Math 124 Names:

advertisement

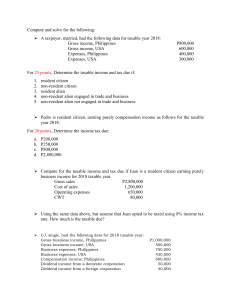

Math 124 Names: Below is the 2006 Tax rate Schedule for people filing as “single.” Let X represent your taxable income. Schedule X — Single If taxable income is over-- But not over-- The tax is: $0 $7,550 10% of the amount over $0 $7,550 $30,650 $755 plus 15% of the amount over 7,550 $30,650 $74,200 $4,220.00 plus 25% of the amount over 30,650 $74,200 $154,800 $15,107.50 plus 28% of the amount over 74,200 $154,800 $336,550 $37,675.50 plus 33% of the amount over 154,800 $336,550 no limit $97,653.00 plus 35% of the amount over 336,550 1. Find the amount of taxes T, due as a function of X. (This will be a piecewise defined function.) 2. Using your function, find T(7,500), T(30,650) and T(74,200). 3. Find the limit as x approaches 7,500, the limit as x approaches 30,650 and the limit as x approaches 74,200. 4. Is this a continuous function? 5. Now find a function describing your Take home income: (taxable income – tax). 6. Is this a continuous function? Justify your answer. 7. Is it possible that a raise at work can leave you with less take-home income?