption is not provided (Meeus et al., 2010). A description of the different POA can be found at Anaya and Pollitt (2014) and Kane and Ault (2014). The POA selected by UK Power Networks is pro rata where all the trial DG customers behind the constraint would be equally curtailed based on their proportion of total connected capacity (across all DG customers from the same technology, same generation profile). A capacity quota of 33.5 MW has been defined in order to limit the interruptible capacity and keep an acceptable curtailment level per generator (Baringa-UK Power Networks, 8 These incentives have not been included in the CBA because the present study is only focussed on generation, thus revenues to DNOs are not taken into account. 4 2013). A concern arises when the maximum quota for interruptible connections is reached. Clearly, it is important to make producers (already connected or new) aware of the way in which the connection of new capacity would be controlled and managed. Three kinds of technologies are involved: wind, solar PV and Anaerobic Digestion Combined Heat and Power (AD CHP). Wind and solar PV power generation have the most significant growth over the last 5 years (IEEE, 2012). In addition, these technologies could have the highest share in electricity power production in the long term, which might raise system integration and grid operation system issues (Niemi and Lund, 2010). We model three scenarios involving 100% wind, with a maximum curtailment level of 5.33% of potential generation. One scenario involves a mix of generation with wind, solar PV and AD CHP. The maximum curtailment levels for solar PV and AD CHP have been estimated in 2.57% and 1.73% respectively. These estimations are based on the results from the different scenarios modelled by Smarter Grid Solutions (SGS) taking into account the total interruptible capacity to be connected and the type of generation plant. 4. Evaluating DG Connections: Data Collection, Assumptions and Scenarios 4.1 Data Collection and Assumptions Data have been collected from different sources. All figures have been adjusted to 2012 prices and all Net Present Value (NPV) are evaluated looking from 2012. Some of the assumptions made in this study are based on those proposed by Baringa in the Reinforcement quota calculation for March Grid Report (Baringa-UK Power Networks, 2013). It has been assumed that electricity demand remains fixed over the project lifetime; this means that there is no assumed load growth. Carbon emission savings generated by the renewable projects under the four proposed scenarios have not been estimated because it is assumed that government support schemes (such as FIT and ROC) already include these benefits (in addition to any revenue impact of the EU Emissions Trading Scheme on modelled wholesale prices) in their respective rates. Appendix A shows the lists of variables, formulas, assumptions and references. A description of the variables that are involved in the CBA is given in Table 1. 4.2 Scenarios As previously mentioned, four scenarios have been suggested. The diversity of the scenarios proposed illustrates the different connection options that a DG customer may face when there is restricted capacity at a specific connection point (constrained area) and provides insights about the possible solutions (by deciding between smart interruptible connections or full connection subject to reinforcement works) and the way in which these affect the project profitability over time. The proposed scenarios contribute to a better explanation of the different connection situations in which the size, number and type of generation plant and the utilisation of the interruptible capacity (partial or full) may influence the decision to select a specific connection option by an individual DG project that secures a positive project NPV. All scenarios assume the same (fixed) demand and the first three scenarios assume only one level of curtailment across the project lifetime in the case of non-firm connections for similar generation plants (set at 0.33% with a total interruptible capacity of 18 MW or 5.33% with full non-firm capacity quota for wind generators). The number of DG customers differs across scenarios. The number of DG customers for each scenario takes into consideration the list of generators provided by UK Power Networks (those engaged or potentially engaged in the FPP trial at the time of the analysis) and the capacity quota. 