4 Income Statement and Related Information CHAPTER

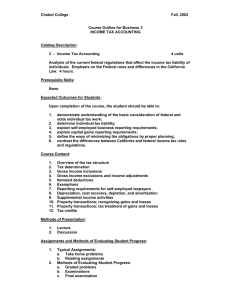

advertisement

CHAPTER Income Statement and Related Information ……..…………………………………………………………... Income and expenses for a given period of time. Usefulness of the Income Statement evaluate past performance predict future performance assess uncertainty of future cash flows 4 Limitations of the Income Statement Not every relevant item is included. LIFO FIFO Numbers not completely reliable. Reliable measures not always available. Numbers not always comparable. Judgment is frequently involved. $ D LL Differences in methods are allowed. Transaction approach Income calculated based on summary information of revenue, expense, gain, and loss transactions Ledger Accounts FORMAT OF THE INCOME STATEMENT Elements From ongoing, major operations From peripheral transactions Increase in Net Assets Decrease in Net Assets Single-Step Income Statement Revenues List and total all revenues and gains - Expenses Net Income List and total all expenses and losses Multiple-Step Income Statement Shows both gross and net sales. Breakdown of purchases and merchandise inventory. Sales Revenues - Cost of Goods Sold + Other Rev. & Gains - Other Exp. & Losses Income before income tax Net Income REPORTING IRREGULAR ITEMS ALL-INCLUSIVE APPROACH CURRENT OPERATING APPROACH most items are recorded in current period income income from regular and recurrent items is reported MODIFIED ALL-INCLUSIVE APPROACH irregular items are highlighted Discontinued Operations Assets Operating Results Activities Clearly distinguishable of the segment Not “discontinued operations” disposal of a part of a business line shifting production locations phasing out a product line Income from continuing operations $20,000,000 Discontinued operations Loss from operation of discontinued division (net of tax) $300,000 Loss from disposal of division (net of tax) Net Income 500,000 800,000 $19,200,000 Extraordinary Items Unusual (unrelated to ordinary activities) Infrequent Not “extraordinary” write-down of receivables, inventories, etc. gains or losses from sale of PP&E effects of a strike Question 27, p. 151 $450,000 gain on forced condemnation sale of facility. Unusual Gains and Losses unusual or infrequent but not both report in “Other Gains and Losses” before income tax Changes in Accounting Principle e.g. change in inventory or depreciation method report the retroactive impact as of the beginning of the year report as an adjustment to beginning R/E; not on the income statement Brief Exercise 4-7, p. 153 Change in estimate of bad debt expense. Changes in Estimates e.g. change in estimate of the useful life of an asset or bad debts expense do not handle retroactively include in ordinary income Prior Period Adjustments record as an adjustment to the beginning balance of retained earnings does not affect net income SPECIAL REPORTING ISSUES Earnings per Share perhaps the most widely followed number in all of the financial statements Basic EPS = Net Income – Preferred dividends Weighted average common shares outstanding break-down EPS for extraordinary items