frank - Stanford University

advertisement

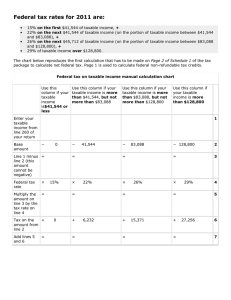

Why Has CEO Pay Been Rising and What, If Anything, Should We Do About It? Robert H. Frank EPI Forum on Executive Pay May 4, 2010 The market for university presidents Suppose Cornell’s Skorton was 3% better at fundraising than the 2nd-best candidate. Bottom-line difference: (0.03)x($4 billion) = $120 million CEOs of large US corporations earned ten times the average worker’s salary in 1980 531 times the average worker’s salary in 2000 “Obscene” Executive Pay? Adam Smith: People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices. Winner-Take-All Markets Markets in which reward depends not just on absolute performance but also on relative performance. CEO pay grew six-fold between 1983 and 2000, same as growth in market capitalization during that period. Gabaix and Landier, 2006 Alfred P. Sloan, Jr. CEOs with Fewer than Three Years Tenure When Appointed Inequality matters because context matters. In a poor country, a man proves to his wife that he loves her by giving her a rose, but in a rich country he must give a dozen roses. Richard Layard Expenditure Cascades • Top earners spend more because they have more money. • This shifts frame of reference for those just below them, who also spend more. • That, in turn, shifts the frame of reference for those next below. • And so on all the way down the income ladder. The cost of sending a child to a school of average quality is linked to the price of the average house in the community. Median size of a newly constructed house: 1980: less than 1600 square feet 2007: more than 2300 square feet Evidence for Expenditure Cascade Hypothesis In 100 most populous U.S. counties, those that experienced highest growth in income inequality also experienced highest Growth in bankruptcy rates Growth in long commute times Growth in divorce rates Frank, Levine, and Dijk, 2010 In OECD, over time and across countries, higher 90/50 ratios are linked with longer hours of work Bowles and Park, 2003 Charles Darwin: Traits are selected because of their impact on the reproductive fitness of individuals, not groups. Traits that benefit individuals often work to the disadvantage of groups. Big Antlers: Smart for One, Dumb for All Bigger Mansions: Smart for One, Dumb for All? The Progressive Consumption Tax Consumption + Savings = Income Consumption = Income – Savings Taxable consumption = Income – Savings – standard deduction Taxable Consumption 0 - $39,999 $40,000 - $49,999 $50,000 - $59,999 Marginal Tax Rate 20 percent 22 percent 24 percent $60,000 - $69,999 $70,000 - $79,999 $80,000 - $89,999 26 percent 28 percent 30 percent $90,000 - $99,999 $100,000 - $129,999 $130,000 - $159,999 $160,000 - $189,999 32 percent 34 percent 38 percent 42 percent $190,000 - $219,999 $220,000 - $249,999 46 percent 50 percent Taxable Consumption $250,000 - $499,000 $500,000 - $999,999 $1,000,000-$1,999,999 Marginal Tax Rate 60 percent 80 percent 100 percent $2,000,000-$3,999,999 $4,000,000+ 150 percent 200 percent If you were society’s median earner, which option would you prefer? 1) You save enough to support a comfortable standard of living in retirement, but your children attend a school whose students score in the 20th percentile on standardized tests in reading and math; or 2) you save too little to support a comfortable standard of living in retirement, but your children attend a school whose students score in the 50th percentile on those tests?