Investments in

Equity Securities

Presentations for Chapter 8 by Glenn Owen

Key Points

Criteria that must be met before a security can be listed in

the current assets section of the balance sheet.

Trading and available-for-sale securities and how the markto-market rule is used to account for them.

Why companies make long-term investments in equity

securities.

The mark-to-market method, the cost method, and the equity

method of accounting for long-term equity investments, and

the conditions under which each method is used.

Consolidated financial statements, when they

are prepared, and how they differ from

financial statements that account for equity

investments using the equity method.

Equity Securities

Classified as Current

Existence of a ready market

– Readily marketable meaning that a security can be sold

and converted into cash on demand

Intention to convert

Trading and

Available-For-Sale Securities

Purchasing trading and available-for-sale

securities

Declaration and receipt of cash dividends

Sale of securities

Price changes of securities on hand at the end of

the accounting period

Reclassifications and permanent

market value declines

Mark-to-market accounting and

comprehensive income

Purchasing Trading and

Available-for-sale Securities

Trading Securities

Available-for Sale Securities

Cash

Dr.

xxx

xxx

Purchased trading and available-for-sale

securities for cash.

Cr.

xxx

Declaration and Receipt of

Cash Dividends

Dividends Receivable

Dividend Income

Recognize declaration of dividend.

Cash

Dividend Receivable

Recognize declaration of dividend.

Dr.

xxx

Cr.

xxx

xxx

xxx

Sale of Trading Securities

Dr.

xxx

Cr.

Trading Securities

Realized Gain on Sale of Trading Securities

Sold trading securities for a gain

or

Cash

xxx

Realized Loss on Sale of Trading Securities

xxx

Trading Securities

Sold trading securities sold for a loss

xxx

xxx

Cash

xxx

Sale of

Available-for-Sale Securities

Cash

Available-for-Sale Securities

Realized Gain on Sale of

Available-for-Sale Securities

Sold available-for-sale securities for a gain

or

Cash

Realized Loss on Sale of

Available-for-Sale Securities

Available-for-Sale Securities

Sold available-for-sale securities for a loss

Dr.

xxx

Cr.

xxx

xxx

xxx

xxx

xxx

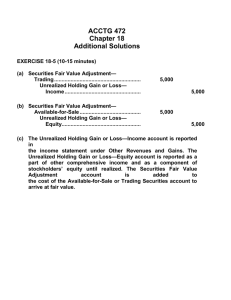

Price Changes of Securities On

Hand at the End of the Period

Dr.

Trading Securities

xxx

Unrealized Gain on Trading Securities

Revalued trading securities to market

or

Unrealized Loss on Trading Securities

xxx

Trading Securities

Revalued trading securities to market

Cr.

xxx

xxx

Price Changes of Securities On

Hand at the End of the Period

Dr.

xxx

Available-for-Sale Securities

Unrealized Gain on

Available-for-Sale Securities

Revalued available-for-sales securities to market

or

Unrealized Loss on

Available-for-Sale Securities

xxx

Available-for-Sale Securities

Revalued available-for-sales securities to market

Cr.

xxx

xxx

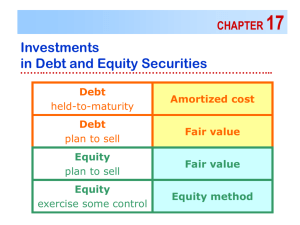

Long-Term Equity Investments

The cost method

– Market value is indeterminable

– Ownership is less than 20 percent

– No change is made in the carrying value of the investment

The equity method

– Significant influence (20 - 50 percent ownership)

– Periodically increase(decrease) the carrying value of the

investment by the investor’s proportionate

share of the net income (loss) of the investee.

– Decrease the carrying value of the investment

by dividends received.

Long-Term Equity Investments

Equity method cautions

– This method will give rise to a difference between

reported net income (loss) and cash flow from

operations.

– It ignores market price.

– 20-50 percent is not always a valid indication of

significant influence.

– It generates off-balance sheet financing

Consolidated financial statements

– Greater than 50 percent ownership

– Purchase or pooling methods

Accounting for Equity Securities

Marketable?

Intend to

liquidate within

time period of

current assets?

Yes

Yes

Proportion of

voting shares

Accounting Mark-toTreatment

Market

No

<20%

Mark-toMarket

20-50%

>50%

Equity ConsoliMethod

date

Accounting for Equity Securities

Marketable?

No

Intend to

No

liquidate within

time period of (implied)

current assets?

Proportion of

voting shares

Accounting

Treatment

No

<20%

Cost

Method

20-50%

>50%

Equity ConsoliMethod

date

Goodwill Accounting Controversy

Goodwill is defined as the excess amount paid for

a corporation over the fair market value of the

acquired company’s assets and liabilities.

