MBA Module 3 PPT

advertisement

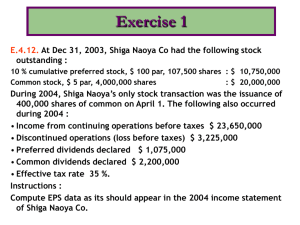

Module 4 Reporting and Analyzing Operating Income Revenue Recognition Revenue recognition refers to the recording of revenue by a company GAAP has two revenue recognition criteria that must be met for revenue to be recognized (and recorded on the income statement)—revenue must be: 1. Realized or realizable 2. Earned SEC Guidelines for Revenue Recognition SEC outlines its guidance for revenue recognition in Staff Accounting Bulletin (SAB) 101, where it states that revenue is realized, or realizable, and earned when each of the following criteria are met: 1. 2. 3. 4. There is persuasive evidence that a sales agreement exists, Delivery has occurred or services have been rendered, Seller’s price to the buyer is fixed or determinable, and Collectibility is reasonably assured. Revenue Recognition Challenges Some serious revenue recognition challenges are: Revenue recognition upon delivery pending execution of sales agreements. Gross vs. Net. Sales on consignment. Failure to take delivery. Nonrefundable fees. Channel stuffing. Mischaracterizing extraordinary or unusual transactions as revenue. Selling undervalued assets. Percentage-of-Completion For certain industries requiring long-term contacts, revenue is recognized using the percentage-of-completion method, which recognizes revenue by determining the costs incurred to date compared with the project’s total expected costs. Percentage-of-completion method of revenue recognition requires an estimate of total anticipated costs. Percentage-of-Completion Example Stock Options Is this compensation? Up factor: Down: 1.05 $52.09 0.125 1/1.05 Up prob: 50% Down: 50% $49.61 0.25 $47.25 0.50 $45.00 1.00 $47.25 0.375 $45.00 0.50 $42.86 0.50 $42.86 0.375 $40.82 0.25 $38.87 0.125 Outcome Probability Stock Price Option Value (Stock price $45, but not less than $0) A 12.5% $52.09 $7.09 $0.89 B 37.5% $47.25 $2.25 $0.84 C 37.5% $42.86 $0.00 $0.00 D 12.5% $38.87 $0.00 $0.00 Probability x Option Value $1.73 Employee Stock Options Employee stock options are a form of compensation. Given to employees in lieu of cash payments or salary. Terms of these plans give employees the right to purchase a fixed number of shares of stock in the company at a fixed price for a pre-determined period of time. Employee Stock Options Current GAAP either: Intrinsic value based method: No compensation recorded if option’s exercise price is equal to or greater than the optioned stock price at the time both the number of shares optioned and their exercise price are known. Fair value based method: Expenses fair value of options over their vesting period. Vesting means option can be exercised even if employee leaves the company. Cisco’s Stock Option “Expense” as currently footnoted Foreign Currency Translation Many companies conduct operations, not only in countries outside of the US, but also in currencies other than $US. Many purchase assets in foreign currencies, borrow in foreign currencies, and transact business with their customers in foreign currencies. US corporations can have subsidiaries whose entire balance sheets and income statements are stated in foreign currencies. Foreign Currency Translation Adjustment at Ford Motor Company Income Statement Effects of Currency Swings McDonald’s: R&D Expenses R&D activities are a significant expenditure for most firms, especially for those in technological industries where R&D costs can range up to 10% of sales or higher. These costs include employment costs for R&D personnel, R&D related contract services and PP&E costs. Accounting standards relating to R&D activities require: expense as incurred. Cisco’s R&D Footnote Income Tax Expense Companies maintain two sets of books 1. 2. One for reporting to their shareholders One for reporting to the IRS. This is perfectly legal as the tax Code is different from GAAP. This can result in dramatically different levels of pre-tax (financial reports to shareholders) and taxable (reported to the IRS) income. These differences result in deferred tax liabilities (book income > taxable income) and deferred tax assets (book income < taxable income) Components of Cisco’s Tax Expense Cisco’s Deferred Tax Footnote Intra-period Tax Allocation Taxes are disclosed in two ways on the I/S First is taxes on income from continuing operations Second is to show remaining items net of taxes Gross amount x (1 - tax rate) Transitory Income Items & Core Earnings Estimation of stock prices entails forecasts