Word

advertisement

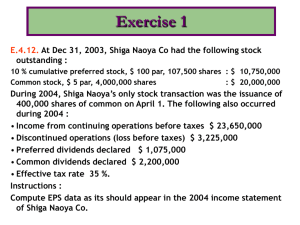

ACCT321, Intermediate Accounting, Study Guide for Test 2, Chapters 4-5 NOTE: You may bring a 3” by 5” piece of paper (index card) with both sides crammed with information. Better yet, bring a brain with both sides crammed with great knowledge. Chapter 4 1. What are some other common names for the income statement (IS)? How should an IS be dated? 2. What is meant by the term “earnings management” and why would a company do it? What is meant by “quality of earnings”? 3. How do revenues differ from gains, and expenses from losses? 4. Make sure to know the outline of a multi-step IS well. The class notes on this should be helpful as well as the outline in your text. You can essentially ignore a single-step income statement. 5. How does a natural expense classification differ from a functional expense classification? Which is required for public companies? 6. Do the following normally have debit or credit balances: sales, sales returns or allowance, sales discounts, purchases, purchase returns and allowance, purchase discounts. 7. Where is freight-in (or transportation-in) reported? Freight-out? 8. T or F: Because the Income Tax Expense line represents taxes only for items above the line, any tax items below the line must show their own income tax. 9. What disposals qualify for discontinued operations? When GM discontinued making Oldsmobiles, would this qualify? How about when Sears discontinued its insurance (Allstate) business? What about when a food company discontinues sales to restaurants but still sells to grocery stores (two major classes of customers)? What about when a mining company sells its foreign subsidiary engaged in uranium mining, although the company continues to mine uranium in other countries? 10. To qualify as extraordinary, what two criteria must both be met? Where would the item be reported if it didn't meet both criteria? Which events are never extraordinary? Why are the effects of Sept. 11 on the airline industry not considered extraordinary? Should the effects of Hurricane Katrina to a real estate business in New Orleans be considered extraordinary? What about the effects of Mt. St. Helens eruption on Weyerhaeuser? What change did the FASB recently vote regarding reporting extraordinary items? For what fiscal year is this change effective? 11. What are common examples of items included in the "Other Revenue/Gains & Expenses/Losses" section? Are these items both unusual and infrequent, or just one or the other? 12. What is an example of a change in accounting principle? How and where are such changes reported in the financial statements under current rules? Where were accounting principle changes recorded under old rules (pre-2006)? 13. What are examples of some common accounting estimates? Do accountants ever go back and change prior year figures to adjust for a bad estimate? How should changes in accounting estimates be handled in the financial statements? 14. How is the correction of an error that was made in a prior period handled? Why are prior period adjustments not shown on the income statement? Where exactly are prior period adjustments shown? Are they shown net of tax? 15. Why do irregular items have to be shown net of tax when tax expense has already been recorded up above? If there was an extraordinary gain of $100,000 before tax, how would this item be reported (assume tax rate of 35%)? What if there was an extraordinary loss of $100,000? 16. Do earnings per common share (EPCS) have to be reported on the face of the IS? Why are preferred dividends deducted from the numerator? For which components of income must EPCS be reported? 17. Review the basic outline of a statement of retained earnings. Can you prepare one in good form? You can? Good. 18. What is comprehensive income? Why has comprehensive income been added to financial statements? What is an example of an item included in comprehensive income that is not in net income does? Where can comprehensive income be shown in the financial statements (several options)? 19. How does iGAAP differ from current U.S. GAAP when it comes to income statements? Does iGAAP report extraordinary items? Does U.S. GAAP allow for revaluing fixed assets? Chapter 5 1. What is the more academic name for a balance sheet (BS)? How should a BS be dated? Be able to intelligently discuss the major weaknesses of a balance sheet prepared according to GAAP. 2. Assets are generally listed in what order? How about liabilities? 3. What are current assets? T or F: The time period for current assets involves one year or the operating cycle, whichever is shorter? What are the major types of items making up current assets? 4. If cash is restricted for a long-term purpose (i.e. endowment), where should it be reported? 5. Investments (securities) can be broken into three categories: trading, available-for-sale & held-to-maturity. Which of the three are reported at fair market values? Which is reported at cost? Which of the three is always a current asset? 6. How is a short-term investment distinguished from a long-term investment? 7. Should a prepaid expense that is prepaid for more than one year be considered a current asset? Should the portion of a note receivable due later than one year be reported as a current asset? If not, where should these items be reported? 8. Note that L/T investments can also be referred to as just investments. What are the common types of L/T investments? (Notice in particular a bond sinking fund, land held for future use/sale, excess pension assets, nonconsolidated subsidiaries, and cash surrender value of life insurance.) Would an investment in marketable securities (e.g. stocks or bonds) be considered L/T if it is the intent of management to hold the investment for less than one year? 9. Note that property, plant and equipment (PP&E) is sometimes still referred to as fixed assets, but this is old terminology. Note also the PP&E should be shown net of accumulated depreciation. Would the following be considered PP&E: dairy cattle or beef cattle? Kentucky Fried chickens or egg-laying chickens? (Note: PP&E are used in the operations to create or provide a product or service; but inventory is the product being sold; therefore, beef cattle and KFC chicken are inventory but dairy cattle and egg-laying chickens are equipment.) Would timber or iron ore be considered PP&E? [These are in a separate category called natural resources.] What about a forklift held for sale by a grocery store? [Yes, this is PP&E.] By Hyster Forklift Company? [No, this is inventory]. 