POST-DURBIN IMPACTS

MARKETING AND PRICING RESPONSE

Overview

2

Durbin Amendment positioned by Congress as

beneficial to consumers

GAO

study concluded that competition has led to

increased costs for merchants

Costs of accepting cards is passed along to consumers

Caps on issuer; not on acquirer

Merchant routing can be exclusive

Yet to see impact from multi-homing provision

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Impact on merchants

3

Merchants overall benefiting from lower costs

Industry

experts expect $450 million savings this year

Signature debit transactions much less expensive

PIN debit slightly more expensive

Some merchants seeing much higher costs

$.21

cap morphed into minimum

Primarily affects small-ticket sales such as Red Box

Heartland reports average savings per merchant is

$260.24 per $100,000 in card volume

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Impact on regulated institutions

4

Large banks without major credit card operations

had 40% loss in interchange in Q4 2011

BOA

lost $441million in Q4 debit revenue

Chase lost $263 million in Q4 debit revenue

Wells Fargo lost $337 million in Q4 debit revenue

U.S. Bancorp lost $58 million in Q4 debit revenue

Banks expect annual losses of $6.6 billion in debit

revenue

Banks steering customers to credit cards

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Impact on exempt institutions

5

Slight increase in interchange Q4 2011

Few

tenths of one percent increase among banks

Many credit unions report similar or greater increase in

interchange

Credit unions and community banks experienced

growth in membership/customers in Q4

Increase

in checking accounts and debit cards led to

increased interchange income

But, costs increased due to higher processing costs

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Impact on card associations

6

Slower growth in debit volume

Regulated

institutions promoting credit cards over debit

Unaffiliated network requirement has major

implications

Incentives offered to merchants to maintain volume

Pricing changes planned

Visa

taking lead with FANF and PAVD

Lowering APF

MasterCard taking similar approach in regard to FANF

Creating uncertainty for issuers

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Outcomes

7

Regulated institutions eliminated or pared down

debit rewards

Regulated institutions increased fees on checking

and other services

Customers migrated to exempt institutions

Exempt institutions experiencing increased

interchange revenue in many cases

Merchants report no intentions to pass savings along

to consumers

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Discontent all around

8

Merchants dissatisfied; threaten lawsuit

Want

certain costs removed from calculation

Claim FRB went beyond Congressional intent

Want cap restored to original proposal

FIs dissatisfied; bill initiated to repeal Durbin

Consumers dissatisfied with banks

Believe

that banks benefitted from Durbin

Perceptions based on fee increases

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Fee increases

9

Regulated institutions striving to make up revenue

Extra

$20 per month per account needed

Monthly debit card fees bombed

Meant

to shift cardholders to credit and pre-paid

Shifting to less salient fees

Increasing

monthly maintenance fees on checking

Card replacement fees ($5-$20)

Remote deposit capture ($.50 per check)

Increase in NSF fees ($40)

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Reliance on fee income

10

Net interest margins have sharply declined over

past two decades

Fee income increasingly important to financial

institutions’ bottom lines

Regulatory scrutiny increasingly placed on fee

income

Institutions must become more efficient and less

reliant on fee income

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Emerging and continuing threats

11

Pressure from large merchants to reduce

interchange costs further

Regulations targeting credit card interchange

Regulations targeting other sources of fee income

Cards becoming obsolete

Increasing adoption of alternative payment systems

Checking accounts becoming obsolete

Assets re-pricing at today’s historically low rates

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Strategic response

12

Focus on relationships

Loyalty

lessens rate and pricing sensitivity

Increases efficiency

Less reliance on back-loaded pricing model

Allows

for greater transparency

Seek non-fee sources of non-interest income

Unrelated

business income

Mortgage servicing

Insurance services

Doreen Kelsey Consulting Services 2012 All Rights Reserved

What is efficiency?

13

Leveraging investments to earn a healthy return

Managing processes, programs, and relationships to

earn revenue in excess of costs

Eliminating obsolete processes, programs or

products

Managing and improving customer/member

relationships

Cross-selling

appropriate services

Maximizing balances among services

Maximizing share of wallet

Doreen Kelsey Consulting Services 2012 All Rights Reserved

How is efficiency measured?

14

Efficiency ratios measure percentage of income

needed to cover non-interest expense

Another way to put it: how much does it cost your

organization to earn a dollar?

Lower is better with efficiency ratios

Banks’ efficiency ratios average 55%

Best performing credit unions typically have

efficiency ratios in the 60 - 70% range

Smaller credit unions often closer to 90%

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Why is efficiency important?

