Week 8

advertisement

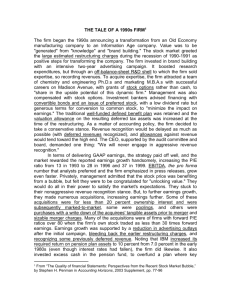

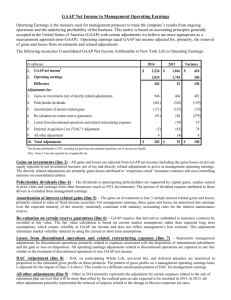

Com 4FK3 Financial Statement Analysis Week 8, 2012 Accounting Quality Accounting Quality • High quality accounting conveys economic information about the firm earnings quality balance sheet quality notes to the financial statements management’s discussion and analysis • Should be fair and complete • Provide relevant information for valuation 2 Estimates • GAAP, tries to set standards to enhance the quality of accounting • Certain transactions contain a high degree of uncertainty, so there is some flexibility bad debt expense, depreciation schedule, etc. • Bias can be intentional or unintentional • Analyst can restate the financial statements 3 Persistence Over Time • Earnings can be; informative about both current and future performance tell current performance but are unsustainable good for current performance, but not a good predictor of future performance not informative about current performance, but a good indicator of future performance 4 Signals • Results are high quality and as expected • Earnings are different from expectations and are likely to recur • Earnings are unexpected, but not likely to be seen again • Current earnings are as expected, but the disclosure changes expectations of future 5 Types of Issues • • • • • • • • Discontinued operations Extraordinary gains or losses Well defined Changes in accounting principles under GAAP Other comprehensive income Asset impairment Restructuring charges Changes in estimates Gains and losses from peripheral activities 6 Discontinued Operations • Not relevant to ongoing value of the firm in most cases • Degree of integration may affect the treatment of the decision • Can adjust all financial statements for analysis if enough information is given 7 Extraordinary Items • Classified as extraordinary if Unusual in nature Infrequent in occurrence Material in amount • Example: settlement of lawsuit • Analysis should exclude income effect • May want to modify cash flow from operations before calculating ratios 8 Changes in Accounting Principles • Disclosed in financial statements • Often imposed by outside agencies • May be voluntary, analyst should consider the possibility of earnings manipulation Cumulative effect may result from several periods and is not indicative of current activity, so is not relevant to current year e.g. Ford: $7.5 b for post-retirement benefits 9 Other Comprehensive Income • Includes unrealized holding period gains • For the analysis, arguments include: Consider 1) Relates to operations 2) Likely to recur 3) Objective if actively traded Ignore 1) Gains may reverse before sale 2) No effect on current cash flow 3) Subjective if not actively traded 10 Impairment Losses • Reported on an infrequent basis • Usually reported on a pre-tax basis Deductible now; shows in income tax note Deductible later; shows in deferred tax Not deductible; shows in tax reconcilliation 11 Restructuring Charges • Firms can decide not to leave an industry, but to substantially change operations • Gives rise to restructuring charges • Can be difficult to asses due to spread out or big bath approaches • If judged to be unlikely to recur, exclude from income (net of tax) for analysis 12 Changes in Estimates • New information can change estimates • GAAP does not allow that to change prior year statements, so results of past misstatements will appear in current income • Many issues to consider • Current Enron testimony 13 Gains and Losses • Gains and losses from peripheral activities • May occur on a regular basis and be related to the operations of the firm e.g. in 3 consecutive years Delta reported a gain on the sale of flight equipment • If excluded from income, the analyst must also consider the income tax effect 14 Restated Financial Statements • Some changes require the company to issue restated statements for previous years significant discontinued operations some changes in accounting principles • Often difficult for the analyst since they only restate 2 or 3 years of statements and that may not allow for useful analysis 15 Earnings Management • Reasons for Optimize management compensation Improve managerial job security Avoid violation of debt covenants and otherwise improve borrowing capacity Influence short term price performance Avoid anti-trust or similar attention 16 Earnings Management • Disincentives Earnings and cash flows can not diverge forever, aggressive earning today mean lower earnings in the future Capital markets and regulators penalize firms thought to manage earnings Possible legal actions (Enron) 17