of future earnings and cash flows. Forecasts are better when we can identify transitory items in reported earnings and cash flows and can eliminate those from our forecasts. Our goal is to identify core earnings and cash flows of the company. Core earnings and cash flows have the greatest persistence or predictive power and are, therefore, most useful for stock price estimation. Disclosure and Presentation Operating revenues and Expenses: usual and frequent Other revenues and expenses: unusual or infrequent Disposal of a segment Extraordinary items: unusual and infrequent Changes in accounting principles Transitory Income Items Discontinued Operations Extraordinary Items Changes in Accounting Principle Discontinued Operations Discontinued operations refer to any separately identifiable business operation that the company intends to sell. Profits (loss) of the discontinued operations (net of tax), together with the gain (loss) on sale, of the segment are reported in a separate section of the income statement below income from continuing operations. Best Buy’s Reporting of Discontinued Operations Best Buy’s Reporting of Discontinued Operations Extraordinary Items Extraordinary items represent transitory events that are both unusual and infrequent. Extraordinary items are segregated from the rest of the income statement items and presented separately following income from continuing operations. The company makes the determination of whether an event is unusual and infrequent. Examples of Extraordinary Items (Not) • Write-down or write-off of assets • Foreign currency gains and losses • Gains and losses form disposal of specific assets or business segments • Effects of a strike • Accrual adjustments related to long-term contracts • Costs of defense against a takeover • Costs incurred as a result of the September 11, 2001 events. Change in Accounting Principle A change in accounting principle results from adoption of a generally accepted accounting principle different from the one previously used for reporting purposes. Changes in Accounting Principles Shown in the “sunshine” Current year operating income reflects current year under new method Separate line for prior year catch-up Pro-forma for prior year Auditor’s report Different from a change in estimate or the correction of an error. Recognition of Gains on Assets Sales When assets are purchased they are recorded at their purchase price. Subsequently, they are carried at their historical cost, even if they appreciate in value, and are written down only if they suffer a permanent decline in value. When they are sold, the company recognizes a gain (loss) equal to the difference between their selling price and the amount at which they are carried on the balance sheet: Selling price of asset – Asset carrying amount from balance sheet = Gain (loss) on sale Gains (Losses) on Asset Sales Gain (loss) = sale proceeds – asset book value Assume that a company sells a machine for $10,000 that it carries on its balance sheet for $8,000 (historical cost of $12,000 less accumulation depreciation of $4,000). The company reports a gain of $2,000 ($10,000-$8,000). This gain is reported in income from continuing operations. Restructuring Charges: Employee Severance Employee severance costs represent the accrual of estimated costs relating to the termination of employees as a result of a restructuring program. Asset write-downs: restructuring activities that usually encompass closure or relocation of manufacturing or administrative facilities. Inventory LT Assets Goodwill Pro Forma Earnings Earnings per Share (EPS) Earnings per Share (EPS) Basic EPS is computed as (Net income – Dividends on preferred stock) / Weighted average number of common shares outstanding during the year. Since net income already includes interest expense, but not dividends (dividends are not treated as an expense under GAAP), subtraction of dividends on preferred stock yields the amount of profit per common share available for payment of dividends to common shareholders. Diluted EPS reflect the additional shares that would have been issued had all stock options and convertible securities been exercised at the beginning of the year. Comprehensive Income Changes in net assets of an entity during a period from transactions and other events from non-owner sources Includes all changes in equity during a period except those resulting from investment by owners and distributions to owners Example – mark to market for available for sale securities