What is Strategy? - Strategic Management 3e

advertisement

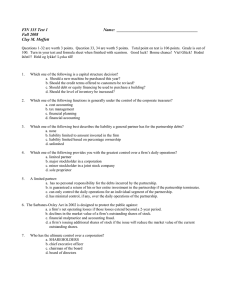

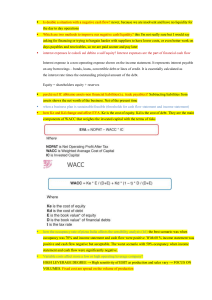

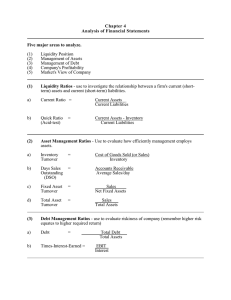

Strategy and Performance Chapter 2 Strategic Management:Value Creation, Sustainability, and Performance, 3e, 2014 Learning Objectives 1. 2. 3. 4. 5. The value of both financial and nonfinancial performance dimensions. Relationship between financial performance and competitive advantage. Use financial analysis to examine strategy. Economic logic of industries and companies. Interaction between strategy formulation and financial analysis. The Goal of Strategy "Superior performance" or "Substantial positive return" or "Above average profitability" or "Above average return on equity" Key Strategy Performance Dimensions Summary performance – the whole firm Relative to competition Over the long run Emerging Performance Considerations Stockholders versus stakeholders Value creation can take many forms: economic, social, cultural, knowledge, etc. Triple Bottom Line Economic Social Ecological or environmental Whole Foods 2014 Stockholder performance ROE Revenue Company 15.1% + 9.9% Industry 8.4% + 1.5% Stakeholder performance Creates larger market for organics farmers Wider shopping choices for consumers Seminars on nutrition and healthy eating GMO transparency Stakeholder Performance Financial Performance Customary measures Return on equity (ROE) Revenue growth Common stock returns (dividends + stock price gains) Market capitalization Calculating ROE – "Dupont Analysis" Detailed Financial Analysis Current financial statements Reveals patterns of investments and strategic behaviors Common-sized statements facilitate comparison of different size competitors Trend analysis – statements over years Changing levels of investments Changing expenses and margins Strategy and Financial Statements Strategic plan and direction Decisions on resource allocations Inter-related sets of activities Patterns of asset allocations Economic Logic "Recipe" for a type of company Club store: "Pile it high, mark it down." Luxury retailer: "Merchandise beautifully, pamper the customer." "Recipe" for an industry Game consoles: "Installed base" Banks: "Net interest margin" Common Industry Operating Metrics Retailing "Same store sales change vs. last year" Airline "RPM" – revenue passenger miles "Load factor" – percentage of seats filled Cable TV Net subscriber additions "Churn" – % subscribers dropping quickly