5 Table 1: Summary of Variables Variables (2012 prices) Description of variables A. Costs Generation Costs Composed of OPEX and CAPEX, includes fuel costs (AD CHP) Connection Costs Vary across generators. Involves smart solutions (ANM) Reinforcement Costs Estimated by UK Power Networks at £4.1m. Associated with the replacement of transformers for increasing the system capacity up to 90 MW Business as Usual Connection Costs Refers to the connection costs estimated by UK Power Network (including conventional reinforcement) without considering the use of smart solutions B. Revenues 1/ Sale of electricity Subsidies C. Other benefits Represented by the sale of electricity in the wholesale market Represented by subsidies and incentives received by generators (e.g. FIT, ROC, LEC) if they are not curtailed Embedded benefits 2/ 1. Refer to those costs that generators may save when they are directly connected to the distribution network instead of the transmission network. Those costs are related to the transmission and distribution losses, BSUoS and DUoS charges 2. Three embedded benefits have been identified: Generator avoidance balancing system charges, Generator transmission loss reduction and Distribution use of system charges (neg.) 3. Based on the Balancing System Code (BSC), a ratio of 45% (generators) and 55% (suppliers) of transmission losses has been assumed 4. Regarding the avoidance of BSUoS and based on the BSC, generators and suppliers have the same ratio (50:50). BSUoS figures are net of Residual Cashflow Reallocation Cashflow – RCRC 5. RCRC represents the payment/charge that is redistributed amongst all BSC parties in proportion to their volume of credit energy 6. Based on the UK Power Networks' Indicative Charging System from April 2013, intermittent generators connected at higher voltages benefit from negative DUoS at £0.51/MWh 7. No transmission charge reductions due to the intermittency of the FPP generators Energy savings D. Technical variables Savings that solar PV are subject when use the produced electricity for own consumption. The savings are given by the difference in price between the price the generator pays for buying electricity for its business (e.g. from a supplier) and the wholesale electricity price Capacity factor Represents the ratio of the actual generation output over a period of time and the generation output with full capacity operation over the same period Depends on the type of generator (availability of the resource). Based on historical data PV module degradation Only for solar. Represents the decrease of the PV module performance over time leading to power reduction Export rate Only for solar. Represents the proportion of electricity that is exported to the grid Losses E. Rates Refers to the following assumptions: ratio of losses and average transmission losses Discount rate F. Power Purchase Agreement Rates vary depending on technology (in agreement with DECC, 2013) These are used for computing the present value of future figures over the project lifetime Different PPA rates have been applied for wholesale electricity, embedded benefits and subsidies/incentives 1/ Revenues from AD CHP plants only make reference to the export of electricity. Revenues from heat have not been taken into account. 2/ We allocate shares of the embedded benefits to the DG. In contrast with the rest of scenarios, the last scenario (Scenario 4) reflects a more dynamic situation where network upgrade is considered as an option by 2019 or 2020. The upgrade would allow an increase in the system capacity to accommodate DG to its maximum limit (90 MW) and to offer firm connection agreements to all DG customers by 2019 or 2020. Scenario 4 assesses the project NPV under both situations of network upgrades (in 2019 and 2020) and evaluates the value of accelerating the connection of the additional 56.5 MW (i.e. the difference between 90 MW and 33.5 MW) by comparing the NPV of the projects considering the network upgrade in 2020 and 2019. Table 2 summarises the scenarios. 6 Table 2: Scenarios Scenarios Non- firm capacity (smart option) Firm capacity (reinforcement option) Scenario 1 (MW) 18 MW (MW) 18 MW 5 wind 100% Scenario 2 33.5 MW 33.5 MW 7 100% Scenario 3 33.5 MW 33.5 MW 11 82.84% Scenario 4 33.5 MW 90 MW 1/ 7 (20) 100% # Generators 2/ Generation Mix solar PV AD CHP Annual curtailment level (%) 3/ 0.33 5.33 13.43% 3.73% 5.33 (wind), 2.57 (solar PV), 1.73 (AD CHP) 1/ Due to the addition of 56.5 MW (33.5+56.5=90 MW) by 2019/2020. 2/ In Scenario 4 the number of generators is 20 after the period 2019/20. 3/ Only applicable to non-firm (smart) connections. In Scenario 4 this % is only valid up to the period 2019/20. After this, a firm connection if offered. 5.33 Each scenario evaluates the costs and benefits for smart and reinforcement connection options. In addition, both options are compared with the Business as Usual (BAU) connection option where each project is individually offered a firm connection solution. The smart connection refers to the non-firm or interruptible connection offered to DG customers under the FPP scheme. The reinforcement alternative refers to a firm connection offer, which involves two kinds of costs: connection costs and reinforcement costs. It has been assumed that reinforcement costs are shared across all DG customers connected to the same point of connection. The BAU connection option refers to the connection option where there is no use of smart solutions and the related conventional reinforcement costs are fully borne by each individual DG customer disregarding the presence of other potential projects. The cost benefit analysis for each DG customer