DUE DILIGENCE IN VC INVESTING AND EXITS Due

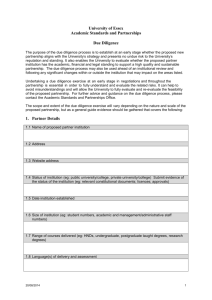

advertisement

REMINDER: The audience is in listen-only mode Please e-mail questions via the Q&A panel box Select questions will be answered during the last 10 minutes of the program Please answer poll questions Webex customer support at 866-229-3239 and welcome you to our webcast: Fine-tuning Your Due Diligence Playbook Introduction Moderator: Mary Kathleen Flynn senior editor/video producer The Deal LLC Bob Profusek partner Jones Day Deborah Farrington founder and co-chairman StarVest Partners LP Steve Deedy managing director/ co-leader of enterprise improvement practice AlixPartners LLP Pamela Ragon senior vice president Allegiance Capital Corp. Due diligence post-financial crisis: What has changed? Regulatory changes that have impacted due diligence for dealmaking Leave no stone uncovered -- the multipronged approach to due diligence: • Accounting and legal • Market and supply chain studies • Intellectual property, licenses and agreements • Customer contact • Employment issues What are the consequences of lengthening the period for due diligence? Evolution of evaluating the operations, market and strategy as well as systems and organization side of a prospective business during due diligence AUDIENCE POLL QUESTION What is the most difficult aspect of the due diligence process? A) Review and authenticate results of foreign operations B) Review intellectual property and patent portfolio C) Gain a firm understanding of the target’s relationships with its partners and vendors D) Lack of cooperation from target company Due diligence in public vs. private companies: Is there a big difference? Private equity approach to risk mitigation DUE DILIGENCE IN VC INVESTING AND EXITS In 2010, VCs invested approximately $22B into 2,749 companies. Among funded companies, it is estimated that: 40% fail 40% return moderate amounts of capital And <20% produce high returns Source: National Venture Capital Association DUE DILIGENCE CRITICAL IN EXPANSION STAGE OF VC-BACKED COMPANIES Due diligence should not just confirm your beliefs Be skeptical of your investment reasons Due diligence is critical part of risk mitigation Due diligence should guide growth strategies, competitive positioning and exit planning AUDIENCE POLL QUESTION #2 How large is your typical internal M&A due diligence team? A) More than 20 B) Between 11 and 20 C) Between 5 and 10 D) Less than 5 people E) The team size vary from deal to deal The evolution of due diligence teams: Size, functions and role Near-term outlook of due diligence: Will it help or hinder dealmaking? AUDIENCE Q&A Upcoming Webcast Brought to you by The Deal LLC and Merrill DataSite, The Deal editor at large Matt Miller moderates this complimentary event “Deal Estate: Analyzing the Pulse of a Changing Commercial Real Estate Market” on Thursday, Sept. 22 at 2 p.m. EST. and thank you for joining our webcast •