Income Recognition and Measurement of Assets

advertisement

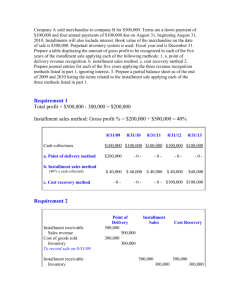

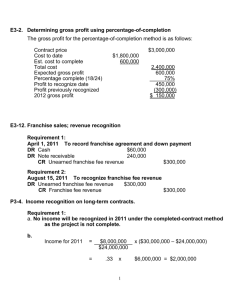

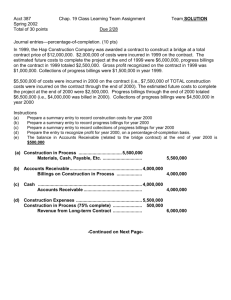

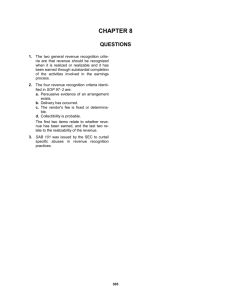

Chapter18 Income Recognition and Measurement of Assets Intermediate Accounting 10th edition Nikolai Bazley Jones An electronic presentation by Norman Sunderman Angelo State University COPYRIGHT © 2007 Thomson South-Western, a part of The Thomson Corporation. Thomson, the Star logo, and South-Western are trademarks used herein under license. 2 Revenue Recognition Recognition is the process of formally recording and reporting items in the financial statements. 3 Revenue Recognition Realization is the process of converting noncash recourses into cash or rights to cash. 4 Revenue Recognition Example 1: Revenue Recognition at Time of Sale 1. Ringwood Company manufactures the inventory. Inventory 100 Cash 2. Ringwood sells the inventory for $150. Accounts Receivable Revenue Cost of Goods Sold Inventory 100 150 150 100 100 5 Revenue Recognition Example 1: Revenue Recognition at Time of Sale 3. Ringwood collects cash of $60. Cash Accounts Receivable 60 60 Income Statement Revenue Cost of goods sold Gross profit $150 (100) $ 50 6 Revenue Recognition Example 2: Revenue Recognition During Production 1. Ringwood Company manufactures the inventory. Inventory 100 Cash 100 2. Ringwood recognizes the revenue during production (the manufacturing process). Production Expense 100 Inventory 50 Revenue 150 7 Revenue Recognition Example 2: Revenue Recognition During Production 3. The company bills the customer for a partial billing of $130. Accounts Receivable 130 Partial Billings 130 4. Ringwood collects cash of $60. Cash Accounts Receivable 60 60 8 Revenue Recognition Example 2: Revenue Recognition During Production Income Statement Revenue Production expense Gross profit $150 (100) $ 50 The balance sheet shows Inventory of $150, less Partial Billings of $130. 9 Revenue Recognition Example 3: Revenue Recognition at Time of Cash Receipt 1. Ringwood Company manufactures the inventory. Inventory 100 Cash 100 2. Ringwood “sells” the inventory and defers the recognition of revenue. Accounts Receivable 150 Inventory 100 Deferred Gross Profit 50 10 Revenue Recognition Example 3: Revenue Recognition at Time of Cash Receipt 3. Ringwood collects cash of $60. Cash 60 Accounts Receivable ($60 ÷ $150) x60 4. The company recognizes revenue on the basis of the $100 cash received. Cost of Goods Sold 40 Deferred Gross Profit 20 Revenue 60 11 Revenue Recognition Example 3: Revenue Recognition at Time of Cash Receipt Income Statement Revenue Cost of goods sold Gross profit $ 60 (40) $ 20 The balance sheet shows Accounts Receivable of $90, less Deferred Gross Profit of $30. 12 Alternative Revenue Recognition Methods 1. 2. 3. 4. 5. Revenue recognition in the period of sale. Revenue recognition prior to the period of sale. Revenue recognition at the completion of production. Revenue recognition after the period of sale. Revenue recognition delayed until a future event. 13 Revenue Recognized Earned and Realizable Not Sufficient Economic Substance Transfer of Risks and Transfer of Risks and Benefits of and Benefits of Ownership Ownership Deposit Method Collectibility is Reasonably Assured Collectibility is Not Reasonably Assured Recognition before Recognition at Installment Physical Transfer Physical Transfer Method Percentage-ofCompletion Method (for Long-Term Contracts) CompletedContract Method (for Long-Term Contracts) Cost Recovery Method Accrual Method: “Normal” Revenue Recognition at Sale 14 Revenue Recognition Prior to the Period of Sale Percentage-of-Completion Method It achieves the goals of accrual accounting. It is consistent with the argument that revenue is earned continuously over the entire earning process. It results in a more relevant measure of periodic income. 15 Percentage of Completion Method AICPA Statement of Position No. 81-1 requires that a construction company use the percentage-of-completion method for long-term contracts when all the following conditions are met: 16 Percentage of Completion Method 1. The company can make reasonably dependable estimates of the extent of progress toward completion, contract revenue, and contract costs. 