10. What are typical examples of intangible assets? Should the specific types (patents, copyrights, goodwill, etc.) be disclosed? Should intangible assets be shown net of amortization? Should the accumulated amortization amount be reported? 11. What are current liabilities? Do they include the current portion of long-term debt? Do they include unearned, deferred or prepaid revenue to be earned in the next year or operating cycle, whichever is longer? 12. What is an operating cycle? What is working capital? What is the current ratio? 13. What are long-term liabilities? How would a discount or premium on bonds payable be shown? Would a current liability that is to be refinanced on a L/T basis still be considered a current liability? 14. What are the major sub-divisions of stockholders' equity? What are the other names for stockholders’ equity (see notes)? How would the equity sections be different between a sole-proprietorship and corporation? Are dividends to a corporation what withdrawals are to a sole-proprietorship? 15. Do all of the following have to be disclosed for capital stock: par value, number of shares authorized, issued and outstanding? Be able to distinguish between the shares authorized, issued, and outstanding. If treasury stock exists, will the number of shares issued equal the number outstanding? 16. What are the other names for additional paid-in capital (APIC) (see notes)? 17. Why is treasury stock subtracted from stockholders' equity (contra-equity)? What is treasury stock? 18. What are the common formats of a balance sheet? Is the report or account form more common in the U.S.? 19. What is the difference between an adjunct account and a contra account? 20. What are two bad words in accounting? Which would be a more appropriate name: Reserve for Doubtful Accounts or Allowance for Doubtful Accounts? 21. If a trial balance is pre-closing, does the retained earnings balance represent the balance at the beginning or end of the year? How would the ending balance be determined (hint: see E5-12)? 22. Understand how to read a statement of cash flows, using the net cash used/provided by the three different sections. 23. How do IFRS differ from US GAAP when it comes to the balance sheet? 24. Understand the different types of auditors’ reports and what they mean. 25. Can you prepare an income statement, a statement of retained earnings, and a balance sheet in good form? You can? Are you sure? Good. WEBAPPs 26. How does the format of the income statement produced by Google Finance or Yahoo Finance compare to the outline in your text? 27. How often do corporations prepare publicly available income statements? What usually happens to a company’s stock price if the actual earnings-per-share (EPS) is more or less than the amount projected by analysts? 28. Review which airlines appear to be doing the best and the worst and how you arrived at these conclusions. Come prepared to move quickly on the test as there’ll be no time for socializing. The better you know it, the faster you can answer it. Good luck! But remember that Thomas Jefferson said “I'm a great believer in luck, and I find that the harder I work, the more I have of it.” See you at the grand celebration. PRACTICE PROBLEM. The information below pertains to the General Company (which makes food products) for the fiscal year ending December 31, 2014. It is listed in no particular order. The company is located in a dry area that has never had floods. Loss From a Write-off of Obsolete Inventories. . Cash & Equivalents (Includes $5,000 for a Long-term Endowment). . . . . . . . . . . . Accounts Payable . . . . . . . . . . . . . . . . Patent (Net of $3,000 Amortization). . . . . . . Cash Dividends Declared & Paid . . . . . . . . . Gain on Sale of Equipment . . . . . . . . . . . Gain From Correcting an Error Made in 2013 (before tax). . . . . . . . . . . Investments in bonds - Trading (Mature in 2021; market value is $18,000, while cost basis is $20,000) . . . . . . . . . . . . . . Property Loss From Flood (before tax) . . . . . Interest Expense . . . . . . . . . . . . . . . Loss on Operations and Disposal of Discontinued Solar Powered Flashlight Division (before tax) Land (Includes $20,000 of Vacant Land Being Held For Sale) . . . . . . . . . . . . . . . . Net Sales . . . . . . . . . . . . . . . . . . . Selling, General & Administrative Expenses . . . Accumulated Depreciation (buildings) . . . . . . Bond Sinking Fund . . . . . . . . . . . . . . . Treasury Stock . . . . . . . . . . . . . . . . . Buildings . . . . . . . . . . . . . . . . . . . Allowance for Doubtful Accounts (receivable expected to not be collected). . . . . . . . . Prepaid Insurance Expense (Includes $5,000 Prepaid for 2016). . . . . . . . . . . . . . . Notes Payable (Includes $5,000 Due Within The Next Year) . . . . . . . . . . . . . . . . . . Accounts Receivable . . . . . . . . . . . . . . Cash Surrender Value of Executive Life Insurance Retained Earnings, January 1, 2014 . . . . . . . Common Stock . . . . . . . . . . . . . . . . . Cost of Goods Sold . . . . . . . . . . . . . . . Inventory . . . . . . . . . . . . . . . . . . . Paid-in Capital > Par Value - Common Stock . . . 10,000 10,000 25,000 12,000 17,000 5,000 50,000 20,000 60,000 $ 20,000 50,000 80,000 700,000 200,000 55,000 30,000 15,000 200,000 10,000 15,000 80,000 54,000 50,000 100,000 250,000 400,000 50,000 19,000 Additional information: Assume a 40% tax rate and that all income statement items are shown before tax. Also, assume 10,000 shares of common stock are authorized, although only 6,500 shares are issued and 6,000 outstanding. There were no items that would be considered other comprehensive income, either in this year or in prior years. Directions Prepare an income statement, statement of retained earnings, and balance sheet for the fiscal year ended Dec. 31, 2014 in good form.