The Evolution of Nation Auto Care An Inside Look at M&A in F&I

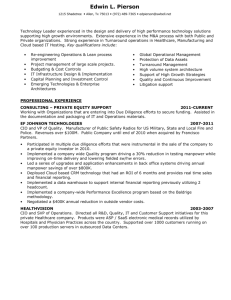

advertisement

The Evolution of National Auto Care An Inside Look at M&A in F&I Agenda • • • • • Introduction to Trivest M&A in F&I The NAC / FFDS Merger Lessons Learned from M&A in F&I Questions & Answers Introduction to Trivest Introduction Jorge A. Gross, Jr. Principal • • • • • • • 10 years at Trivest Responsible for originating, executing and monitoring investments Involved in over 20 transactions totaling more than $600 million in value Current Board member of National Auto Care, GetixHealth and Northfield Previously with Credit Suisse First Boston B.A., Columbia University M.B.A, The Wharton School of the University of Pennsylvania Est. 1981 Oldest PE Firm in the Southeast U.S. Founder / Family-Owned Focus Lower Middle Market Specialists FL 200 Transactions / $5.0 Billion in Value Unparalleled Flexibility Experienced Deal Team Trivest’s Committed Capital Key Investors The following appears as a matter of record only $415,000,000 Notable 1 10 Trivest Founders Invested in Fund V Trivest Fund V, L.P. A partnership formed to invest in founder/family owned businesses April 2013 Relationship Oriented Investment Criteria Investment Type Control Investments Target (Platforms) Founder/Family Owned Geography United States & Canada Company Size Revenues: $20 million and up EBITDA: $4 million and up Business Sector Focus Services Consumer Manufacturing / Distribution Outsourced RCM Solutions Houston, TX Window Treatments New York, NY Industrial Component Manufacturer Schaumburg, IL 16 Portfolio Companies 2,500+ Employees Scrap Recycler Intermediary Columbus, MS $1.2 Billion in Sales OEM Part Supplier Waukesha, WI Quick Service Oil Changes New Orleans, LA Automated Retail Kiosks New York, NY Litigation Support Services Irvine, CA Car Wash Service / Equipment Des Moines, IA Electric Fireplaces Delray Beach, FL Seafood Distribution Pompano Beach, FL Water Purification Products DeLand, FL ALL Founder/Family Owned at Investment F&I Products Administrator Jacksonville, FL Auto Air Fresheners Salt Lake City, UT Systems Integrator Atlanta, GA Freeze Dried Food Salt Lake City, UT M&A in F&I The M&A Process “Today” “Pre-LOI Phase” “Confirmatory Due Diligence” Signed LOI 15 – 30 Days “Investment Period” Transaction Closing 60-75 Days 3 - 5 Years “Second Sale” A Tale of Two Media Companies Company TTM Revenue $1.6 billion $1.8 Billion TTM Net Income $25 Million $600 Million LOSS $2 Billion $18 Billion Market Cap Today’s Value Driven By Future Outlook Public vs. Private Public Company Values Driven Only By Future Growth Private Company Values Driven By Future Growth + Past/Present State Past/Present Strong Projections Maximum Value Valuation Principles Valuation Principles Science • • • • Precedent transactions Public comps Discounted Cash Flow LBO Model vs. Art • • • • Growth opportunities Management team Differentiation Brand/Reputation Math Intangibles Determine the Range Where in the Range Valuation Considerations Purchase Price Considerations Past Performance Customer Concentration Cyclicality Growth Prospects Industry Dynamics Competitive Landscape Depth of Management Needed Investments in Company Cash Generation The M&A Process “Today” “Pre-LOI Phase” “Confirmatory Due Diligence” Signed LOI 15 – 30 Days “Investment Period” Transaction Closing 60-75 Days 3 - 5 Years “Second Sale” Due Diligence Process KeyKey Diligence Areas Investors Accounting Actuarial • Quality of Earnings and tax review • Analysis of reserves and loss experience Legal • Review of legal documents, licenses, records, etc. Industry • Understand market dynamics, opportunities and threats Background Checks • Owners and key managers Insurance / Benefits • Review status of insurance in place at the Company Customers • Survey/customer calls to ensure the Company is in good standing with key customers Diligence Timeline Start Date End Date Holiday Tasks To