2. The contract clearly specifies the enforceable rights regarding goods or services to be provided and received by both the company and the buyer, the consideration to be exchanged, and the manner and terms of settlement. 3. The buyer can be expected to satisfy its obligations under the contract. 4. The company expects to perform its contractual obligations. 17 Percentage of Completion Method …for a short-term contract, and The Statement also when there areainherent requires that companyhazards contract beyond the use in thethe completed-contract normal business risks for which method only when at least reasonably dependable one of these conditionsestimates is cannot be made. not met... 18 Completed Contract Method Entries 1, 2, and 3 are the same as those used for the percentage-of-completion method. The completed-contract method does not recognize revenue until the project is completed, so there is no Entry 4 until 2009. 19 Capitalized Interest If interest cost is associated with the funds used in the construction, the firm should include this cost in the Construction in Progress account. 20 Proportional Performance Contracts Used to recognize service revenue earned by performing more than one act if services are to be rendered in more than one accounting period. Types of service transactions Similar performance acts-recognize an equal amount of revenue for each act Dissimilar performance acts-recognize revenue in proportion to direct costs to perform each act. Similar acts with a fixed period for performancerecognize revenue using straight-line method 21 Proportional Performance Contracts Revenue allocate using percentage of direct costs Initial direct costs allocate using percentage of direct costs Direct costs expense as incurred Indirect costs expense as incurred 22 Installment Method Installment sales involve a financing agreement whereby the customer signs a contract,... ...makes a small down payment,... 23 Installment Method …and agrees to make periodic payments over an extended period, often several years. 24 Revenue Recognized at Collection Two methods employed to defer revenue recognition until cash is received are the installment sales method and the cost recovery method. These methods are used only when the point-of-sale or other GAAP revenue recognition methods are not appropriate. These methods may be used only when there is uncertainty about whether the sales price will be collected and when an allowance for bad debts cannot be reasonably estimated. 25 Installment Method Total sales, cost of goods sold, and collections are recorded in the normal manner during the year. 2. At the end of the year, installment sales are identified. The revenue and the related cost of goods sold are “reversed,” and the deferred gross profit is recognized. 3. At the end of the year, the gross profit rate on installment sales is computed. 1. Continued 26 Installment Method 4. A portion of the deferred gross profit is recognized as gross profit. 5. In future years the remaining deferred gross profit is reduced and the gross profit is recognized based on the cash collected on the installment sales. 27 Installment Method Consider the following information for Lee for 2007: Total credit sales $500,000 Total cost of goods sold 390,000 Installment method sales 100,000 Installment method cost of goods sold 75,000 Gross profit rate on installment method sales 25% Cash receipts on installment method sales 20,000 Cash receipts on other credit sales 300,000 Lee Company uses a perpetual inventory method. 