Goodwill appears on the balance sheet.

Until recently, goodwill was amortized over a

future period not to exceed forty years.

In July 2001, the FASB passed an accounting

standard with removes the requirement

to amortize goodwill.

Review Problem I (a)

Securities

Cost

*AAA

*BBB

**CCC

$140

375

120

Market Value

$170

350

150

MV - Cost

$30

(25)

30

Mark-to-market journal entry on 12/31/xx for AAA:

Trading Securities (AAA) (+A)

30

Unrealized Gain on Trading Securities(R, +SE) 30

* Trading security ** Available-for-sale security

Review Problem I (a)

Securities

Cost

*AAA

*BBB

**CCC

$140

375

120

Market Value

$170

350

150

MV - Cost

$30

(25)

30

Mark-to-market journal entry on 12/31/xx for BBB:

Unrealized Loss on Trading

Securities (Lo, -SE)

Trading Securities (BBB) (-A)

25

* Trading security ** Available-for-sale security

25

Review Problem I (a)

Securities

Cost

*AAA

*BBB

**CCC

$140

375

120

Market Value

$170

350

150

MV - Cost

$30

(25)

30

Mark-to-market journal entry on 12/31/99 for CCC:

Available-for-Sale Securities (CCC) (+A)

Unrealized Loss on

Available-for-Sale Securities (+SE)

30

* Trading security ** Available-for-sale security

30

Review Problem I (b)

Securities

Cost

*AAA

*BBB

**CCC

$140

375

120

Market Value

$170

350

150

MV - Cost

$30

(25)

30

Sold all of AAA in 2000 for $180:

Cash (+A)

180

Trading Securities (-A)

170

Realized Gain on Trading Securities (Ga, +SE) 10

* Trading security ** Available-for-sale security

Review Problem I (b)

Securities

Cost

*AAA

*BBB

**CCC

$140

375

120

Market Value

$170

350

150

Sold 20% of BBB in 2000 for $65:

MV - Cost

$30

(25)

30

20%

Cash (+A)

65

Realized Loss on Trading Securities (Lo, -SE 5

Trading Securities (-A)

70

* Trading security ** Available-for-sale security

Review Problem I (b)

Securities

*AAA

*BBB

**CCC

Cost

Market Value

$140

375

120

MV - Cost

$170

350

150

$30

(25)

30

Received $60 in BBB dividends and $30 in

dividends were declared on CCC stock:

Cash (+A)

Dividends Receivable (+A)

Dividend Revenue (R, +SE)

60

30

* Trading security ** Available-for-sale security

90

Review Problem I (b)

Securities

Cost

*AAA

*BBB

**CCC

$140

375

120

Market Value

MV - Cost

$170

350

150

$30

(25)

30

Revalued BBB shares to market 12/31/00:

Unrealized Loss on

Trading Securities (Lo, -SE)

Trading Securities (BBB) (-A)

40

$2 per share x 20 shares.

* Trading security ** Available-for-sale security

40

Review Problem I (b)

Securities

Cost

*AAA

*BBB

**CCC

$140

375

120

Market Value

MV - Cost

$170

350

150

$30

(25)

30

Revalued CCC shares to market 12/31/00:

Unrealized Price Increase

on Available-for-Sale Securities (-SE)

Available-for-Sale Securities (CCC) (-A)

15

$1 per share x 15 shares.

* Trading security ** Available-for-sale security

15

Review Problem I (c)

Securities

Cost

*AAA

*BBB

**CCC

$140

375

120

Market Value

MV - Cost

$170

350

150

$30

(25)

30

Sold 20 shares of BBB stock during 2001:

Cash (+A)

Trading Securities (BBB) (-A)

Realized Gain on

Trading Securities (R, +SE)

Gain of $1 per share x 20 shares.

260

240

* Trading security ** Available-for-sale security

20

Review Problem I (c)

Securities

Cost

*AAA

*BBB

**CCC

$140

375

120

Market Value

MV - Cost

$170

350

150

$30

(25)

30

Sold 15 shares of CCC stock during 2001:

Cash (+A)

Unrealized Gain on

Available-for-Sale Securities (-SE)

Available-for-Sale Securities (CCC) (-A)

Realized Gain on

Available-for-Sale Securities (Ga, +SE)

165

15

* Trading security ** Available-for-sale security

135

45

COPYRIGHT

Copyright © 2003, John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted in

Section 117 of the 1976 United States Copyright Act without the

express written permission of the copyright owner is unlawful.

Request for further information should be addressed to the

Permissions Department, John Wiley & Sons, Inc. The purchaser

may make back-up copies for his/her own use only and not for

distribution or resale. The Publisher assumes no responsibility

for errors, omissions, or damages, caused by the use of these

programs or from the use of the information contained herein.