Intermediate Financial Management-5th ed.

Financial Planning and Control

Financial Planning

Sales forecasts

AFN formula method

Financial plan

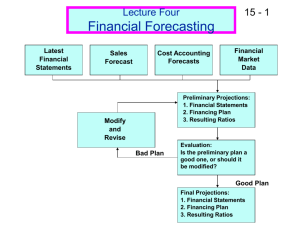

Set up a system of projected financial statements.

Determine the funds needed.

Forecast funds available.

Establish and maintain the system of controls.

Develop procedures for adjusting the basic plan.

Establish the performance-based

Financial Planning and

Control

Financial Planning

The projection of sales, income, and assets based on alternative production and marketing strategies, as well as the determination of the resources needed to achieve these projections.

Financial Control

The phase in which financial plans are implemented; control deals with the feedback and adjustment process required to ensure adherence to plans and modification of plans because of unforeseen changes.

Financial Planning:

The Sales Forecast

A forecast of a firm’s unit and dollar sales for some future period; generally based on recent sales trends plus forecasts of the economic prospects for the nation, region, industry, etc.

Sales Projection

(millions of dollars)

$3,000

$2,500

$2,000

$1,500

$1,000

$500

$0

2009 2010 2011 2012 2013 2014

Projected (Pro Forma)

Financial Statements

A method of forecasting financial requirements based on forecasted financial statements.

ADF = additional funds needed to support the level of forecasted operations

2011 Balance Sheet (in millions of $)

Cash & sec.

Accounts rec.

Inventories

Total CA

Net fixed assets

Total assets

$ 20 Accts. pay & accruals

240 Notes payable

240

$ 500 Total CL

L-T debt

Common stk

Retained

500 earnings

$1,000 Total claims

$ 100

100

$ 200

100

500

200

$1,000

2011 Income Statement

(in millions of $)

Sales

Less: Var. costs (60%)

Fixed costs

EBIT

Interest

EBT

Taxes (3 0%)

Net income

Dividends (30%)

Add’n to RE

$2,000.00

1,200.00

700.00

$ 100.00

16.00

$ 84.00

25 .20

$ 58.80

$ 17 .64

$ 41 .16

BEP

Profit Margin

ROE

DSO (days)

Inv. turnover

FA turnover

TA turnover

D/A ratio

TIE

Current ratio

Payout ratio

Key Ratios

NWC Industry Condition

10.00% 20.00%

2.52% 4.00%

7.20% 15.60%

43.2

32.0

8.33x

4.00x

2.00x

11.00x

5.00x

2.50x

30.00% 36.00%

6.25x

9.40x

2.50x

3.00x

30.00% 30.00%

Poor

Poor

Poor

Poor

Poor

Poor

Poor

Good

Poor

Poor

OK

Key Assumptions

Interest rate = 8% for any debt.

Operating at full capacity in 2011 .

Each type of asset grows proportionally with sales.

Payables and accruals grow proportionally with sales.

2011 profit margin (2.52%) and payout (30%) will be maintained.

Sales are expected to increase by

$500 million. (%

D

S = 25%)

Assets

1,250

1,000

Assets = 0.5 sales

D

Assets =

(A/S)

D

Sales

= 0.5(500)

= 250.

2,500

Sales

0 2,000

A/S = 1,000/2,000 = 0.5 = 1,250/2,500.

AFN formula

AFN= (A*/S)

D

S - (L*/S)

D

S - M(S

1

)(1 - d)

Additional funds needed

Required increase in assets

Spontaneous increase in liabilities

Increase in retained earnings

AFN formula

AFN= Additional funds needed

A*= assets that tied directly to sales, so must increase if sales are to increase

S = sales during the last year

D

S = change in sales =S

1

- S

L*= liabilities that increase spontaneously, normally include account payables and accruals, but not bank loans and bonds

M = profit margin = profit per $1 of sales

AFN formula

S

1= total sales projected for next year

(1 - d)= Retention ratio = the percentage of net income that retained

(A*/S) = percentage of required assets to sales, showing the required dollar increase in asset per $1 increase in sales

(L*/S) = liabilities that increase spontaneously as a percentage of sales, or spontaneously generated financing per $1 increase in sales

What is the AFN based on the AFN equation?

AFN = (A*/S)

D

S - (L*/S)

D

S - M(S

1

)(1 - d)

= ($1,000/$2,000)($500)

- ($100/$2,000)($500)

- 0.0252($2,500)(1 - 0.3)

= $250 - $25 - $44.1

= $180.9 million .

Questions the Financial Planner

Should Consider

Mark Twain once said

“ forecasting is very difficult, particularly if it concerns the future ”. The process of financial planning involves the use of mathematical models

Questions the Financial Planner

Should Consider

In assessing a financial forecast, the planner should ask the following questions:

Are the results generated by the model reasonable ?

Have I considered all possible outcomes?

How reasonable were the economic assumptions which were used to generate the forecast?

Which assumptions have the greatest impact on the outcome?