Be Completed Sign Letter of Intent Diligence Kick-Off Meetings Compilation of Due Diligence Request Items Business Due Diligence (Including On-Site Visits) Background Checks Quality of Earnings & Tax Analysis (Including 2-3 Days On-Site) Third Party Market Study Actuarial Study Insurance & Benefits Review Operations Review Legal Due Diligence Review Distribute Draft Purchase Agreement Finalize Purchase Agreement Closing & Funding September 14 21 28 5 October 12 19 26 2 November 9 16 23 30 Trivest Checklist No "Single Event" Risk…………………………………………………………………………………….. Customers: Management: Diverse customer base (no significant concentration)………………………… Management team filled with A-players………………………………………………………………….. Strong/longstanding customer relationships……………..………………………… History of taking market share……………………………………………………………………………. Strong customer retention / "sticky customers"…………………………………… No concentration of institutional knowledge/customer relationships…………………… Track record of managing through challenges…………………………………………………… Supply chain: No Founder transition issues…………………………………………………………………………. Diverse supplier/partner base (no significant concentration)……………………… Strong partner relationships / "buying power" w/vendors…………………… Business: Differentiated products/services………………………………………………………………………… Sales: Diverse offering of products/services……………………………………………………………………. Robust sales/marketing capabilities……………………………………………… Defensible market niche…………...…………………………………………………………………………………………………… Significant market share…………...…………………………………………………………………………………………………… Other: Compelling value proposition…………...…………………………………………………………………………………………………… No outstanding litigation…………………………………………………………… Attractive cash flow characteristics…………………………………………………………………… Stable competitive environment…………………………………………………… High barriers to entry………………………………………………………………………………………. Clean from an environmental standpoint………………………………………… Identifiable areas for continued growth…………………………………………………………….. Reputation in the industry………………………………………………………… Scalability……………………………………………………………………………………………………………… Strong claims process…………………………………………………………… Solid Loss Experience…………………………………………………………… Financial: Historical sales growth……………………………………………………………………………………. Historical EBITDA growth………………………………………………………………………………….. Consistent margins (increasing not declining)……………………………………………………… Strong financial reporting……………………………………………………………………………………. Robust/accurate budgeting/forecasting capabilities……………………………………… High free cash flow (ability to pay down debt)……………………………………………………. F&I: A Lot to Like Strong Cash Flow Profit Center Sticky Customers Scalable Diverse Customer Base Fragmented Market Buyer Interest F&I: Buyer Beware Regulatory Environment Cyclicality Underwriting Risk Low Barriers to Entry Projection-based Business High Competition Severities Value Drivers in F&I Diversity Consistency Experience Contracts Programs Leadership Customers Sales Loss Ratios Underwriters Unique Knowledgeable Products Losses Cancellations Dealers Differentiated Trustworthy Geographies Customers Severities Agents Valuable Credible The NAC / FFDS Merger Opposites Attract • • • • • • Long-standing Stable Conservative Exclusively VSC Westerville, OH Buckeye Fans • • • • • • Newly Established Innovative Young & Energetic Multiple products Ponte Vedra, FL Gators & Canes Fans Strategic Rationale •Talent •Expertise •Complementary •Full product suite •Cross-selling •New customers Team Redundancy •Technology •Claims Sales Operating Leverage •Scale •Pricing model •Diversity Key Considerations People & Culture Carriers Systems Sales Channels Customers Products Admin Services Integration Plan Project Plan Ownership Goals Leadership Communication Timeline Measure Lessons Learned from M&A in F&I Lessons Learned • • • • • • Information is power Not all TPAs are created equal Mix matters Compliance above all else Growth is hard Earnings curves don’t tell the whole story Q&A Thank you!