Name - TeacherWeb

advertisement

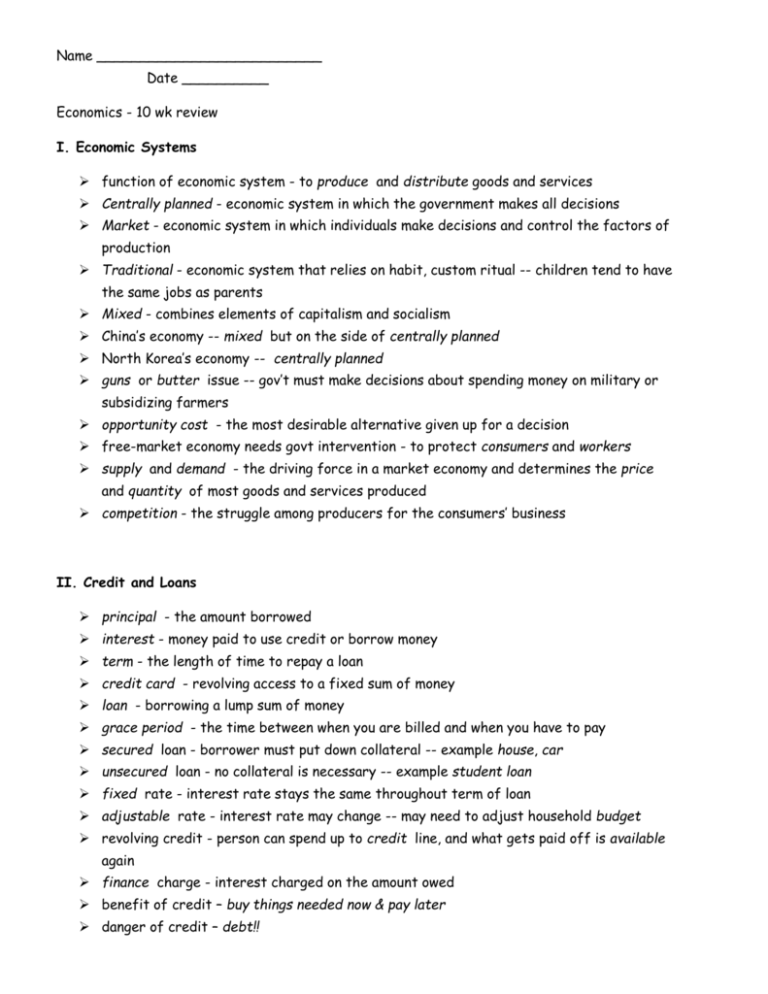

Name __________________________ Date __________ Economics - 10 wk review I. Economic Systems function of economic system - to produce and distribute goods and services Centrally planned - economic system in which the government makes all decisions Market - economic system in which individuals make decisions and control the factors of production Traditional - economic system that relies on habit, custom ritual -- children tend to have the same jobs as parents Mixed - combines elements of capitalism and socialism China’s economy -- mixed but on the side of centrally planned North Korea’s economy -- centrally planned guns or butter issue -- gov’t must make decisions about spending money on military or subsidizing farmers opportunity cost - the most desirable alternative given up for a decision free-market economy needs govt intervention - to protect consumers and workers supply and demand - the driving force in a market economy and determines the price and quantity of most goods and services produced competition - the struggle among producers for the consumers’ business II. Credit and Loans principal - the amount borrowed interest - money paid to use credit or borrow money term - the length of time to repay a loan credit card - revolving access to a fixed sum of money loan - borrowing a lump sum of money grace period - the time between when you are billed and when you have to pay secured loan - borrower must put down collateral -- example house, car unsecured loan - no collateral is necessary -- example student loan fixed rate - interest rate stays the same throughout term of loan adjustable rate - interest rate may change -- may need to adjust household budget revolving credit - person can spend up to credit line, and what gets paid off is available again finance charge - interest charged on the amount owed benefit of credit – buy things needed now & pay later danger of credit – debt!! paying only minimum payment - pay more interest and in debt for longer time III. Investing stocks - ownership shares in a company bonds - loans investors make to corporations or government liquidity - how easily an investment can be converted to cash --- ex high –savings account, ex low – stock, real estate bear market – sluggish market bull market – growing market blue chip stock – large, well-established US company market capitalization - total dollar market value of all of a company’s shares diversification - to make up for losses in one area with gains in another dividends - what you earn on some stock while you own it capital gains - profit made when stock is sold capital loss - when you sell stock for less than you bought it for stock split - may occur when the price of stock gets too high to make shares more available/affordable Mutual funds – pools investors money together in a variety of investments - Diversifies investments - Varying degrees of risk Life cycle funds – invest more aggressively early, more conservatively later Higher risk = higher potential return Investing for growth – over time for growth in market value Starting early - can have great effect on money earned Higher risk = new companies