28 Installment Method Credit sales during the year 2007: Accounts Receivable Sales Cost of Goods Sold Inventory 500,000 500,000 390,000 390,000 Collected $300,000; $20,000 related to installment sales: Cash Accounts Receivable Continued 320,000 320,000 29 Installment Method Installment sales and related cost of goods sold identified and “reversed” on December 31, 2007: Sales (closed) 100,000 Cost of Goods Sold (closed) 75,000 Deferred Gross Profit, 2007 25,000 Recognized a gross profit of 25% of cash collected on installment sales December 31, 2007 : Deferred Gross Profit, 2007 5,000 Gross Profit Realized on Installment Method Sales 5,000 30 Installment Method Consider the following information for Lee for 2008: Total credit sales $600,000 Total cost of goods sold 430,000 Installment method sales 150,000 Installment method cost of goods sold 105,000 Gross profit rate on installment method sales 30% Cash receipts on installment method sales: 2007 sales 30,000 2008 sales 40,000 Cash receipts on other credit sales 480,000 31 Installment Method Credit sales 2008: Accounts Receivable Sales Cost of Goods Sold Inventory 600,000 600,000 430,000 430,000 Collected $550,000; $70,000 related to installment sales: Cash Accounts Receivable Continued 550,000 550,000 32 Installment Method Installment sales and related cost of goods sold identified and “reversed” on December 31, 2008: Sales 150,000 Cost of Goods Sold 105,000 Deferred Gross Profit, 2008 45,000 Continued 33 Installment Method On December 31, 2008, recognized a gross profit of 25% of cash collected on installment sales for 2007 and 30% for 2008: Deferred Gross Profit, 2007 7,500 Deferred Gross Profit, 2008 12,000 Gross Profit Realized on Installment Method Sales 19,500 34 Cost Recovery Method APB Opinion No. 10 found the cost recovery method of recognizing revenue generally to be unacceptable. However, the Board did agree that this method could be used in exceptional cases where receivables are collected over an extended period and where the terms of the transaction provide no reasonable basis for estimating the degree of collectibility. 35 Cost Recovery Method Consider the following information for the Parken Company: Sale of property under cost recovery method $20,000 Cost of property sold (net) 12,000 Cash collections: 2007 5,000 2008 9,000 2009 6,000 36 Cost Recovery Method During 2007 Accounts Receivable Deferred Gross Profit Property (net) 20,000 8,000 12,000 Collected $5,000 Cash Accounts Receivable Continued 5,000 5,000 37 Cost Recovery Method During 2008 Cash Accounts Receivable December 31, 2008 9,000 Deferred Gross Profit Gross Profit Realized on Cost Recovery Transactions 2,000 9,000 2,000 ($5,000 + $9,000) minus property cost of $12,000 Continued 38 Cost Recovery Method During 2009 Cash Accounts Receivable December 31, 2009 6,000 Deferred Gross Profit Gross Profit Realized on Cost Recovery Transactions 6,000 6,000 The cash collected in 2009 results in the recognition of an equal amount of gross profit. 6,000 39 Revenue Recognition Delayed a Future Event Occurs (Deposit Method) Oscar Company sells a subsidiary to the Pet Company and accepts a $500,000 down payment and a 10% note for the balance of the sale of $7 million. The net assets of the subsidiary are $5 million and Pet Company has the right to cancel the agreement for the next year. Revenue Recognition Delayed a Future Event Occurs (Deposit Method) liability 40 Upon receipt of down payment (Oscar Company): Cash 500,000 Deposit from Purchaser 500,000 When circumstances allow the revenue to be recognized: Interest Receivable 650,000 Note Receivable 6,500,000 Deposit from Purchaser 500,000 Interest Revenue 650,000 10% x $6,500,000 Gain 2,000,000 Net Assets of Subsidiary 5,000,000 41 Software Revenue Recognition Guidelines of AICPA Statement of Position No. 97-2 If a company has an agreement to deliver software that requires significant production, modification, or customization of software, it uses contract accounting for the agreement. 42 Software Revenue Recognition Guidelines of AICPA Statement of Position No. 97-2 If a company has an agreement to deliver software that does not require significant production, modification, or customization of software, it recognizes revenue when (a) persuasive evidence of an agreement exists, (b) delivery has occurred, (c) the seller’s fee is fixed or determinable, and (d) collectibility is probable. 43 Software Revenue Recognition Guidelines of AICPA Statement of Position No. 97-2 A company separately accounts for a service element if (a) the services are not essential to the functionality of any other element of the transaction, and (b) the services are stated separately in the contract such that the total price of the agreement would be expected to vary as the result of inclusion or exclusion of the service. 