15

Previously, earnings model based on net interest

income less operating expenses

Shrinking margins have made industry more

dependent on non-interest income

Regulatory changes and emerging payment systems

threaten to reduce non-interest income

Higher costs for compliance have increased

operating expenses

It’s time to get back to fundamentals

Doreen Kelsey Consulting Services 2012 All Rights Reserved

How not to drive efficiency

16

Focusing solely on cost reduction

Relying on price to drive product and balance

volume

Promoting product of the month

Focusing only on product profitability instead of

household profitability

Focusing only on services sold and not on balances

acquired

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Calculating efficiency ratio

17

Total interest income (line115 on call report)

Plus other operating income (659)

Plus total fee income (131)

Subtotal

Less total interest expense (350)

Equals total adjusted operating income

Divide total non-interest expense (671) by total

adjusted operating income = efficiency ratio

Doreen Kelsey Consulting Services 2011 All Rights Reserved

Back-loaded pricing model

18

Relies on hyperbolic discounting

Consumers

fail to consider contingent costs

End up paying more

Banking industry examples

NSF

fee income funds free checking

Punitive fees/rates fund credit card rewards

Other industry examples

Airfares

Printers

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Hyperbolic discounting

19

Major issuer offers 0% balance transfer with promo

rate effective for six months

Balance transfer fee is 4%

Post-promo rate is 7.9%

Compare to credit union offering 6.9% balance

transfers for life with no balance transfer fee

Cardholder

perceives 0% offer as more beneficial

Yet, effective APR of balance transfer is 8%

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Profitability drivers

20

Drive profitability from cross-sales

Market

driven

Customer centric

Organic growth

Convenience and value drive loyalty

Benefits of high loyalty index

Rates

and fees rank #10 and #11 on a 20-part survey

Service and convenience rank #2 and #3

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Benefits of free checking

21

Exemption offers competitive advantage

Use advantage to gain market share

Interchange income eventually needs to be offset

by other income

Institutions should not be quick to eliminate free

checking

Consumers

say they will switch

Many alternatives now exist

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Leveraging free checking

22

Reduce overdraft fee to increase fee income

Cross-sell credit cards

Interchange

not subject to caps

Credit cards offer two revenue streams

Cross-sell additional loan products

Focus

on refinancing and balance transfers

Target small business owners not being served by

larger institutions

Assist those impacted by financial crisis

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Market for balances

23

Services increase relationship

Cross-sell

services to improve loyalty

But, it’s only half the job needed

Balances increase profits

Market for balances when promoting credit cards

Consumer

debt remains at record levels

Household debt 110% of disposable income currently

In 1980 - 65% by comparison

Consumers want to deleverage, reduce cost of credit

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Credit card preferences

24

Doreen Kelsey Consulting Services 2012 All Rights Reserved

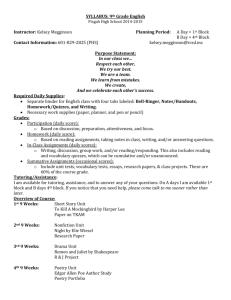

Checking standalone profit

25

Free Checking

Standalone Profit

Post-Durbin

(current interest

rates)

Pre-Durbin

(current interest

rates)

Yields at

historically high

interest rates

Average balance

$2,500

$2,500

$2,500

Interest rate

0.00%

0.00%

0.00%

Replacement rate

.085%

.085%

5.00%

Net margin

.085%

.085%

5.00%

Net interest income

$2.13

$2.13

$125.00

Debit interchange

$41.76

$76.56

$76.56

Gross income

$43.89

$78.69

$201.56

Account expense

$249.00

$249.00

$249.00

Net income

<-$205.1>

<-$170.32>

<-$47.44>

Return on balance

<-8.205%>

<-6.813%>

<-1.898%>

Doreen Kelsey Consulting Services 2012 All Rights Reserved

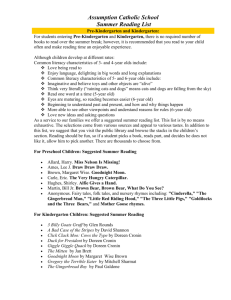

Credit card standalone profit

26

Credit card standalone

profit

Today’s interest rates

Historically high interest

rates

Average card balance

$2,355.00

$2,355.00

Interest rate

14.00%

14.00%

Replacement rate

0.85%

5.00%

Loan loss percentage

4.98%

4.98%

Net interest margin

8.17%

4.02%

Net interest income

$192.40

$94.67

Interchange income

$65

$65

Gross income

$257.40

$159.67

Account expense

$150.00

$150.00

Net income

$107.40

$9.67

Return on balances

Doreen Kelsey Consulting4.56%

Services 2012 All Rights Reserved 0.41%

Mobile channels

27

Adoption of mobile banking accelerating

15%

of all HHs

34% of credit-driven (young, high income)

Shifting from information to transaction based

Continued foray into payments space by PayPal,

Google, Yahoo, Dwolla and more

Industry experts predict cards obsolete in 3-5 years

Checking accounts also may become obsolete

Doreen Kelsey Consulting Services 2012 All Rights Reserved

Factors driving innovation

28

Mostly about convenience

Customers only need to carry phone (not wallets)

Faster than paying with cash; moves the line

Sales tickets higher than when paying with cash

Combines touch points

Payments, shopping list and loyalty rewards

Payment method and marketing medium all in one

Saves money

Merchants avoid minimum fees on multiple, low value

transactions

Merchants will invest in systems that reduce or eliminate

interchange fees

Doreen Kelsey Consulting Services 2012 All Rights Reserved

29

Doreen Kelsey helps organizations become more

strategic and competitive.

Doreen Kelsey Consulting

P.O. Box 8483, Spokane, WA 99203-0483

(800) 716-4479 (509) 499-5223

kelseyconsulting@yahoo.com

Doreen Kelsey Consulting Services 2012 All Rights Reserved