“sales,” “ownership” and “title”—to

advertisement

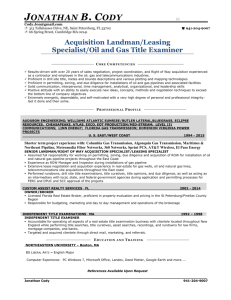

REPRINTS FROM E-DD DISORDER M&A DUE DILIGENCE IN THE E-INFORMATION AGE BY HOLLY K. TOWLE A fundamental commerce shift from bricks-and-mortar to clicks-withoutborders has changed the rules of due diligence. As our economy has moved from “goods” to intellectual property and information, due diligence has changed to include reviews for open-source software and its potential “viral” effect. Yet, while intellectual property matters dominate the headlines, “Non-IP/Electronic” due diligence, or E-DD, focuses on issues arising from doing business electronically and information that tends not to enjoy intellectual property protection. The importance of due diligence reviews is no secret. An investigation may reveal risks that lurk below the surface, and only the foolhardy acquirer skips this step. When computer information is created, collected, held, used or discarded, E-DD is essential. Here are a few key due diligence questions for the e-information age. Is the acquisition agreement wording outdated? Most agreements focus on tangible “property” concepts, yet items important in an information economy are not tangible. Some are not even “property.” As intellectual property rights became as or more important than brick-and-mortar assets, wording of acquisition agreements shifted from focusing on tangible property— 1 THE DEAL R E P R I N T S “sales,” “ownership” and “title”—to dealing with “licenses” and intangible intellectual property rights. But another shift beyond IP is necessary. If a target entertainment company is sending computer “robots” to gather ticket prices from Internet auction sites, the gathered facts are not protected by copyright, so getting an assurance that the target is not “infringing” misses the mark. The target could be “trespassing,” however, and E-DD would have used language to capture that kind of difference. Exactly what E-DD laws are we referring to? Assume a buyer wants to send e-mail promotions to post-merger customers. This makes the target’s customer list a valuable asset in the deal. These days, having customers is not the same as being able to send marketing e-mails to them. If E-DD ignores this, the buyer may end up paying for something it is not really getting, specifically the ability to send e-mails to the full list. In another example, new state laws require customer notice upon breach of information security. ChoicePoint Inc. made news in February 2005 when the company provided notice that it had been duped into selling the personal information of almost 145,000 people. ChoicePoint made this disclosure under a 2003 California law (recently followed by about 20 states), more than eight months after the breach occurred. Had ChoicePoint been an acquisition target during that period, asking during E-DD whether it had suffered any security breaches might have elicited important information. Let’s put the potential acquisition risks into perspective: ChoicePoint stock lost 1.3% the day after the announcement, fell nearly 14% the next week and, as of June 2005, was still down more than 12% from the day of disclosure, according to The Wall Street Journal. Won’t a representation regarding compliance with all applicable law solve all of this? No. Many of the new laws do not require anything, so they cannot be violated—they simply create material consequences if the law is ignored. Thus, a target could accurately represent that it is not in violation of law while still being at risk under those laws. To illustrate, assume the target has a Web site where customers make contracts. Those contracts are electronic records and several state and federal laws will affect them simply because they are electronic (that is, these laws do not exist for paper records). For example, under federal law, e-records may be denied legal effect, validity or enforceability if they do not meet certain federal rules. There is no “violation” of law if the rules are not met—the records simply become susceptible to challenge. Worst case, the target might not have the enforceable or valid contracts that it thinks it has—instead, it may have contracts and records that are subject to challenge because that is a consequence of, but not a requirement of, not meeting the new e-rules. Had the acquirer sought a specific representation regarding electronic records and done some E-DD regarding them, it might have paid less for the contracts or added “fix e-records and procedures” to its post-merger to-do list. What’s best, due diligence or a mere representation? E-DD liabilities and issues tend to create an affirmative need to investigate instead of relying on representations in acquisition agreements. REPRINTS FROM In modern practice, a mismatch between privacy policy text and practice may present greater liability or reputational risk and business disruption than many issues examined in traditional due diligence. Review is necessary, not mere assurances. E-DD is a “tip of the iceberg” is- sue, and addressing every new law and concept would be prohibitive. But E-DD commensurate with the circumstances, risks and the target company’s business is a new necessity. This includes updating acquisition agreements and taking another look at the focus of existing due dili- AS FEATURED IN REPRINT FROM DECEMBER 12, 2005 PP. 25 © 2005 THE DEAL LLC. WWW.THEDEAL.COM 2 THE DEAL R E P R I N T S The Deal (ISSN 1547-7584) is published bimonthly by The Deal LLC. ©2005 The Deal LLC. The Copyright Act of 1976 prohibits the reproduction by photocopy machine or any other means of any portion of this publication except with the permission of the publisher. gence. ■ Holly K. Towle is a partner in the Seattle office of Preston Gates & Ellis LLP, head of the firm’s Electronics in Commerce practice and the author of “The Law of Electronic Commercial Transactions.”