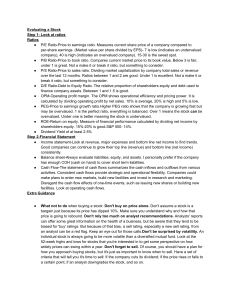

INTERPRETATION OF FINANCIAL RATIOS P/B ratio The price to book ratio is calculated by dividing the market price of the share and the book value of the equity per share. It is used to measure whether and how much a company is undervalued or overvalued by the market. If this ratio is greater than 1, it means that the market gives the company a value greater than its book value, so the latter is overvalued. Conversely, a ratio lower than 1 indicates an undervalued company. We can say that a lower P/B ratio is better. ROE The return on equity is calculated by dividing the net income by the equity employed. It indicates the ability to generate income from the assets. If this is high and P/B is low, we are facing an undervalued company on the market. If the ROE is low and the P/B is high, we are in the opposite situation: an overvalued company. The other combinations (low ROE and low P/B, high ROE and high P/B) raise an alarm and invite caution on that title. Investors are attracted to stocks with low P / BV and high ROE. P/E ratio The price to earnings ratio is calculated by dividing the price paid for a share and the earnings per share, also called Earning Per Share (EPS). The higher P/E corresponds to a higher price paid by investors for each unit (1€) of profit and therefore indicates that an action is more expensive compared to others with lower P/E. P/S ratio The price to sales ratio is calculated by dividing the price paid for a share by the total sales or revenue. Most analysts say that the optimal P/S ratio is equal to 1.5, meaning that the right price (Fair Value) should be equal to one and a half times the turnover per share. A very low P/S ratio (less than 1) could be an alarm signal where a very high P/S ratio (above 2) could be a sign of confidence.