Chapter 4

advertisement

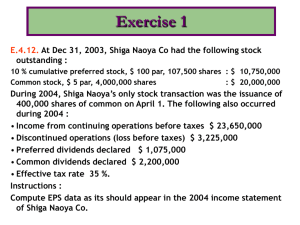

Chapter 4 Income Statement and Related Information 1 Income Statement Usefulness: evaluate past performance; predict future performance; assess future cash flows. Limitations: different numbers from different methods; affected by estimation and judgement; asymmetry in the measurement of losses and gains. Quality of Earnings: earnings management limits earnings quality through “cookie jar” reserves and “big bath” write-offs and writedowns. 2 1. Format of the I/S Multiple Step Income Statement (condensed) Sales COGS Gross margin Operating expenses Income from operations Other revenues and gains Other expenses and losses Income from continuing operations (IFCO) Discontinued operations Extraordinary items Net income 3 1. Format of the I/S Single Step Income Statement (condensed) Revenues Sales revenue Other revenues and gains Expenses COGS Operating expenses Other expenses and losses Income from continuing operations (IFCO) Discontinued operations Extraordinary items Net income 4 Content of the I/S Research and development expenses Prior to SFAS 2 (1974), all R&D costs were capitalized, then amortized when products “came on line” and generated revenues (matching). SFAS 2 required companies to expense all costs relating to R&D, unless they related to fixed assets with multiple project uses (ex: buildings and some equipment). Rationale: too difficult to identify and match costs incurred to specific product revenues. 5 Content of the I/S Restructuring expenses Include charges for employee severance and relocation. Include charges for write-down of assets retained in the business and write-off of assets sold or disposed of. Disclosure of components of restructuring charges now required by SEC. Companies historically used this account to “dump” a number of costs, including those not related to restructuring, in a “big bath” year. 6 Content - Discontinued Operations Discontinued operations (DO) relate to the disposal of a component of a company. Separate disclosures are required so that investors can distinguish between ongoing activity and nonrecurring activity. A component contains operating activities and cash flows that can be distinguished from other activities of the company. To be considered a discontinued operation, two criteria must be met: (1) the results of operations and cash flows of the component are eliminated from its ongoing operations, and (2) there is no significant continuing involvement in the component after the discontinuance. Financial statement presentation includes any operating income or loss to the measurement date, as well as any gain or loss on the disposal of the assets. 7 Content - Extraordinary Items Extraordinary items are defined as those activities that are material in amount, unusual in nature, and infrequent in occurrence. To determine, consider the natural, political, and economic environment of the firm. Examples of EI include natural disasters, nationalization or expropriation of assets by a foreign government, and one-time major economic transactions. If unusual or infrequent, but not both, report in “other gains/losses”, as part of IFCO. Examples include material write-down of receivables, and loss from employee strike. FASB ruled “9/11 events not extraordinary” 8 I/S Classification - Class Problem 1.Loss in Florida from hurricane: 2.Loss from sale of a component: 3.Property loss from terrorist activity on U.S. soil: 4.Material write-off of accounts receivable: 5.Normal write-off of accounts receivable: 6.Loss from flood (in a 500-year flood plain): 9 Content – Changes and Errors (more in Chapter 22) Change in Accounting Principle: includes changes in accounting methods for such topics as inventory, depreciation, construction costs treated by retrospective adjustment of the financial statements (restate prior years). Change in Estimate: like changes in depreciation life or salvage value; change is treated prospectively – affects only current and future periods. Correction of Errors: include errors in calculation and mistakes in the application of accounting principles; treated as a prior period adjustment to beginning retained earnings. 10 Intraperiod Tax Allocation The first level of tax allocation is at Income from Continuing Operations (IFCO). After that calculation, each item presented below (discontinued operations and extraordinary items) is presented net of tax. Each of these items is presented “net of tax.” This is necessary because income tax expense has already been calculated on IFCO. Therefore, each level below IFCO must present the tax effect for that component. This is called “intraperiod” tax allocation allocation of income tax expense to different parts of the income statement. A “partial” income statement is presented on the next slide (and assumes a 25% tax rate). 