Planning 10 – Finances -The game of life – Taxes Notes

advertisement

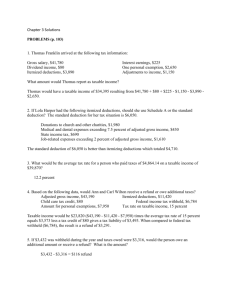

The guarantees of life – Taxes What are Taxes: Tax is a __________________________________ levied on __________________________________ _______________________________ for the support of government for economic and social operations. In other words, it is _____________________________________________ _____________________________________________. Who’s responsible for this: Canada uses _______________________________ for tax collection. That means that _________________________________ is responsible for having their taxes paid according to the Income Tax Act. It is up ___________________________ how much _____________________________ and what ___________________________ you should be receiving. Why is my pay check so low: Your employer _____________________________________ from your salary or wages. The most common ones are ______________________________________________________ _______________________________________________________________________________________. Once you _________________________________________ you have to make _______ contributions based on your income. _________________________________ are based on a percentage of your pay and may change year to year. Important Information: Everyone’s tax return ___________________________! Don’t assume that just because your neighbour got a refund that you will get a refund. Know your benefits and where to look for extra benefits! There are lots of places where you can ______________________________its that you may not have thought of. For example, if ______________________________________________ you can deduct certain expenses from your net income thus saving you money! You can deduct the ____________________________________________________ from your net income! You can claim up _______________________________________________ for any physical activity programs that you paid to register them in! Step-by-Step Guide: Step 1: On Page 1 of the form T1 General 2010 fill in the Identification Information If you do not have a SIN (social insurance number) make one up for the sake of this exercise. Read all descriptions of boxes carefully. You don’t want to provide inaccurate information. If you are under 19 and will not be turning 19 by April of that year you must check NO for the GST/HST credit Step 2: On Page 2 of the T1 General 2010 form you will be calculating your Total Income for that year. In Box 101 – Enter the total amount of employment income. This is the sum of all the amounts of Employment Income from any T4 slips that you received. If you received any other sources of employment income (ie. Tips) you must enter those in box 104 Be sure to go through each line and see if any areas apply to you (For example, Interest and other investment income, or Universal Child Care Benefit, or SelfEmployment Income Don’t mix CPP benefits or Employment Insurance benefits with the amounts listed on your T4. You need to make sure the box numbers and descriptions all match! Step 3: On Page 2 of the T1 General 2010, add all of the amounts listed in the right hand column for your Total Income. Enter this final amount in Box 150 at the bottom of the page. This is not your net income for the year. Step 4: Copy the amount from Box 150 on the BOTTOM of page 2 into Box 150 at the TOP of page 3. Page 3 is where we find deductions used to calculate your Net Income for the year. Step 5: Go through lines 207 to 233 carefully to see if there are any benefits that are applicable to you. There may not be any. Step 6: Subtract the total amount from line 233 from line 150. If you have no deductions on line 235 then enter the same amount from line 233 in line 236. This is your Net Income. Step 7: See if there are any other deductions that apply to you in the Taxable Income section. If there are none, enter the amount from line 236 into line 260. This is your Taxable Income. Step 8: Remove Schedule 1 from the Forms 2010 booklet. This is used to calculate your Federal Tax for the year. Step 9: You will first calculate the Tax Credits that you will receive for that year. This is found in lines 300 to 378 (note: some numbers are skipped) Step 10: Everyone is given a basic federal amount of $10, 382. Enter this amount on line 300. Go through the remaining lines and see if there are any other tax credits that are owed to you. Most people will find they have CPP Contributions (Line 308) and EI Premiums (Line 312) that can be included. These amounts are found on your T4’s. You can also claim the Canada Employment amount if you entered employment income on line 101. Enter the lesser of $1,051 and the total employment income from line 101 and 104 combined. If you are unsure about whether or not you can claim a tax credit refer to the General Income Tax and Benefit Guide. Step 11: Add up the amounts from line 300 to 332 and enter the result on line 335. Multiply line 335 by 15% and enter this amount on line 338. If you have no donations or gifts to declare, enter the same amount on line 350. This is your total federal tax credit. Step 12: Enter the taxable income amount from line 260 of the T! General into the appropriate space (line 29) of Schedule 1. Step 13: Find the appropriate table for your taxable income and complete the calculations to find the amount to enter into line 36. Enter this amount on line 37 and if the following line (Federal tax on split income) does not apply enter the same amount on line 39. Step 14: Enter the amount from line 28 onto line 40. If no other credits (lines 41 – 43) apply then enter the same amount on line 44. Subtract Line 44 from Line 39 to calculate your Basic Federal Tax. If the amount on line 45 is negative then the basic federal tax is 0. Step 15: If the basic federal tax is zero, Enter 0 on lines 52 and 55 and Schedule 1 is complete. Step 16: Enter the amount from line 55 of Schedule 1 into Line 420 on page 4 of the T1 General form. Add lines 420, 421, 430, 422, 428 and enter this in line 435. This is your total payable amount. Step 17: In line 437 enter the sum of the Income Tax Deducted as listed in box 22 of any T4 slips. Add lines 437 to 479 (Note: numbers missing) and enter the total in line 482. This is the Total Tax Credit that you have. Step 18: Subtract Line 482 from line 435. If the total is negative you have a tax refund. If it is positive you have a balance owing. If the amount is $2.00 or less no refund is paid out and no balance owing must be paid. Step 19: Sign and date in the appropriate box at the bottom of Page 4.