Name_____________________________________ Pd ______

advertisement

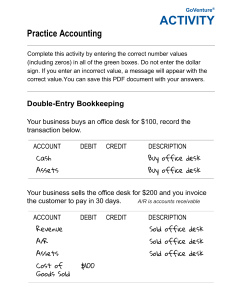

Name_____________________________________ Pd ______ PERSONAL FINANCE FINAL EXAM REVIEW GUIDE 1. Define and understand the following: a. Needs b. Wants c. Goals d. SMART goals e. DECIDE process 2. Compare short term vs. medium term vs. long term goals. 3. Define: a. PYF b. Fixed expense c. Variable expense d. Periodic expense 4. List four different sources of income: 5. Be able to analyze a paystub and define: a. Net pay b. Gross Pay c. Bi weekly pay d. Calculate earnings per hour based on info from a paystub 6. Define budget and when you should review it. 7. Review all your notes on career paths and education for your future including: a. Factors effecting your financial future b. Benefits to a career plan c. Difference between: i. Two year college ii. Four year college iii. Apprenticeship/Trade school iv. Military d. Define and understand: i. Private student loans ii. Government student loans e. List advantages to getting more and more education: f. Define and explain the education ladder approach: g. List five rewards/benefits at work besides a paycheck: h. Define: i. Overtime ii. Commissions, tips and bonus iii. Opportunity cost 8. Identify the SIMPLE INTEREST FORMULA and be able to use it to calculate total interest paid back on a loan: 9. List some advantages and disadvantages to having a credit card. 10. Define the following: a. Late fee b. Over the limit fee c. Annual fee d. Grace period e. Mortgage f. Installment loan g. Revolving credit 11. Define: a. Total debt b. Identity theft c. Identity fraud d. Introductory APR e. Microloan 12. Define the 5 C’s of credit and know how a lender (bank) uses them to approve or deny a loan application: a. Character b. Capacity c. Capital d. Collateral e. Conditions 13. Define credit report and credit score. 14. Compare and contrast a commercial bank vs. a credit union. 15. Define and understand the characteristics of: a. Checking account b. Savings account c. Debit (check) card swiped as debit and as credit (what’s the difference?) d. Post-dating a check 16. Define the following terms from our Investing unit: a. Windfall b. Diversification c. Mutual Fund and its characteristics d. Stock e. Bond f. Collectible g. Inflation h. Asset i. Liability j. Saving vs. Investing k. Risk tolerance, age, investment objectives when investing l. Dollar cost averaging m. IRA vs. 401(K)