44 Software Revenue Recognition Guidelines of AICPA Statement of Position No. 97-2 Software arrangements may consist of multiple elements such as additional software products, upgrades and/or enhancements, rights to exchange or return software, and customer support. If contract accounting does not apply, a company must allocate its fee to the various elements based on fair values. 45 Software Revenue Recognition Guidelines of AICPA Statement of Position No. 97-2 A company must allocate any discounts proportionately to all the elements, except that none can be allocated to upgrade rights. 46 Franchise A franchise agreement involves the granting of business rights by the franchisor to a franchisee who will operate the franchised business. 47 Franchise A franchise agreement involves the granting of business rights by the franchisor to a franchisee who will operate the franchised business. 48 Franchise Castle Company sells a franchise that requires an initial franchise fee of $70,000. A down payment of $20,000 cash is required, with the balance covered by the issuance of a $50,000, 10% note, payable by the franchisee in five equal annual installments. 49 Franchise Situation 1: Castle has substantially performed all material services, the refund period has expired, and the collectibility of the note is reasonably assured. Cash Notes Receivable Franchise Revenue 20,000 50,000 70,000 50 Franchise Situation 2: The refund period has expired and the collectibility of the note is reasonably assured, but Castle has not substantially performed all material services. Cash Notes Receivable Unearned Franchise Fees 20,000 50,000 70,000 Castle will recognize the unearned franchise fees as revenue when it has performed all material services. 51 Franchise Situation 3: Castle has substantially performed all material services and the collectibility of the note is reasonably assured, but the refund period has not expired. Cash Notes Receivable Unearned Franchise Fees 20,000 50,000 70,000 Castle will recognize the unearned franchise fees as revenue when the refund period expires. 52 Franchise Situation 4: Castle has substantially performed all material services and the refund period has expired, but the collectibility of the note is not reasonably assured. Cash Notes Receivable Unearned Franchise Fees Franchise Revenue 20,000 50,000 Each year revenue of $10,000 is recognized as cash is collected. 50,000 20,000 53 Franchise Situation 5: The refund period has expired, but Castle has not substantially performed all material services and there is no basis for estimating the collectibility of the note. Cash Unearned Franchise Fees 20,000 20,000 Castle recognizes revenue either under the accrual method (if collectibility is reasonably assured) or the installment method (if it has no basis for estimating the collectibility of the note). 54 Franchise Situation 6: Castle has earned only $30,000 from providing initial services, with the balance being a down payment for continuing services. The refund period has expired and collectibility of the note is reasonably assured. Cash Notes Receivable Franchise Revenue Unearned Franchise Fees 20,000 50,000 30,000 40,000 Castle recognizes the unearned franchise fees as revenue when it performs the continuing services. 55 Continuing Franchise Fee Assume that Castle also charges a continuing franchise fee of $9,000 per year. Fee is earned by providing services Cash 9,000 Continuing Franchise Fee Revenue 9,000 $1,000 of the fee is for National Advertising Cash 9,000 Continuing Franchise Fee Revenue Unearned Franchise Fees 8,000 1,000 56 Consignment Sales Accounting for consignments may be summarized-1. Since title remains with the consignor, when the goods are transferred from the consignor to the consignee, the consignor does not record the sale of inventory. 2. The consignor recognizes revenue only when the sale to the third party occurs. 3. The consignee uses a Consignment-in account. 4. The consignor uses a Consignment-out account, which is a special inventory account. 57 Chapter18 Task Force Image Gallery clip art included in this electronic presentation is used with the permission of NVTech Inc.