Chapter 6, Part 1

advertisement

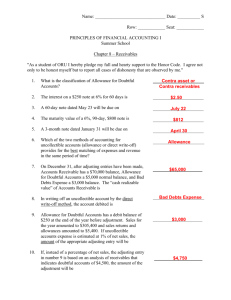

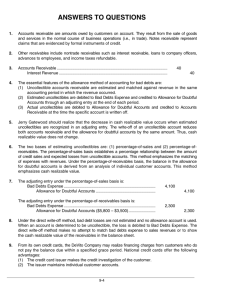

Chapter 6: Reporting & Analyzing Operating Assets Part 1: Accounts Receivable 1 Accounts Receivable Accounts receivable arise from selling goods or services to customers on account. Recorded at face amount to be collected. However, we must also reflect the fact that a portion of A/R may not be collected. Reasons for lack of collection: (1) sales discounts (2) sales returns (3) uncollectible A/R (bad debts) 2 Uncollected A/R (1)Sales Discounts occur when a customer takes advantage of a cash discount for early payment. (2)Sales Returns occur when a customer returns a purchase. (3)Uncollectible A/R (bad debts) occur when a customer defaults on the receivable, and the company cannot collect the amount owed. This item requires a separate expense account (rather than a reduction of revenue). 3 Uncollectible A/R Method 1:Direct Write-Off Method Small (or privately held) companies may use this technique to recognize uncollectible A/R. In the year that a specific A/R is deemed uncollectible (usually 1 – 2 years after the initial sale/service transaction), the company would remove the A/R, and recognize bad debt expense: Bad Debt Expense xx A/R xx However, A/R is overstated until the write-off and the Bad Debt Expense is not recognized in the same period as the revenue (no matching). 4 Uncollectible A/R Method 2: the Allowance Method For matching, we estimate the A/R that will not be collected, and match that expense to current revenues. The AJE (adjusting journal entry) to record an estimate for future uncollectibles in year of sale: Bad Debt Expense xx Allowance for Uncoll. xx The General JE in later periods, when a specific A/R is deemed uncollectible (this is called the write-off of a specific A/R): Allowance for Uncoll. xx A/R xx 5 Estimation of Uncollectibles Note that we do not know in the year of the sale which A/Rs will not be collected in the future. Therefore, we must estimate uncollectibles. There are two methods to estimate uncollectibles (for the AJE): 1. Percentage of sales 2. Percentage of accounts receivable Both methods are acceptable under GAAP(generally accepted accounting principles). 6 Percentage of Sales Method The percentage of sales method is very simple. Based on some percentage, derived from historical data, industry averages, economic conditions, etc., the estimated expense may be calculated: Revenue x % = Bad Debt Expense This is also called the income statement method. The AJE, based on this number, is Bad Debt Expense x Allowance for Uncoll. x 7 Percentage of A/R Method (using Aging Schedule) Based on ending A/R and ending Allowance account. Calculation: Ending A/R x % = Ending Allowance (focus on the credit side of the AJE) Called Balance Sheet approach, because: ending asset x % = ending contra asset. Requires the analysis of the Allowance account before preparing the AJE. An aging schedule of A/R is the most accurate way to estimate uncollectibles (see Exhibit 6-1). 8 Percentage of A/R Method (using Aging Schedule) The aging schedule is beneficial, even if the Direct Write-off method is used. The aging schedule highlights slow-payers (including insurance companies), and allows the company to develop additional collection techniques. Many billing programs will do an aging schedule, and include the information on each customer’s bill. 9 T-Account Approach for Percentage of A/R Method Based on the analysis of the Allowance account. Calculate the “desired ending balance” based on an aging of A/R. Now, given the Beginning, Ending and Write-off amounts, calculate the amount of the current estimate that must be added to the Allowance account to achieve the “desired ending balance.” 10 Allowance for Doubtful Accts. (T-account) Allowance for Doubtful Accts. 1. Beginning Balance 1. The allowance established in the prior period carries forward for current period write-offs. 11 Allowance for Doubtful Accts. (T-account) Allowance for Doubtful Accts. 2. Write-off of specific accounts receivable Beginning Balance Accounts Receivable 2. Write-off of specific accounts receivable 2. As specific accounts are determined uncollectible during the year, they are written-off to the allowance account as shown. These write-offs may cause the allowance account to have a debit balance before the AJE if the prior year’s expense was underestimated. 12 Allowance for Doubtful Accts. (T-account) Allowance for Doubtful Accts. Beginning Balance Write-off of accounts receivable 3. Ending Balance Accounts Receivable Write-off of accounts receivable 3. The “desired ending balance” in the allowance account is estimated using the percentage calculation or the aging schedule. 13 Allowance for Doubtful Accts. (T-account) Allowance for Doubtful Accts. Beginning Balance Write-off of accounts receivable Bad Debts Expense 4. Recognition of bad debt expense 4. Recognition of bad debt expense Ending Balance Accounts Receivable Write-off of accounts receivable 4. The AJE to record the estimate of uncollectibles is calculated based on the amount necessary to achieve the “desired ending balance” in the allowance account. The focus is on the Allowance account. 14 Class Problem Given the following information: At December 31, 2010, Company Z prepared an aging schedule to determine that the uncollectible accounts receivable at that date were $18,000. The balance in the Allowance for Doubtful Accounts at 1/1/10 was a $3,000 credit. During 2010, the company wrote off $5,000 of specific accounts receivable that were deemed to be uncollectible. Required: prepare the AJE to record the estimated uncollectibles at 12/31/10. 15 Solution to Class Problems (1) Post the beginning balance and write-off. (2) Post the desired ending balance. (3) Post the adjusting journal entry. Allowance for Doubtful Accounts 16 Manipulation of Sales and Bad Debt Expense Financial statement users should be aware of the fact that policies may vary from company to company in recognition of sales and in estimation of bad debt expense. Early recognition of sales (before revenue is realizable) is not GAAP, and is a violation of SEC Regulations. Estimation of bad debt expense may vary because of legitimate reasons and the judgment of the accountants, but may also vary because of manipulation. Users should watch for inconsistencies in the recognition of these amounts from period to period. 17 Other Manipulations of Revenues and Expenses Historically, managers have used estimates and AJEs to create “cookie jar reserves”, or to take a “big bath” to manipulate income statement items. Cookie jar reserves: overestimate expense in current period, and “draw” against estimate in future periods (see Business Insight, page 6-9). Big bath: accrue a number of expenses and losses into one year, so that future years look better. 18 Analysis of A/R and Allowance Basic analysis of the allowance account may reveal inconsistencies in bad debt estimation. Compare change in allowance to change in A/R; growth in one with reduction in the other may indicate manipulation. Review note in the financials relating to the allowance account; the amounts for expense and write-offs are disclosed in this section. See Exhibit 6.4, page 6-8. 19 Ratios Relating to A/R Activity A/R Turnover: Sales Average A/R Indicates how often we “turn over” or collect our A/R. High factor is a positive indicator. Average Collection Period (Days sales outstanding): 365 A/R Turnover Indicates how many days A/R are outstanding. Shorter periods are desirable. 20