Presentation

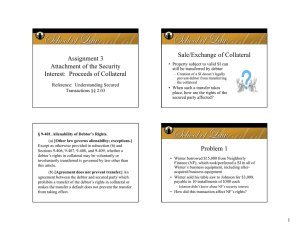

advertisement

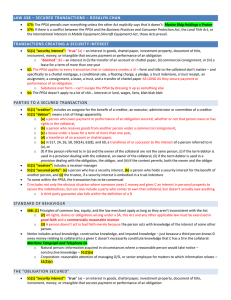

skennedy@hrslaw.com Review Carefully Check Note repayment terms Check names Check collateral Check equity Check use of proceeds If Authorization is incorrect, prepare change letter and send If you have any doubt about what is in the Authorization do a change letter Collect and submit timely Only get one form signed MUST HAVE AN AUDIT TRAIL Must comply with use of proceeds in Authorization Must match disbursements with use within 10% Watch out for EPC/OC. No Working Capital Have reviewed by experienced person Less is more, the more exceptions the less coverage Watch out for: Use covenants Existing liens Some standard Endorsements Oil and Gas Should have with new construction Look for encroachments Look for access Verify balance Determine if Open End Watch for HELOC Future Advances Check all jurisdictions Check Bankruptcy Check Judgments Credit Report will have Order right away to avoid problems POST CLOSING UCC SEARCH: Verify Priority Good to pre-file Be certain of name Be certain of where to file Watch out for collateral that must be in possession of Secured Party (stocks) Process filing takes 7-10 business days Pre-file Similar to Security Agreement Sometimes done if business is licensed May need to posses stock Need for uncertificated stocks, investment accounts, etc. Only way to get to the Collateral and only way to perfect security interest Done with Stock Certificates Sign in blank Must match term of Loan If you don’t care do a change letter because Authorization requires the term of the lease to be as loan as the loan May include renewal options as long as tenant can exercise unilaterally Subordinate Landlord lien to Bank lien Must be able to cure default, so need notice of default and opportunity to cure Must have access to collateral Problem if you don’t get it Rare, but sometimes required Difficult to get May not want it A license is a privilege In Pennsylvania you can take security interest but subject to Liquor Control Board You can get interest in the ability to transfer General Intangible under UCC-1; someone else may have a lien already Should be mentioned in both the Security Agreement and the UCC-1 If the business closes down, you may want to remove the license Good to have so that you can work with Liquor Control Board and taxing authorities, Pennsylvania Department of Revenue Allows lender to execute transfer documents and fill out forms Whole process in SOP Be sure you have all the Franchise Documents and all signed Franchisor should certify that these are all the documents Careful! May render Loan ineligible! Requires notice of default and opportunity to cure Defer franchise fees is Loan is in default (hard to get) Access to Franchisor’s books as they pertain to Borrower Make sure in place Change Endorsement Copy of Declarations page Mortgagee/Lender Loss Payee Must have if they have employees Be certain Insured is correct Owner may be other than insured Copy of the policy Term long enough for loan? Be sure in correct amount Must be signed by OWNER of the policy Must not be assigned to anyone else Must be correct Insured Must be correct Amount Must be assigned as Collateral, NOT CHANGE IN BENEFICIARY Check all parties Be sure allow for Confession of Judgment whether a GP or an LP If not all Partners must sign authority of one Partner to sign Confession of Judgment Get copy of Standby Note Compare to be sure it is correct Be sure you have payee on Note as Standby Creditor If no Note, tell them to draft one Have Note endorsed as follows: “This Note is subject to the terms and conditions of a Standby Creditor’s agreement between Payee and ____________ (Bank) dated the _____ day of _____________, 20__” Critical I prefer an Affidavit One of the first things looked at Cash is King In kind must be supported by appraisal (I would be sure SBA agrees) Careful about where it comes from, there are many specific rules about this Purchase of more than 51% of assets Pennsylvania Department of Revenue clearance Escrow/Indemnification Verify payment of seller taxes Important as this is required by Authorization under collateral where security interest is listed Should have list of all equipment All equipment over the value of $5,000 should have a complete description with serial number Good way to track use of proceeds Same as a Deed for personal property Must have EIN If Borrower requires a license, need a copy (attorney, barber, restaurant with liquor license, dentist, doctor, etc.) Pennsylvania contractors are required to have permits Good to have in a business acquisition Be sure the principal or principals of the seller are bound. No good if seller is a corporation and person that can compete is an individual. They are not bound. Protects Lender and Borrower Must match use of proceeds Need if you have to complete work Post closing Very important for new construction and leasehold improvements New construction only