reflects the costs they face in connecting and operating their project and the revenues that they can expect to recover. Costs figures for each DG customer thus include generation, connection and reinforcement costs (in the case of firm connections). Benefits are represented by electricity revenues, incentives (FIT, ROC, LEC), embedded benefits and savings for auto consumption (only for solar PV). The NPV of each project is calculated by the difference between total benefits and costs (discounted at different rates depending on technology) over the project lifetime. We then calculate the total project NPV for the group of DG customers under each scenario. Specific situations of demand growth and their effect on the project NPV for each scenario are also analysed. It is important to note that the cost of solving the technical constraint 9which impedes the connection of more DG units in the March Grid trial area is already embedded in the cost benefit analysis by suggesting two different types of connection options: (1) non-firm/smart connections or (2) firm connections. In the first case, cheaper connection costs with smart solutions (i.e. ANM)10 are offered to generators but the total revenues (associated with sale of electricity, subsidies/incentives and embedded benefits) are lower due to the cost of being curtailed. In the second case, generators are allowed to reach full export capacity, however the connection costs increase importantly due to the need to pay for the network reinforcement (primary transformer upgrade). Finally, the effect of corporate taxes has not been included in the analysis. It is convenient to estimate the NPV before tax deductions in order to avoid adding more complexity to the analysis. In addition this allows making proper comparisons with different studies where generators/developers might be subject to different revenue tax rules. Appendix B summarises the specifications for each scenario. 5. Results The results from the cost benefit analysis are summarised in Table 3 where we distinguish between the NPV of the set of projects with and without including their share of the indirect (embedded) benefits. We discuss the detailed results from each scenario in turn. 9 As previously mentioned, technical constraints are represented by the excessive reverse power that flows on the existing 45 MVA transformers (132/33kV). 10 The use of smart solutions would allow the DNO to reduce remotely the generation output. Specific control and communication equipment at the generation site is required to make this possible. The cost of this additional equipment has been covered by the FPP project and represents around £50,000/generator. 7 Table 3: Summary of the results from the four scenarios Scenarios Scenario 1 NPV(£m) NPV(£m/MW) Scenario 2 NPV(£m) NPV(£m/MW) Scenario 3 NPV(£m) NPV(£m/MW) Scenario 4 years NPV(£m) NPV(£m/MW) 1/ With Embedded Benefits Smart connection Reinforcement option connection option Business as Usual 1/ Without Embedded Benefits Smart connection Reinforcement option connection option Business as Usual 1/ 17.75 0.99 14.40 0.80 9.55 0.53 17.23 0.96 13.88 0.77 9.03 0.50 24.15 0.72 24.84 0.74 14.43 0.43 23.24 0.69 23.88 0.71 13.47 0.40 25.47 0.76 25.83 0.77 10.41 (8/11) 0.31 24.60 0.73 24.91 0.74 9.48 (8/11) 0.28 2019 2020 68.29 66.17 0.76 0.74 2019 66.21 0.74 2020 64.17 0.71 Figures in parenthesis indicate the number of generators (with positive NPV) that may connect over the total. In the rest of cases all generators connect (positive NPV) 5.1 Scenario 1: With partial interruptible connected capacity -100% wind In this scenario, a partial utilisation of the total interruptible capacity quota (18 MW out of 33.5 MW) is proposed. Based on the group of possible connected generators (evaluated by our project partner SGS in the estimation of curtailed energy), five wind DG customers with a total installed capacity of 18 MW were selected. This scenario illustrates the case in which there is not enough DG connection demand for covering the full interruptible capacity offered at a specific connection point. In this case, it is expected that there will be a low curtailment level (annual curtailment level is only 0.33%). In addition, there are only five DG customers connected and it is clear that the option of smart connection fits best across all of them (due to the avoidance of reinforcement costs and the low level of curtailment) with positive project NPV over time with and without embedded benefits. However, we also note the effect of combining a small number of DG customers11 with different sizes connected to the same point. The higher the standard deviation (in terms of generator size) the higher the losses for large DG customers. This fact is explained by the high share of reinforcement costs that large DG customers face in comparison with the rate applied to small DG customers (pro rata distribution based on the MW size of generator). The connection of DG customers with similar size and connected to the same point, may help to reach a quicker consensus to proceed with network reinforcement due to the similar share of costs. The BAU connection option is by far the least profitable option across all DG customers, resulting in a lower NPV if all the projects were to individually connect. Results from this scenario indicate that under the smart connection option total project NPV is equal to £17.75m (£0.99m/MW) and under the reinforcement option the project NPV is around £14.40m (£0.8m/MW). If embedded benefits are not included, these values decrease in 2.9% and 3.6% respectively. When comparing only connection costs, total savings for selecting a smart or the reinforcement connection option instead of the BAU option are £9.8m (£0.54m/MW) and £5.7m (£0.32m/MW) respectively. 