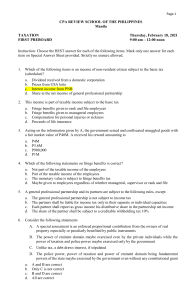

-----Original Message----- From: K.Audette [ ]

advertisement

![-----Original Message----- From: K.Audette [ ]](http://s2.studylib.net/store/data/015587928_1-66e3b3936af11bf9c348b9a1cff2a224-768x994.png)

-----Original Message----From: K.Audette [mailto:kaudette@verizon.net] Sent: Monday, March 21, 2005 9:27 PM To: comments@taxreformpanel.gov Subject: You MUST address the CONSTITUTIONALITY of the un-apportioned DIRECT tax on labor ! The Supreme Court has repeatedly ruled that labor is property and is NOT taxable . Stop the fraud ! You know that Corporations and foreigners are supposed to be the ones taxed . Otherwise , what makes me free ? Why do I care if I am a citizen here ? Other countries have socialist programs , and monarchies and communism too . Freedom to Live , Pursue happiness , and the freedom to keep %100 of MY property are God given rights , not US federal government given rights . You CANNOT force American citizens to work for 70 percent of their pay and take 30 percent for yourselves . That is not freedom , by any definition , in any language . The 16th Amendment in no way repeals the prior provisions for taxation . All it sought to do was to keep income taxes in the category of in-direct taxes "to which they inherently belong" . It was passed to tax the priviledge of corporate status (foreign and domestic) and the tax was to be measured by the income . I work for a living . That is my right as a citizen . Rights ARE NOT TAXABLE . Privileges ARE taxable . A corporation is a fictitious entity created by the Federal government . The existence of a corporation is a privilege granted to it by the Federal government . That privilege is taxable . The tax is called an income tax .It is called an income tax because the tax due is calculated by the amount of income (profit) recieved by the corporation . There is no law , including the 16th amendment, that allows the US federal government to force any citizen to pay this tax on income unless derived from corporate or foreign sources . The term " from whatever source derived " means that whatever TAXABLE SOURCE . My labor , as my property , is NOT a taxable source of " income " . There is no law that makes me ot any other citizen liable for the income tax in 26 CFR 1.1 . If you are to revise the tax system in this country , you MUST adhere to the constitution . This is not an option .Without this Constitution , the Federal government does not exist . Any laws "passed" that are repugnant to the constitution are "null and void" . This is not an option . Read the rulebook .