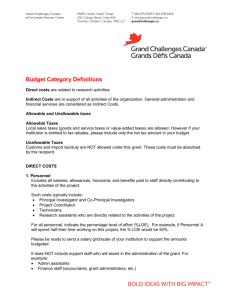

Introducton To Government Contracting (4-28-15)

advertisement

Overview of Accounting Requirements in Government Contracting Warren Stoker Vice President, Government Liaison & Business Process Controls, Textron Inc. University of Texas at Arlington CPA Day – August 20, 2015 Learning Objectives • Identify how certain U.S. Government (USG) acquisition policies drive associated accounting practices • Identify specific USG Contract types requiring unique accounting practices • Identify reasons supporting the requirement for these accounting practices • Review examples of the required accounting practices • Provide sources for additional information 2 Applicable Regulations • Federal Acquisition Regulation (FAR) – FAR is codified in Title 48 of the United States Code of Federal Regulations – FAR and its agency supplements have “the force and effect of law,” see Davies Precision Machining, Inc. v U.S., 35 Fed. Cl. 651 (1995). – Nearly all government agencies are required to comply with the FAR. 3 Significant FAR Parts • FAR part 12 describes policies and procedures unique to the acquisition of commercial items. It implements the Federal Government’s preference for the acquisition of commercial items contained in Title VIII of the Federal Acquisition Streamlining Act of 1994 (Public Law 103-355) by establishing acquisition policies more closely resembling those of the commercial marketplace and encouraging the acquisition of commercial items and components. 4 Significant FAR Parts • FAR Part 15 describes policies and procedures governing competitive and noncompetitive negotiated acquisitions. • Part 16 – Types of Contracts – describes type of contracts that may be used in acquisitions and when the various types should be used. Common contract types used by DOD are Fixed Price, Cost Reimbursement, Cost + award fee, and Cost + incentive fee among others. 5 Significant FAR Parts • Part 30 – Cost Accounting Standards (CAS) Administration - describes policies and procedures for applying CASB rules and regulations to negotiated contracts. • Part 31 – Cost Principles and Procedures – for the pricing of contracts, subcontracts and modifications to contracts and subcontracts when ever cost analysis is performed, and the determination, negotiation, or allowance of costs when required by a contract clause. 6 DoD FAR Part 15 vs. Commercial Acquisition Process • The primary driver relative to DoD vs. Commercial acquisition process is based on the consumer and market relationship. • In commercial markets, consumers typically have many similar products from which to choose (i.e., Ford, GM, Honda, Toyota, etc.). • The consumer makes their choice based on need and available data, including price. • Generally, Price is the primary consideration. 7 DoD FAR 15 vs. Commercial Acquisition Process • DoD acquisitions generally start with issuance of a Request for Proposal (RFP). These proposals will often include the technical requirements that DoD specifies to meet their need (i.e., an aircraft that can fly x mph at x altitude for x period of time with a payload capacity of x). Due to the limitations of companies that are able to comply with security and system requirements for this type of contracting, the list is typically short, and may even be a sole source • Generally, Costs are the primary consideration. 8 Types of Costs - Direct Cost • Direct Cost - any cost that is identified specifically with a particular final cost objective. Direct costs are not limited to items that are incorporated in the end product as material or labor. Costs identified specifically with a contract are direct costs of that contract All costs identified specifically with other final cost objectives of the contractor are direct costs of those cost objectives • Examples of Direct Cost – – – – Program Specific Cost Direct Labor Engineering Manufacturing Assemblies 9 Types of Cost - Indirect Cost • Indirect Cost - any cost not directly identified with a single final cost objective, but identified with two or more final cost objectives or with at least one intermediate cost objective. – FAR Subpart 2.1 • Examples of Indirect Cost – – – – – – Accounting Audit Indirect Labor Office Supplies Human Resource Support Information Technology Support 10 How Indirect Costs are Reported to the Government • Primary Documents the Vendor provides to the USG: – Disclosure Statement – details the manner in which corporate office costs are accumulated (by pool) and subsequently allocated (over base) based on a causal/beneficial relationship as defined in the FAR and DFARS. – Incurred Cost Submittal – Provides the USG with the total corporate cost for the prior year (less those determined to be unallowable, unallocable, or unreasonable) in accordance with the Disclosure Statement. 