5.2 Scenario 2: With full interruptible connected capacity - 100% wind The purpose of this scenario is to evaluate the impact that a full interruptible capacity quota (33.5 MW) has on the project NPV. This scenario includes the five wind DG customers from Scenario 1 and two additional customers with nameplate capacity of 7.2 and 8.3 MW (Wind_F_7.2, Wind_G_8.3). Cost data regarding these wind DG customers were estimated based on those costs from Wind_E_10, due to the similar nameplate capacity. A pro-rata approach was used for estimating these costs. This scenario models a more efficient use of the distribution network due to the fact that the maximum interruptible capacity has been connected. This is a scenario where there is enough DG connection demand for the total capacity that is being offered by the DNO at 11 Small DG customers are those with nameplate capacity no greater than 1.5 MW, large DG customers are those with nameplate capacity greater than 1.5 MW. 8 a specific point of connection. The increase in the number of DG customers and by default the increase in total interruptible capacity connected reduces the share of reinforcement costs across all DG customers. As a result, DG customers may connect under the reinforcement option with a positive project NPV, regardless the effect of embedded benefits. The reinforcement connection option is the preferred among DG customers, because they can get a firm connection by paying a low proportion of total reinforcement costs. However their preference (in selecting the smart or the reinforcement connection option) may vary if a higher discount rate is applied. If the rate increases to 10%, small generators would still prefer the reinforcement connection option but large DG customers would select the smart connection option instead. This means that large DG customers appear to be more sensitive to the discount rate than the smaller ones. The gap between the project NPV of the smart connection option and the reinforcement connection option has been reduced as well. Two factors may contribute to this reduction: a lower share of reinforcement costs and an increase in the curtailment level (from 0.33% to 5.33%). In general and in comparison with Scenario 1, a higher curtailment level is expected with a maximum level of average curtailment of 5.33%. This makes sense because there is more capacity (the full quota is connected) at the same point behind a constraint. However, it is important to notice that decreases in demand and growth of micro-generation outside the ANM control will increase the curtailment level applied to DG customers. Once again, the BAU connection option is the least profitable option across the majority of DG customers. Results from this scenario show that under the smart connection option total project NPV is equal to £24.15m (£0.72m/MW) and under the reinforcement option the project NPV is around £24.84m (£0.74m/MW). If embedded benefits are not included, these values decrease on average 3.83%. If only connection costs are taken into account, total savings for selecting a smart or the reinforcement connection option instead of the BAU option are £16.3m (£0.49/MW) and £12.2m (£0.36m/MW) respectively. 5.3 Scenario 3: With full interruptible connected capacity and a mix of DG generation In this scenario, we want to understand to what extent the composition of the energy mix affects the project NPV. Five new DG customers were added in addition to the first six wind farms from Scenario 2. The connections costs regarding Wind_G-2.55 were calculated based on the connection costs associated with DG customers with similar nameplate capacity (1.5 MW). Connection costs regarding solar PV and the three AD CHP DG customers were provided by UK Power Networks. Based on the estimations made by our project partner SGS, the curtailment rates used in this scenario are: 5.33% (wind), 2.57% (solar PV) and 1.73% (AD CHP). This scenario simulates the connection of different types of generation plants to the same connection point and similar to Scenario 2 promotes a more efficient use of the distribution network due to the allocation of the total available interruptible capacity across DG customers. Likewise Scenario 2, the majority of DG customers would connect under the reinforcement connection option with or without embedded benefits. This