Chapter 15 & 18

advertisement

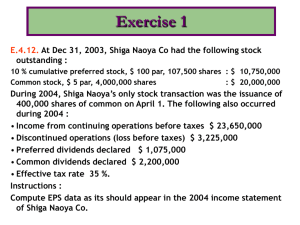

CHAPTERS 15 &18 FINANCIAL REPORTING: Part 1: The Income Statement INCOME STATEMENTS Additional Sections • Additional sections follow below operating income; they are for reporting material items not typical of regular operations. • These non-typical times include: 1. Non Operating Revenues and Expenses 2. Discontinued operations 3. Extraordinary items • Each item should be carefully explained in notes to the financial statements, and the income statement should report the income tax expense or savings applicable to each item. INCOME STATEMENTS 1. Non Operating Revenues and Expenses • Any item that does not have anything to do with the regular business activities of the business. Examples include: – Minor “other” revenues – Interest expense – Gains and losses on the disposal of assets INCOME STATEMENTS 2. Discontinued Operations • Discontinued operations refers to the disposal of a significant segment of a business, such as the elimination of an entire activity or of a major class of customers. • Income (loss) from discontinued operations consists of 1. Income (loss) from operations, and 2. Gain (loss) on disposal of the segment. INCOME STATEMENTS 3. Extraordinary Items • Extraordinary items are events and transactions that meet three conditions: 1. Infrequent 2. Non-typical 3. Not subject to management decision INCOME STATEMENTS Extraordinary vs. Non-Extraordinary Extraordinary Items Ordinary Items (But not Operating Items) 1. Effects of major 1. Effects of major casualties (acts of God) casualties (acts of if rare in the area God) if frequent in the 2. Expropriation area (takeover) of property 2. Write down of by a government inventories or write off 3. Effects of a newly of receivables enacted law or 3. Losses attributable to regulation, such as a labour disputes condemnation action 4. Gains or losses from sale of capital assets INCOME STATEMENTS Presentation – From Operating Income Onwards Operating Income $504,850 Non – Operating Items Other Revenues and Gains Interest Revenue Gain on sale of Equipment Total non-operating revenues and gains $2,900 8,000 10,900 Other Expenses and Losses Interest Expense Casualty Loss from Vandalism Total non-operating expenses and losses Total Income before Taxes Less: Income Taxes (assume 40% tax rate) Income from Continuing Operations Discontinued Operations Income from real estate division, net of tax expense Loss from sale of real estate division, net of tax savings Income (Loss) on Discontinued Operations Income before Extraordinary Items Expropriation of Property, net of tax savings Net Income $(3,750) (5,000) (8,750) $507,000 (202,800) $304,200 $5,000 –$2,000 $3,000 (40%) is… $50,000(30,000) –$20,000 (40%) is… (27,000) 277,200 (60,000) – 24,000 (36,000) (40%) is… 241,200 INCOME STATEMENTS Earnings Per Share - Additional Disclosures HWA ENERGY, INC. Net income Earnings per share Income from continuing operations Loss from discontinued operations Income before extraordinary item Extraordinary loss Net income $301,000 $5.60 (2.10) 3.50 (.49) $3.01 When the income statement contains any nontypical item, EPS should be disclosed for each component. Prior Period Adjustments • Whenever a change in an accounting policy or procedure is made (e.g. FIFO to LIFO), the effects on Net Income (net of tax) for all prior years is charged directly to Capital. – Capital Account (for sole proprietorships) – Retained Earnings (for corporations) Prior Period Adjustments • A business with a 6 year old machine, and a 40% tax rate, changes it’s amortization method from straight line to declining balance. This produces $40,000 of additional expense up to Jan. 1 of this year. It is shown in the Equity section as follows Begin. Balance Jan. 1 as previously reported Change in accounting policy net of $16,000 in tax Retained Earnings Jan. 1 as adjusted $100,000 Add: Net Income Less: Drawings/Dividends Change in Equity for the year Ending Balance, Dec. 31 $124,000 (24,000) $80,000 (20,000) 60,000 $160,000 Do Problems: P15-6A P15-7A, plus add the following: A change in accounting policy reduced a prior period’s net income by $166,000 before a tax savings of $40,000 EARNINGS PER SHARE • Earnings per share (EPS) indicates the net income earned by each common share. • Companies report earnings per share on the income statement • The formula to calculate earnings per share when there has been no change in shares during the year is as follows: Net Income – Preferred Dividends Number of Common Shares Earnings per Share PRICE - EARNINGS RATIO The price-earnings (P/E) ratio helps investors determine whether the shares are a good investment in relation to earnings. It is a per share calculation, calculated by dividing the market price of the shares by its earnings per share. Market price per share Earnings per share Price-Earnings Ratio A high P/E ratio can be one indicator that investors believe the company has future growth potential.