11 How Indirect Costs are Reported to the Government – Forward Pricing Rates – a forecast of costs for the current year plus three years into the future. These rates are utilized for estimating cost for future USG contracts and would be included with proposals. – Forward Pricing Rate Agreement – formalized agreement between the contractor and the Government defining the rate package (i.e., any escalation factors, assumptions, etc. used in the forecast.) 12 FAR Part 31 Identifies Covered Costs Cost Type FAR Reference Public Relations and Advertising Costs * Bad Debts Bonding Costs Compensation for Personal Services Contingencies Contributions or Donations * Cost of Money Depreciation Economic Planning Costs Employee Morale, Health, Welfare, Food Service, and Dormitory Costs and Credits * Entertainment Costs * Fines, Penalties, and Mischarging Costs Gains and Losses on Disposition or Impairment of Depreciable Property or Other Capital Assets Idle Facilities and Idle Capacity Costs Plant Reconversion Costs Precontract Costs Professional and Consultant Service Costs Recruitment Costs Relocation Costs Special Tooling and Special Test Equipment Costs 31.205-1 31.205-3 31.205-4 31.205-6 31.205-7 31.205-8 31.205-10 31.205-11 31.205-12 31.205-13 31.205-14 31.205-15 31.205-16 31.205-17 31.205-31 31.205-32 31.205-33 31.205-34 31.205-35 31.205-40 Taxes 31.205-41 13 FAR Covered Costs (cont.) Cost Type Termination Costs Independent Research and Development and Bid and Proposal Costs Insurance and Indemnification Interest and Other Financial Costs Independent Research and Development and Bid and Proposal Costs Insurance and Indemnification Interest and Other Financial Costs Labor Relations Costs Lobbying and Political Activity Costs Losses on Other Contracts Manufacturing and Production Engineering Costs Material Costs Organization Costs Plant Protection Costs Patent Costs Trade, Business, Technical and Professional Activity Costs Training and Education Costs Travel Costs * Costs Related to Legal and Other Proceedings Research and Development Costs Goodwill Costs of Alcoholic Beverages * Asset Valuations Resulting from Business Combinations FAR Reference 31.205-42 31.205-18 31.205-19 31.205-20 31.205-18 31.205-19 31.205-20 31.205-21 31.205-22 31.205-23 31.205-25 31.205-26 31.205-27 31.205-29 31.205-30 31.205-43 31.205-44 31.205-46 31.205-47 31.205-48 31.205-49 31.205-51 31.205-52 14 Cost Criteria • In accordance with FAR 31.203 certain criteria must be met in order to charge costs to the USG. • Costs must be Allowable, and • Costs must be Allocable, • Pursuant to guidance in FAR Part 30 – Cost Accounting Standards (CAS). 15 Allowability of Cost • Cost is allowable only when the cost complies with all of the following requirements: – Reasonableness – Allocability (Costs can be allocable but Unallowable) – Standards promulgated by the CAS Board, if applicable, otherwise relevant US GAAP (Generally Accepted Accounting Principles) – Terms of the contract – Any limitations set forth in this FAR Subpart 31.203 • Even if a contract is not CAS covered, Allowable/Unallowable determination must be made • Inconsistent treatment of cost may result in a portion of cost being questioned as unallowable • Contractors are responsible for maintaining adequate cost documentation records in order for the cost to be considered allowable 16 Unallowable Cost Review and Removal • Direct cost (i.e., manufacturing assembly) are charged directly to the contract • Indirect costs (i.e., accounting labor, office supplies) must be “cleansed” before being charged – In a government contracting environment unallowable cost must be removed before costs are charged to the US Government in the Incurred Cost Claim for the year Cost Incurred Unallowable Cost Removed Allowable, Indirect Costs Built into Claim Cost charged to the US Government 17 Allocability of Cost • A cost is allocable if it is assignable or chargeable to one or more cost objectives on the basis of relative benefits received or other equitable relationship. Subject to the foregoing, a cost is allocable to a Government contract if it – Is incurred specifically for the contract – Benefits both the contract and other work, and can be distributed to them in reasonable proportion to the benefits received – Is necessary to the overall operation of the