is explained by the low share of reinforcement costs applicable to these customers. Thus, DG customers would prefer to invest a relatively small amount and get the option of full export capacity after the respective network reinforcement. The solar PV DG customer is the one that would prefer the smart connection option instead. This generator is the one with the lowest project NPV (but still positive), even though with a technology specific discount rate of 6.2%. If the discount rate increases to 10%, the project NPV becomes negative and the solar PV DG customer would not connect. Regarding the rest of DG customers, and in agreement with Scenario 2, again the small generators would still select the reinforcement connection option but the large ones will choose the smart connection option. This scenario assumes full interruptible connected capacity and the total project NPV is higher than the one estimated in Scenario 2. Different kinds of generation plants have different generation patterns and their average curtailment level also differs. This means that some of them are able to generate and export more over the same period of time. In this case, solar PV and AD CHP are subject to a lower average curtailment level than wind generation however their respective capacity factors are different to wind generation. 9 In terms of solar PV, it is also observed that the profitability of the project is importantly influenced not only by the assumption on the discount rate but also on the export energy rate. With an export rate of 100% (which means no energy savings due to zero auto consumption) the project NPV decreases significantly (still positive for smart option connection but negative under the reinforcement connection option). As with the previous two scenarios, the BAU connection option is the most expensive one and some DG customers will not be connected due to negative project NPV. In summary, the results from this scenario indicate that total NPV is around £25.47m (£0.76m/MW) if the smart connection option is selected and around £25.83m (£0.77m/MW) with the reinforcement connection option. With the exclusion of embedded benefits these values decrease on average 3.51%. If only connection costs are taken into account, total savings for selecting a smart or the reinforcement connection option instead of the BAU option are £22.7m (£0.7m/MW) and £18.6m (£0.6m/MW) respectively. 5.4 Scenario 4: With full interruptible connected capacity and the option of network reinforcement – 100% wind This scenario is a variation of Scenario 2 and proposes a more dynamic approach. The purpose of this scenario is to evaluate how the project NPV is affected when considering in the medium term the option of full firm capacity (up to 90 MW) and to value the benefits of accelerating the connection of additional capacity by one year. There are two sources of value of the acceleration: the reduction of curtailment by one year for 33.5 MW (from 5.33% to 0%) and the bringing forward by one year of the NPV of the 56.5 MW (with 0% curtailment). This scenario contemplates the possibility of network upgrade (reinforcement) after five or six years of the beginning of operation, which allows existing and new DG customers full export capacity (0% curtailment). This is represented as follows: Fig. 1: Installed capacity and curtailment level over time i ns talled ca pacity (MW) 90.0 Firm capacity (0% avg. curtailment) number of genera tors : 13 33.5 Non-firm capacity Firm capacity (5.33% avg. curtailment) (0% avg. curtailment) number of genera tors : 7 2014 2019 2020 2034 2039 2040 It has been assumed that incentives rates and bandings remain the same in real values. The project NPV is assessed in two consecutive years in order to estimate the value of accelerating the connection of 56.5 MW by one year (and reach the maximum firm capacity equal to 90 MW). These years are 2019 and 2020. The difference of the project NPV under both years represents the value of accelerating these connections. Results suggest that all DG customers connect by 2014 (the first 7 projects) or in 2019 or 2020 (an additional 13 projects). Small DG customers connected in advance (2014) benefit disproportionately due to higher project NPV in comparison with those with the same size but connected in the medium term (2019 or 2020). Large DG customers show an opposite effect. This fact is explained by the associated discount factor which decreases over the project lifetime and has a greater impact for large DG customers where connection costs (in terms of CAPEX) tend to be much higher. This scenario has assumed that the 2020 reinforcement costs will be incurred by demand (i.e. that the baseline network reinforcement costs do not affect the DG projects considered) in the 10 medium term and also that after this there would be enough DG capacity wishing to connect at a specific connection point to fulfil the maximum available firm capacity (90 MW). However, an alternative approach might be to consider a progressive increase of DG customers getting connected over