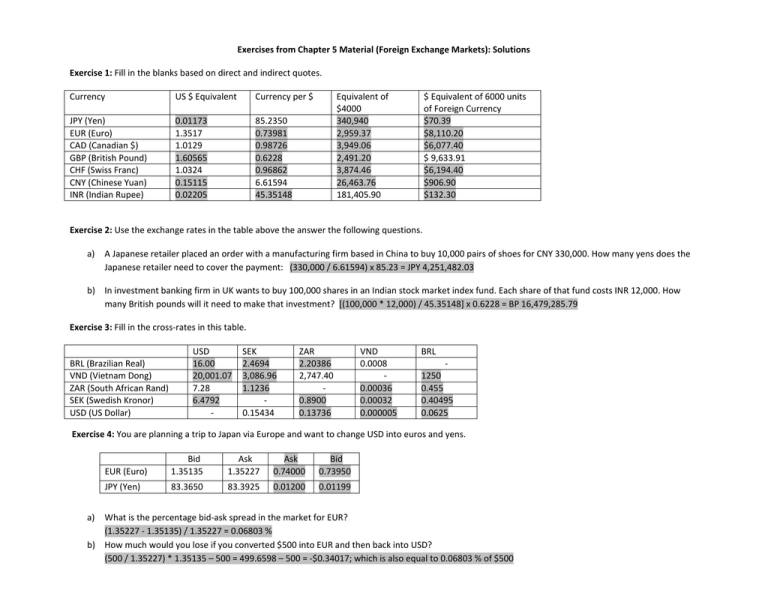

Exercises from Chapter 5 Material (Foreign Exchange Markets): Solutions Exercise 1: Currency US $ Equivalent

advertisement

Exercises from Chapter 5 Material (Foreign Exchange Markets): Solutions Exercise 1: Fill in the blanks based on direct and indirect quotes. Currency US $ Equivalent Currency per $ JPY (Yen) EUR (Euro) CAD (Canadian $) GBP (British Pound) CHF (Swiss Franc) CNY (Chinese Yuan) INR (Indian Rupee) 0.01173 1.3517 1.0129 1.60565 1.0324 0.15115 0.02205 85.2350 0.73981 0.98726 0.6228 0.96862 6.61594 45.35148 Equivalent of $4000 340,940 2,959.37 3,949.06 2,491.20 3,874.46 26,463.76 181,405.90 $ Equivalent of 6000 units of Foreign Currency $70.39 $8,110.20 $6,077.40 $ 9,633.91 $6,194.40 $906.90 $132.30 Exercise 2: Use the exchange rates in the table above the answer the following questions. a) A Japanese retailer placed an order with a manufacturing firm based in China to buy 10,000 pairs of shoes for CNY 330,000. How many yens does the Japanese retailer need to cover the payment: (330,000 / 6.61594) x 85.23 = JPY 4,251,482.03 b) In investment banking firm in UK wants to buy 100,000 shares in an Indian stock market index fund. Each share of that fund costs INR 12,000. How many British pounds will it need to make that investment? [(100,000 * 12,000) / 45.35148] x 0.6228 = BP 16,479,285.79 Exercise 3: Fill in the cross‐rates in this table. BRL (Brazilian Real) VND (Vietnam Dong) ZAR (South African Rand) SEK (Swedish Kronor) USD (US Dollar) USD 16.00 20,001.07 7.28 6.4792 ‐ SEK 2.4694 3,086.96 1.1236 ‐ 0.15434 ZAR 2.20386 2,747.40 ‐ 0.8900 0.13736 VND 0.0008 ‐ 0.00036 0.00032 0.000005 BRL ‐ 1250 0.455 0.40495 0.0625 Exercise 4: You are planning a trip to Japan via Europe and want to change USD into euros and yens. EUR (Euro) Bid 1.35135 Ask 1.35227 Ask 0.74000 Bid 0.73950 JPY (Yen) 83.3650 83.3925 0.01200 0.01199 a) What is the percentage bid‐ask spread in the market for EUR? (1.35227 ‐ 1.35135) / 1.35227 = 0.06803 % b) How much would you lose if you converted $500 into EUR and then back into USD? (500 / 1.35227) * 1.35135 – 500 = 499.6598 – 500 = ‐$0.34017; which is also equal to 0.06803 % of $500 c) What is the percentage bid‐ask spread in the market for JPY? (83.3925 ‐ 83.3650) / 83.3925 = 0.03298 % d) How much would you lose if you converted $500 into JPY and then back into USD? (500 / 83.3925) * 83.3650 – 500 = 499.83512 – 500 = ‐$0.16488; which is also equal to 0.03298 % of $500 e) What is the bid‐ask spread for EUR in terms of JPY? Ask: 1.35227 * 83.3925 = 112.76918 Bid: 1.35135 * 83.3650 = 112.65529 f) What is the bid‐ask spread for JPY in terms of EUR? Ask: 0.7400 * 0.01200 = 0.00888 Bid: 0.7395 * 0.01199 = 0.00887 g) How much would you lose if you converted $500 into EUR, then into JPY, and then back into USD? [(500 / 1.35227) * 112.65529] / 83.3925 = $499.49505 – $500 = ‐ $0.50495 h) How much would you lose if you converted $500 into JPY, then into EUR, and then back into USD? [(500 * 83.3650) / 112.76918] * 1.35135 = $499.49504 – $500 = ‐ $0.50496 Exercise 5: Based on the quotes around a one year interval, determine the extent to which the USD and the foreign currency appreciated or depreciated during the period. 2/14/2010 2/14/2011 % age Appreciation/Depreciation of % age Appreciation/Depreciation of Foreign Currency USD JPY/USD: 90.000 (IQ) JPY/USD: 85.2350 (IQ) ‐5.2944% 5.590% USD/EUR: 1.3329 (DQ) USD/EUR: 1.3517 (DQ) ‐1.391% 1.410% USD/CNY: 0.14631 (DQ) CNY/USD: 6.1659 (IQ) ‐9.787% 10.848% AUD/USD: 1.1225 (IQ) USD/AUD: 1.0047 (DQ) ‐11.3299% 12.778% Also determine the extent to which: ‐ The AUD appreciated or depreciated against the JPY: 2/14/2010 2/14/2011 %Change JPY/AUD 1.1225 * 90.000 = 101.025 (1/1.0047* 85.235) = 85.63058 ‐16.024% ‐ The CNY appreciated or depreciated against the EUR: 2/14/2010 2/14/2011 %Change EUR/CNY 0.14631/1.3329 = 0.10977 1 / (6.1659 * 1.3517) = 0.11998 9.106%