business, although a direct relationship to any particular cost objective cannot be shown 18 Cost Accounting Standards (CAS) CAS are mandatory for use, as applicable, by the prime contractors and subcontractors of all executive agencies in estimating, accumulating, and reporting costs, and settlement of disputes concerning, all negotiated prime contract and subcontract procurements with the United States Government that are in excess of $650,000 and not exempted by CAS Board regulations 19 CAS Sections 401 Consistency in Estimating, Accumulating, and Reporting Costs 402 Consistency in Allocating Costs for the Same Purpose 411 Accounting for Acquisition Costs of Material 412 Composition and Measurement of Pension Cost 403 Allocation of Home Office Expenses 413 Adjustment and Allocation of Pension Cost 404 Capitalization of Tangible Assets 405 Accounting for Unallowable Costs 414 Cost of Money as an Element of the Cost of Facilities Capital 415 Accounting for the Cost of Deferred Compensation 406 Cost Accounting Period 416 Accounting for Insurance Costs 407 Standard Costs 417 Cost of Money as an Element of the Cost of Capital Assets Under Construction 408 Costs of Compensated Personal Absence 418 Allocation of Direct and Indirect Costs 409 Depreciation of Capital Assets 419 Reserved 410 Allocation of G&A 420 Accounting for IR&D and B&P Costs 20 CAS 401: Consistency in Estimating, Accumulating and Reporting Costs • Purpose – To ensure that the contractor’s practices used in estimating costs for a proposal are consistent with cost accounting practices used to accumulate and report costs • Basic requirements – Classification of elements or functions of costs as direct or indirect – The indirect cost pools to which each element or function of costs charged or proposed to be charged – Methods of allocating indirect costs to the contract 21 CAS 401: Consistency in Estimating, Accumulating and Reporting Costs • Purpose • – To ensure that the contractor’s practices used in estimating costs for a proposal are consistent with cost accounting practices used to accumulate and Accounting Earned Value report costs Estimating System Management (incl. Billing, System Basic requirements System Labor, etc.) – Classification of elements or functions of costs as direct or indirect – The indirect cost pools to which each element or function of costs charged or proposed to be charged – Methods of allocating indirect costs to the contract 22 CAS 402: Consistency in Allocating Costs for the Same Purpose • Purpose – No final cost objective shall have any cost allocated as an indirect cost, if other costs incurred for the same purpose, in like circumstances, have been included as a direct cost of that or any other final cost objective, and vice versa • Basic requirements – Equally applicable to estimates of costs to be incurred as used in contract proposals 23 CAS 405: Accounting for Unallowable Costs • Purpose – To facilitate contract negotiation, audit, administration and settlement • Basic Requirements – Costs expressly unallowable, or mutually agreed to be unallowable, shall be identified and excluded from any billing, claim, or proposal – Costs which become designated as unallowable as a result of a CO’s written decision pursuant to disputes procedures shall be identified if included or used in the computation of any billing, claim, or proposal – Costs directly associated with unallowable costs that would not have been incurred if not for the incurrence of the unallowable costs are also unallowable – Costs of any project not contractually authorized shall be accounted for in a manner which allows ready separation from costs of authorized projects – Where unallowable costs are normally part of a base(s) for the allocation of indirect expenses, the unallowable costs shall remain a part of the base(s) 24 CAS 407: Standard Costs • Purpose – To improve cost measurement and cost assignment for contractors that choose to use a "standard" type accounting system • Basic Requirements – Standard costs may be used for estimating, accumulating, and reporting costs of direct material and direct labor when: • Standard costs are entered into the books of the account • Standard costs and related variances are appropriately accounted for at the level of the production unit • Practices regarding the setting and revising of standards, use of standard costs, and disposition of variances are stated in writing and are consistently followed 25 CAS 410: Allocation of G&A Expense • Purpose – To provide criteria for the allocation of business unit G&A expenses to