FEDERAL INCOME TAX: PAYING THE PRICE

advertisement

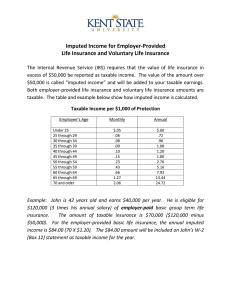

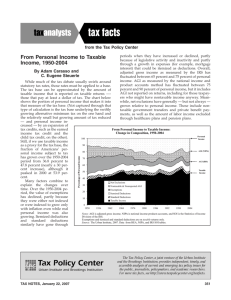

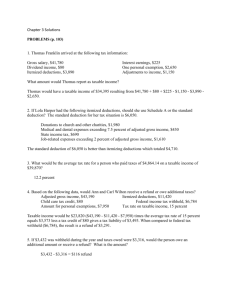

Ch. 9.1 FEDERAL INCOME TAX: PAYING THE PRICE Whether or not we agree with how our tax dollar is spent, most of us would not want to do without at least some of the services that our federal, state, and local governments provide Federal Income Tax Taxes are one of the largest items in the family budget. The average taxpayer works every year from January 1 to around early May just to cover tax obligations. However, most of the tax that we pay never goes through our hands; our employer withholds some of our pay for taxes and sends that withheld money directly to the Internal Revenue Service (IRS). 9.1 Finding Your Income Tax The price of government Taxes are what we pay for a civilized society Oliver Wendell Holmes, Jr. In this world nothing is certain but death and taxes Benjamin Franklin How did this happen? For the first 100 years the United States covered its expenses by imposing taxes on certain goods manufactured here and on products brought in from other countries. Then our country changed to a mainly rural and agricultural society to a mainly industrial society. As a result, the government’s need for income increased The 16th amendment, adopted in 1913, Congress passed tax laws. We now have taxes on income as well as on sales and property. United States Individual Income Tax The Individual income tax is imposed on an individual’s earnings from wages and salary. Characteristics of Income Tax System Ability to pay- the federal income tax rules are designed to match one’s ability to pay. The more money one makes the higher share of taxes one pays. Voluntary compliance- The IRS trusts that each citizen will file taxes and pay their taxes. However, if an individual fails to do so, they may face a fine or jail time (tax evasion) Characteristics of Income Tax System Pay as you go – the taxes are taken from you wages. This prevents citizens from owing any money on April 15th. Ask Yourself 1. What is an income tax? 2. How long does he average person have to work in a year to earn the amount of money that he or she pays to the government in taxes? 3. What are two characteristics of our income tax system? Tax Tables Taxable income is the amount of money that you actually make during the year minus certain adjustments, deductions, and exemptions that the government allows. Single Rate $0 – $8,025 10% $8,026 - $32,550 15% $32,551 - $78,850 25% $78,851 - $164,550 28% $164,551 - $357,700 33% $357,701 + 35% Sharpen Your Skills Example 1: Elizabeth’s taxable income for the past year was $2,275. How much tax does Elizabeth, who is single, owe? Solution: $2,275 is listed twice. Go with the second listing. Tax Rate Schedules Formulas for Tax Rate Schedule X (for single taxpayers): 1. 2. 3. if if if Example 2 Marilyn’s taxable income is $102,000. How much does Marilyn, who is single, pay in taxes? Example 3 Finding taxable income. Taxable Income = total income – (deductions and exemptions) Ex. Luis’s monthly income for this year was $675. He had a deduction of $3600 and an exemption of $2300. He has one withholding allowance, and he is single. 1. What was Luis’s total income for the year? 2. What was his taxable income? 3. How much income tax does he owe? 4. How much was withheld from his paychecks? 5. Does he have a refund? If so, how much is it?

![-----Original Message----- From: K.Audette [ ]](http://s2.studylib.net/store/data/015587928_1-66e3b3936af11bf9c348b9a1cff2a224-300x300.png)