11 Partial Income StatementSample Company (assuming a 25% tax rate) Income from continuing operations Income tax expense Income from continuing operations - net of tax Discontinued operations Income from operations of discontinued segment (less tax effect of $25) Loss on disposal of discontinued segment (less tax effect of $10) Extraordinary item Loss from flood damage (less tax effect of $9) $120 (30) 90 Net income $108 75 (30) (27) 12 Earnings Per Share (EPS) SFAS 128 (ACS 260) simplified the presentation of earnings per share to two components: – basic EPS – diluted EPS Calculation of Basic EPS = Net Income - preferred dividends Average common shares outstanding Concept: to indicate how much each common shareholder “owns” with respect to earnings. Preferred dividends are deducted - if declared or if cumulative - because they are “owned” by to preferred shareholders. This is a calculation of “what is” - the numerator and denominator use actual shares outstanding and actual net income for the year. 13 Earnings Per Share (EPS) Diluted earnings per share examines all the potentially dilutive securities that a company has issued, like convertible preferred stock, convertible bonds, and employee stock options. Although these securities have not been converted at year end, the calculation shows the effect that the shares could have on EPS. Calculation of Diluted EPS = Net Income - P.D + adjustment for dilutive shares Avg. CS outstanding + adjustment for dilutive shares Concept: to indicate how much each common shareholder would “own” with respect to earnings IF all dilutive securities had been exercised at the beginning of the year. 14 EPS Disclosure Separate EPS disclosure for: – Net income from continuing operations (after tax) – Disposals of business segments – Extraordinary items Calculation – Separate dollar amount (from above categories) divided by number of common shares outstanding If diluted EPS exists, the company should also calculate diluted EPS for each level of presentation. If diluted EPS is antidilutive (the calculation is actually higher than basic EPS), the company does not have to present diluted EPS. 15 EPS Disclosure - Sample Co. (Based on 100,000 shares outstanding.) Basic Earnings Per Share: Income from continuing operations $0.90 Discontinued operations Income from operations of segment 0.75 Loss on disposal (0.30) Extraordinary loss (0.27) Net income $1.08 16 Statement of Retained Earnings Expanded Format: Retained Earnings, Beginning $ xx Prior Period Adjustment (net of tax) xx Retained Earn., Begin adjusted $ xx Add: Net Income xx Less: Cash Dividends xx Less: Stock Dividends xx Retained Earnings, Ending $ xx Note that an appropriation of retained earnings might be deducted above, creating two retained earnings (restricted and unrestricted); the same effect can be achieved through a footnote disclosure, to indicate restricted use of RE. 17 Comprehensive Income Definition: change in equity (net assets) of an entity during a period from transactions and other events and circumstances from nonowner sources. It includes all changes in equity during a period except those resulting from investments by owners and distributions to owners (SFAC 6). Comprehensive income = Net Income +Other Comprehensive Income 18 Other Comprehensive Income Other comprehensive income (OCI) includes a number of equity changes that are not included in net income. In Ch. 17, we will discuss “Unrealized Gains and Losses on Available-for-Sale Investments.” These G/L are excluded from net income because they are usually noncurrent G/L which will not be realized until sometime in the future when the investment is sold. (Other activities affecting OCI will be discussed in ACCT 3305). For the last 20+ years, these changes have been disclosed in the Statement of Stockholders’ Equity. This has changed, starting in Dec. 2011. 19 Comprehensive Income Presentation Although Comprehensive Income has existed as a concept even before SFAC 6, it has never been presented as a component of the financials, until now. The new standard (ASC 220-10) allows 2 alternatives: – Presentation as a single statement which includes both the Income Statement components and the OCI components. – Presentation of 2 contiguous statements: (1) Income Statement (2) Statement of Comprehensive Income (which shows both Net Income and OCI) 20 Statement of Stockholders’ Equity The Statement of Stockholders’ Equity (SSE) has been used for many years, instead of the Statement of Retained Earnings, to explain the detail changes in all the components of Stockholders’ Equity. The column for OCI will no longer present the detail changes in OCI, just as the Retained Earnings Column does not show the detail revenues and expenses. 21 Example of SSE CS PS APIC RE AOCI $200 $200 $600 $400 20 250 (40) (200) Balance 1/1/12 Net income Cash dividends Stock dividends Purchase of TS Other Comp. Income Balance, 12/31/12 $200 TS $(40) $200 $600 $410 $12 $32 $(40) Note: CS is Common Stock; PS is Preferred Stock; APIC is Additional Paid-in Capital; RE is Retained Earnings; AOCI is Accumulated Other Comprehensive Income; TS is Treasury Stock. 22