business final cost objectives based on their beneficial or causal relationship • Basic Requirements – Business unit G&A expenses shall be grouped in a separate indirect cost pool which shall be allocated only to final cost objectives – The G&A expense pool shall be allocated by means of a cost input base which best represents the total activity of a typical cost accounting period (i.e., total cost input, value-added cost input, or single element cost input) – Home office expenses received by a segment shall be included in its G&A expense pool (exceptions apply) – Any costs that do not satisfy the definition of a G&A expense can remain in the G&A pool unless they can be allocated on a beneficial or causal relationship best measured by a base other than cost input 26 CAS 418: Allocation of Direct and Indirect Costs • Purpose – To improve classification of costs as either direct or indirect and as such – To provide criteria for accumulating indirect cost into cost pools • Basic Requirements – Indirect costs shall be accumulated in homogeneous cost pools – Pooled costs shall be allocated to cost objectives in reasonable proportion to the beneficial or causal relationship as follows: • If cost pool costs consist of material amounts of management or supervision costs, the pool shall be allocated to a base representative of the activity being managed or supervised. • If management or supervision costs are not significant, the pool shall be allocated based on resource consumption measure 27 CAS 420: Accounting for IR&D and B&P Costs • Purpose – To improve cost allocation of Internal Research & Development (IR&D) and Bid & Proposal (B&P) costs • Basic Requirements – IR&D and B&P costs shall be tracked by individual project – The IR&D and B&P cost pools shall consist of project costs and other allocable costs except G&A – The IR&D and B&P cost pools of a home office shall be allocated to segments based on a beneficial or causal relationship – The IR&D and B&P cost pools of a business unit shall be allocated to the final cost objectives of that business unit based on a causal/beneficial relationship – IR&D and B&P costs incurred in a cost accounting period shall not be assigned to any other period (exceptions apply to IR&D) 28 Costs Must Also Be Determined Reasonable • A cost is reasonable if, in its nature and amount, it does not exceed that which would be incurred by a prudent person in the conduct of competitive business. What is reasonable depends upon a variety of considerations and circumstances, including – Whether it is the type of cost generally recognized as ordinary and necessary for the conduct of the contractor’s business or the contract performance – Generally accepted sound business practices, arm’s-length bargaining as well as Federal and State laws and regulations; – The contractor’s responsibilities to the Government, other customers, the owners of the business, employees, and the public at large – Any significant deviations from the contractor’s established practices 29 Additional Definitions • • • • • • Actual Costs - (except for Subpart 31.6) amounts determined on the basis of costs incurred, as distinguished from forecasted costs. Actual costs include standard costs properly adjusted for applicable variances Allocate - to assign an item of cost, or a group of items of cost, to one or more cost objectives. This term includes both direct assignment of cost and the reassignment of a share from an indirect cost pool Cost Objective - (except for Subpart 31.6) a function, organizational subdivision, contract, or other work unit for which cost data are desired and for which provision is made to accumulate and measure the cost of processes, products, jobs, capitalized projects, etc. Expressly Unallowable Cost - a particular item or type of cost which, under the express provisions of an applicable law, regulation, or contract, is specifically named and stated to be unallowable Indirect Cost Pools - (except for Subparts 31.3 and 31.6) groupings of incurred costs identified with two or more cost objectives but not identified specifically with any final cost objective Profit Center - (except for Subparts 31.3 and 31.6) the smallest organizationally independent segment of a company charged by management with profit and loss responsibilities 30 Additional Resources • • • • Code of Federal Regulations Title 41 of the United States Code Federal Acquisition Regulation (FAR) Defense Federal Acquisition Regulation Supplement (DFARS) • Defense Contract Management Agency (DCMA) • Defense Contract Audit Agency (DCAA) 31