time up to fulfil the available capacity. Accelerating the connection of additional DG capacity by one year impacts the total project NPV positively. However this also increases the discounted cost of the network reinforcement which now occurs a year earlier. In general the deferral of network investment may produce a positive impact due to discounting network costs and because network costs tend to be lower over time (progress on technology). However, our results show a net benefit of accelerating the network reinforcement (borne by demand) taking the two effects into account (increasing capacity and reducing curtailment). Thus this study proves that taking into consideration all the benefits and costs associated with the connection of DG customers at specific connection point, advancing the connection of these set of generators has a positive impact on the whole project. In this scenario, the NPV of accelerating network capacity and reducing curtailment by one year is £2.12m (£0.024/MW) with embedded benefits or £2.04m (£0.023/MW) without these benefits. This should be set against the cost of bringing forward the network reinforcement expenditure from 2020 to 2019, which is £0.1m12. This implies that the DG projects would collectively be willing to pay for the cost of accelerating the upgrade of capacity 13. 5.5 Effect of demand growth on project NPV A sensitivity analysis of different scenarios for demand growth that produces reduced curtailment of generation output is evaluated. Three demand scenarios are proposed: a reduction of 25, 50 and 75% of the curtailed energy. Results suggest that if demand grows in a way that produces a decrease in curtailed energy, project NPV increases importantly. This effect is more significant when embedded benefits are excluded. Additionally, lower curtailment levels reduce the value of firmness. Project NPV will increase if the level of curtailed output decreases, thus there is a point at which the value of a non-firm connection (smart option) exceeds the value of a firm connection (reinforcement option). For instance, in the case of Scenario 2 we observe an upward trend in the number of generators that would prefer the smart connection option when the curtailment level decreases. Table 4 illustrates this dynamic (white values indicate that the firm connection option would be preferred and grey values indicate an opposite effect). With a curtailment level of 1.33% all DG customers would select the smart connection option. A similar approach is observed in Scenario 3. Table 4: Effect of demand growth on project NPV across generators – Scenario 2 Generator Wind_A_0.5 Wind_B_1 Wind_C_1.5 Wind_D_5 Wind_E_10 Wind_F_7.2 Wind_G_8.3 Capacity Difference between firm and non-firm NPV (MW) Base - 5.33% 4.00% 2.66% 1.33% 0.5 96,788 59,548 22,307 - 14,933 1 89,136 40,765 - 7,606 - 55,977 1.5 133,705 61,148 - 11,408 - 83,965 5 88,688 - 63,918 - 216,525 - 369,131 10 111,201 - 177,468 - 466,137 - 754,806 7.2 80,065 - 127,777 - 335,619 - 543,460 8.3 92,297 - 147,298 - 386,894 - 626,489 12 The pre-tax WACC applied to DNOs was used as discount rate. Currently, the DG projects would actually be expected to bear the full cost of early reinforcement (if they wanted to occur in 2019 rather waiting until 2020 when demand would pay). This would have a discounted cost of £1.6m. 13 11 6. Final remarks This study is related to the business opportunities that DG customers could have in deciding between a non – firm (interruptible) and a firm (non-interruptible) connection. We are aware that results from the CBA are subject to uncertainty due to our static assumptions related to the generation mix (and the associated curtailment levels), the timescale of network upgrades and to demand growth. They also represent a conservative estimate of individual project value, based on the simultaneous connection of all other projects. In reality individual projects that connect relatively early will have higher project NPV due to experiencing lower than the modelled maximum level of curtailment. The results from the CBA suggest that in general small wind DG customers will tend to favour reinforcement rather than curtailment relative to the larger generators (i.e. have higher relative NPV/MW) due to their lower share of reinforcement costs. Large generators appear to be more sensitive to the discount rate than small generators. If the discount rate is set at 10%; small wind generators will still prefer to reinforce however large generators will select the smart option. In addition, solar PV generators may struggle to get a positive NPV over the project lifetime if full export capacity and a higher discount rate is assumed. This generator is the one with the smallest project NPV. The CBA also suggests that the BAU connection option is the least profitable option with negative project NPV in some specific cases for the group of generators considered. This fact is explained by the very high connection costs that individual DG customers are required to pay under the conventional connection option which