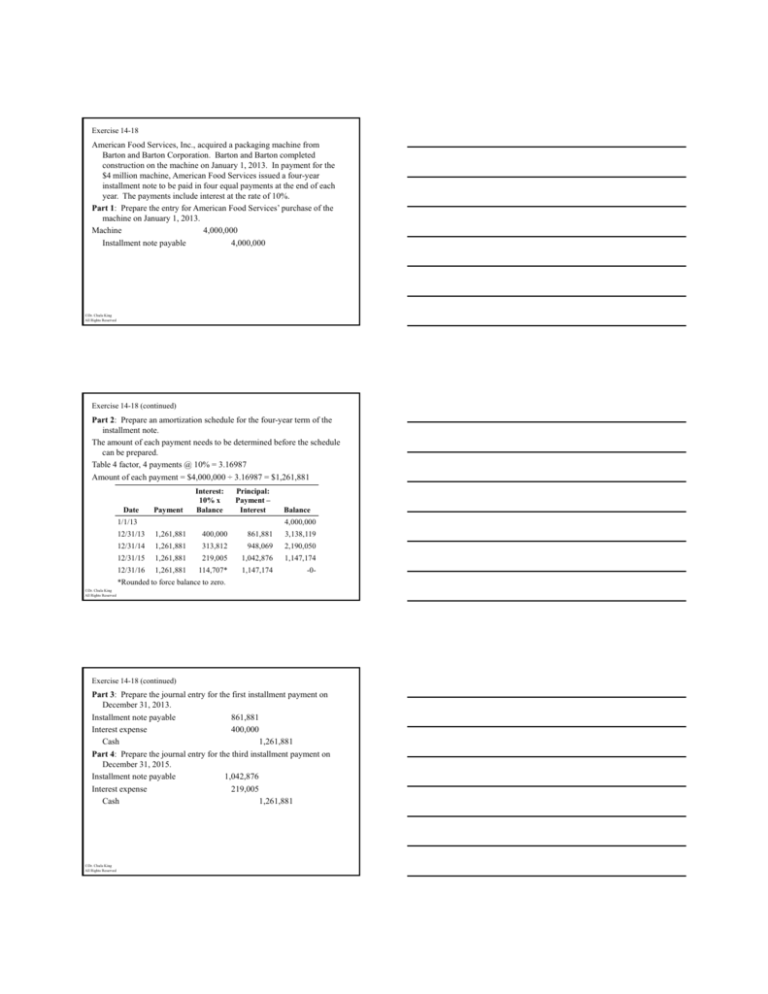

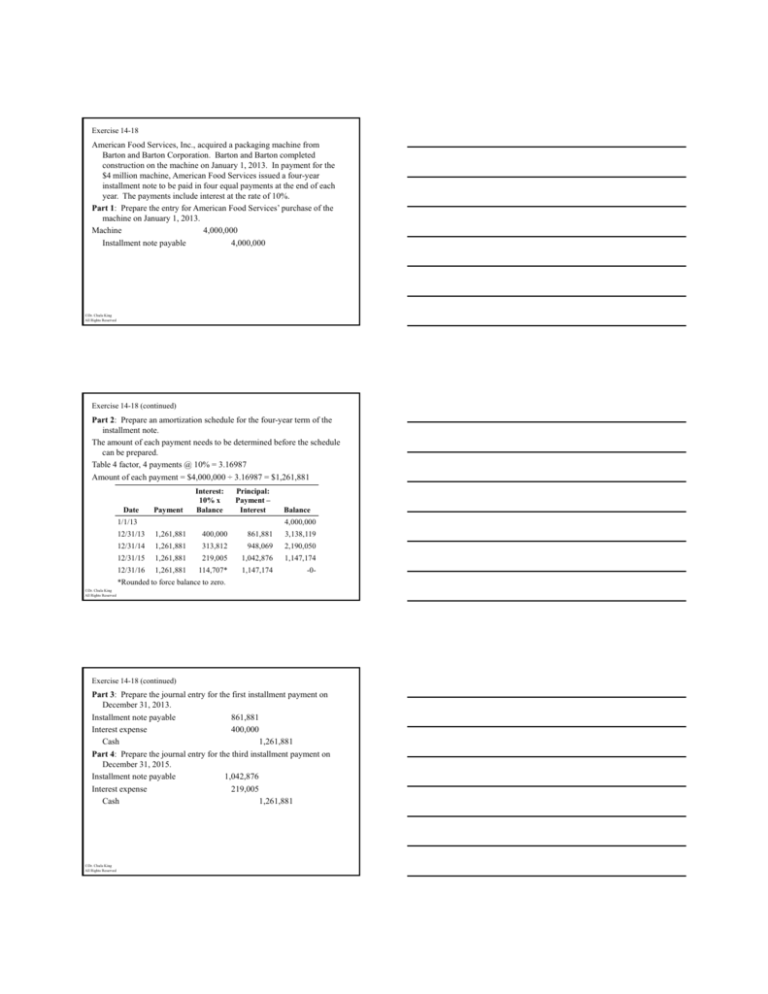

Exercise 14-18

American Food Services, Inc., acquired a packaging machine from

Barton and Barton Corporation. Barton and Barton completed

construction on the machine on January 1, 2013. In payment for the

$4 million machine, American Food Services issued a four-year

installment note to be paid in four equal payments at the end of each

year. The payments include interest at the rate of 10%.

Part 1: Prepare the entry for American Food Services’ purchase of the

machine on Januaryy 1,, 2013.

Machine

4,000,000

Installment note payable

4,000,000

©Dr. Chula King

All Rights Reserved

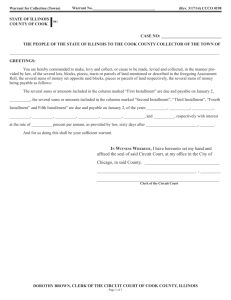

Exercise 14-18 (continued)

Part 2: Prepare an amortization schedule for the four-year term of the

installment note.

The amount of each payment needs to be determined before the schedule

can be prepared.

Table 4 factor, 4 payments @ 10% = 3.16987

Amount of each payment = $4,000,000 ÷ 3.16987 = $1,261,881

Date

Payment

Interest:

10% x

Balance

Principal:

Payment –

Interest

1/1/13

Balance

4,000,000

12/31/13

1,261,881

400,000

861,881

3,138,119

12/31/14

1,261,881

313,812

948,069

2,190,050

12/31/15

1,261,881

219,005

1,042,876

1,147,174

12/31/16

1,261,881

114,707*

1,147,174

-0-

*Rounded to force balance to zero.

©Dr. Chula King

All Rights Reserved

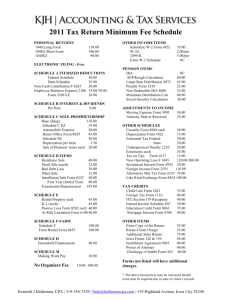

Exercise 14-18 (continued)

Part 3: Prepare the journal entry for the first installment payment on

December 31, 2013.

Installment note payable

861,881

Interest expense

400,000

Cash

1,261,881

Part 4: Prepare the journal entry for the third installment payment on

December 31, 2015.

Installment note payable

1,042,876

Interest expense

219,005

Cash

1,261,881

©Dr. Chula King

All Rights Reserved