does not consider smart solutions or a share of combined reinforcement costs. The study also demonstrates that lower curtailment levels (due to demand growth) tend to reduce the value of firm connection. Our findings strongly suggest that smarter connection with the option to bring forward reinforcement should a capacity quota be reached is likely to be significantly better than either a BAU connection offer or a collectively reinforce now offer. Acknowledgments The authors wish to acknowledge the financial support of UK Power Networks via the Low Carbon Networks Fund’s Flexible Plug and Play Project and of an anonymous reviewer. The authors are also grateful to Adriana Laguna and Sotiris Georgiopoulos from UK Power Networks, the Solar Trade Association and OFGEM for the provision of relevant information and helpful clarifications. Any opinions expressed in the paper are those of the authors alone and should not be taken to be representative of any organisation or individual with whom they are associated. References Anaya, K.L., Pollitt, M.G. (2014), “Experience with smarter commercial arrangements for distributed wind generation”, Energy Policy, Vol. 71, pp. 52-62. Baringa – UK Power Networks (2013), “Flexible Plug and Play: Reinforcement quota calculation for March Grid”, Baringa Partners and UK Power Networks, London. Boehme, T., Harrison, G.P. and Wallace, A.R. (2010), Assessment of distribution network limits for non-firm connection of renewable generation. IET Renew. Power Gener., 2010, Vol. 4, No. 1, pp. 64-74. DECC (2011a) “UK Renewable Energy Roadmap 2011”, in Department of Energy and Climate Change, London. DECC (2011b), “Consultation on proposal for the levels of banded support under the Renewables Obligation for the period 2013-17 and the Renewables Obligation Order 2012”, Department of Energy and Climate Change, London. DECC (2012a), “Solar PV cost update”. Prepared by Parsons Brinckerhoff, Department of Energy and Climate Change, London. DECC (2012b), “Government response to the consultation on proposals for the levels of banded support under the Renewables Obligation for the period 2013-17 and the Renewables Obligation Order 2012”, Department of Energy and Climate Change, London. DECC (2013), “Electricity Generation Costs (December 2013)”, Department of Energy and Climate Change, London. 12 Elexon (2012), “Information Sheet. Overview of Transmission Losses”, London. ENA (2011), “Distributed generation connection guide. A guide for connecting generation that falls under G59/2 to the distribution network”, Version 3.3, Energy Networks Association, London. Energy and Climate Change Committee (2012), “The economics of wind power: Written evidence”, UK Parliament, London. Gil, H.A., Joos, G. (2006), “On the quantification of the network capacity deferral value of distributed generation” , IEEE Trans. Power Syst., Vol. 21, No. 4, pp. 1592-1599. Harrisons, G, Piccolo, A., Siano, P. and Wallace, R. (2007), “Exploring the tradeoffs between incentives for distributed generation developers and DNOs,” IEEE Trans. Power Syst., Vol. 22, No. 2, pp. 821-828. Hung, D.Q. and Mithulananthan, N. (2012), “A simple approach for distributed generation integration considering benefits for DNOs”, Presented at 2012 IEEE International Conference of Power System Technology (POWERCON). IEEE (2012), “Power system of the future: The case for energy storage, distributed generation and microgrids,” Sponsored by IEEE Smart Grid with analysis by ZPRYME. Kane, L., Graham, A. (2014), “A review and analysis of renewable energy curtailment schemes and Principle of Access: Transitioning towards business as usual”, Energy Policy, Vol. 72, pp. 67-77. Meeus, L., Saguan, M., Glachant, J-M., and Belmans, R. (2010) “Smart regulation for smart grids. EUI Working Paper RSCAS 2010/45”, European University Institute, Florence. Robert Schuman Centre for Advanced Studies. Florence School of Regulation. Méndez, V.H., Rivier, J. and Gomez, T. (2006) ‘Assessment of energy distribution losses for increasing penetration of distributed generation’, IEEE Trans. on Power Systems, Vol. 21, No. 2, pp. 533-540. Niemi, R. Lund, P.D. (2010), “Decentralized electricity system sizing and placement in distribution networks”, Applied Energy, Vol. 87, No. 6, pp. 1865-1869. OFGEM (2009), “Electricity distribution price control review. Final proposal – Incentives and Obligations”, Office of Gas and Electricity Market, London. OFGEM (2013a), “The Renewables Obligation buyout price and mutualisation ceiling 2013/14. Information Note”, Office of Gas and Electricity Market, London. OFGEM (2013b), “Strategy decision for the RIIO-ED1 electricity distribution price control. Outputs, incentives and innovation. Supplementary annex to RIIO-ED1 overview paper”, Office of Gas and Electricity Market, London. Passey, R., Spooner, T., MacGill, I., Watt, M., and Syngellakis, K. (2011), “The potential impacts of grid-connected distributed generation and how to address them: A review of technical and non-technical factors”, Energy Policy, Vol. 39, No. 10, pp. 6280-6290. Pöyry (2013), “Potential impact of revised Renewables Obligation technology bands: updated modelling”, Pöyry Management Consultancy, Oxford. REDPOINT (2009), “Decarbonising the BG power sector: evaluating investment pathways, generation patterns and emissions through to 2030. A report to the Committee on Climate Change”, Final report vI, RedPoint Energy Ltd., London. Rubino, A. (2011), “Investment in power generation: From market uncertainty to policy uncertainty. Real options approach applied to the UK electricity market”. Thesis submitted to the Department of Economics and the Committee of Graduate of Studies of the University of Siena for the degree of Doctor of Philosophy in Economics. Siano, P., Ochoa, L.F., Harrison, G.P. and Piccolo, A. (2009), “Assessing the strategic benefits of distributed generation ownership for DNOs”, IET Gen., Transm., Distrib., Vol. 3, No. 3, pp. 225-236. UK Power Networks (2013), “Innovation update”, Issue 2, Spring 2013, UK Power Networks, London. Wang, D.T.C, Ochoa, L.F., Harrison, G.P. (2009), “Distributed generation and security of supply: Assessing the investment deferral”, Paper presented at 2009 IEEE Bucharest Power Tech Conference, June 28th-July 2nd, Bucharest, Romania. Ward, J., Pooley, M. and Owen, G. (2012), “GB Electricity Demand- realising the resource Paper 4: What demand-side services can provide value to the electricity sector?”, Sustainability First, London. 13 Appendix A Table A.1: List of variables, formulas and references Variable Value/Formula References/Sources 1. Costs CAPEX OPEX Connection Costs Reinforcement Costs 2. Revenues/Incentives Wholesale Electricity FIT - Wind FIT - Solar PV FIT - AD Depends on technology. It includes construction costs and predevelopment costs DECC (2012a): solar PV; DECC (2012b): wind, AD CHP. In agreement with (Redpoint, 2009; Rubino, 2011; Energy of Climate Change Committee, 2012). Depends on technology. It includes fixed and variable opex, insurance, connection and grid charges Depends on type of generator and capacity connected Depends on type of generator and capacity connected. Total costs: £4.1m DECC (2012a): solar PV; DECC (2012b): wind, AD CHP; DECC (2011b): AD CHP fuel price Provided by UK Power Networks Provided by UK Power Networks £49.82/MWh (at gate, 2012) Redpoint's reference case (Jan. 2013) Wind 0.5= £180.4/MWh, Wind 1= Wind 1.5=£97.9/MWh, Wind 2.55=Wind 5= £41.5/MWh From OFGEM Portal (FIT) Solar PV 4.5= £68.5/MWh From OFGEM Portal (FIT) AD 0.25=£151.6/MWh, AD 0.5=£140.2/MWh From OFGEM Portal (FIT) OFGEM (2013a), Baringa-UK Power ROC&Banding - Wind Buyout price: Wind 7.2=Wind 8.3=Wind 10=£40.71/MWh, Recycle price (10% buyout)=£4.07/MWh Networks (2013) Banding: Wind (0.9 ROC/MWh), ROC = (Buyout price+recycle price)*Banding LEC Initial value: £5.09/MWh, 2012 prices DECC (2012b) Redpoint's reference case (Jan. 2013) 3. Other benefits Embedded benefits Generator avoidance balancing system charges From National Grid Portal (BSUoS Prices and Charges) and Elexon Portal (RCRC) Generator transmission loss reduction See (2), (4) Distribution use of system charges (neg.) Baringa-UK Power Networks (2013) 4. Technical Variables Wind capacity factor Solar PV capacity factor 30% 11.16% Suggested by SmartGrid Solutions, based on UK Power Networks' March Grid Case Suggested by SmartGrid Solutions, based on UK Power Networks' March Grid Case AD CHP capacity factor 84% PV module degradation 0.55% Solar Trade Association 85% Solar Trade Association Export rate (solar PV) Pöyri (2013) Losses: Ratio generator Ratio supplier Average transmission losses 45% 55% 2% (current average) Balancing Settlement Code Balancing Settlement Code Elexon (2012) 5. Rates Discount rate RPI (2011-2012) 6. Power Purchase Agreement Electricity ROC LEC Embedded benefits 8.3% (wind), 6.2% (solar PV), 13% (AD CHP) 3.2% DECC (2013) From UK National Statistics Portal Assumptions made in Baringa-UK Power Networks (2013) 85% 90% 85% 50% 14 Appendix B: Table B.1: Scenario Specifications Generators No 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Type of generator wind wind wind wind wind wind wind wind solar PV AD CHP AD CHP AD CHP wind wind wind wind wind wind wind wind wind wind wind wind wind Capacity (MW) 0.5 1 1.5 5 10 7.2 8.3 2.55 4.5 0.5 0.5 0.25 0.5 1 1.5 5 10 7.2 8.3 0.5 1 1.5 5 10 5 Scenario 1 Scenario2 Scenario 3 Estimated curtailment annual MWh 4 9 13 43 86 Estimated curtailment annual MWh 70 140 210 700 1,400 1,008 1,162 Estimated curtailment annual MWh 70 140 210 700 1,400 1,008 357 113 64 64 32 Scenario 4 Costs (2012 prices) Estimated Estimated curtailment curtailment (2014- (2019/20 onwards) - BAU connection 2019/20) - annual annual costs (BAU offer) MWh MWh £(m) 70 0 1.90 140 0 2.00 210 0 1.90 700 0 1.20 1,400 0 4.80 1,008 0 3.46 1,162 0 3.98 3.23 1.08 1.90 2.50 2.21 0 1.90 0 2.00 0 1.90 0 1.20 0 4.80 0 3.46 0 3.98 0 1.90 0 2.00 0 1.90 0 1.20 0 4.80 0 1.20 FPP smarter connection costs £(m) 0.23 0.38 0.16 0.65 0.59 0.43 0.49 0.27 0.23 0.35 0.10 0.12 0.23 0.38 0.16 0.65 0.59 0.43 0.49 0.23 0.38 0.16 0.65 0.59 0.65 15