Lecture 5 - Financial Planning and Forecasting

advertisement

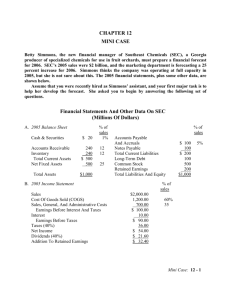

Lecture 5– Financial Planning and Forecasting Lecture 5 - Financial Planning and Forecasting Strategy A company’s strategy consists of the competitive moves, internal operating approaches, and action plans devised by management to produce successful performance. Strategy is management’s “game plan” for running the business. Managers need strategies to guide HOW the organization’s business will be conducted and HOW performance targets will be achieved. 2 Strategic Planning versus Operational Planning Strategic Planning Strategic planning is a systematic process through which an organization agrees on and builds commitment among key stakeholders to priorities that are essential to its mission and are responsive to the environment. n Strategic Planning – formulation – What, where – ends – vision – effectiveness – risk Strategic Planning guides the acquisition and allocation of resources to achieve these priorities. 3 n Operational Planning – implementation – how – means – plans – efficiency – control 4 Lecture 5– Financial Planning and Forecasting Steps in Financial Forecasting Financial Planning and Pro Forma Statements Financial plans evaluate the economics behind the strategy and operations. They consist of six steps: Forecast sales 1. Project financial statements to analyze the effects of the operating plan on projected profits and financial ratios. Project the assets needed to support sales 2. Determine the funds needed to support the plan. Project internally generated funds 3. Forecast funds availability. Project outside funds needed 4. Establish and maintain a system of controls to govern the allocation and use of funds within the firm. Decide how to raise funds 5. Develop procedures for adjusting the basic plan if the economic forecasts upon which the plan was based do not materialize See effects of plan on ratios and stock price 6. Establish a performance-based management compensation system. 5 6 Sales Forecast Sales Forecast Sales forecasts are usually based on the analysis of historic data. An accurate sale forecast is critical to the firm’s profitability: Sales Forecast •Company will fail to meet demand •Market share will be lost Under-optimistic Over-optimistic Too much inventory and/or fixed assets •Low turnover ratio •High cost of depreciation and storage •Write-offs of obsolete inventory •Low profit •Low rate of return on equity •Low free cash flow •Depressed stock price 7 8 Lecture 5– Financial Planning and Forecasting The Percent of Sales Method Step 1 - Analyze the Historical Ratios This is the most common method, which begins with the sales forecast expressed as an annual growth rate in dollar sale revenue. Many items on the balance sheet and income statement are assumed to change proportionally with sales. * * 9 Step 2 – Forecast the Income Statement *Spontaneous generated funds - increase spontaneously with sales 10 How to Forecast Interest Expense Interest expense is actually based on the daily balance of debt during the year. There are three ways to approximate interest expense. Base it on: Debt at end of year Debt at beginning of year Average of beginning and ending debt More… 11 12 Lecture 5– Financial Planning and Forecasting Basing Interest Expense on Debt at End of Year Basing Interest Expense on Average of Beginning and Ending Debt Will over-estimate interest expense if debt is added throughout the year instead of all on January 1. Will accurately estimate the interest payments if debt is added smoothly throughout the year. Causes circularity called financial feedback: more debt causes more interest, which reduces net income, which reduces retained earnings, which causes more debt, etc. But has problem of circularity. Basing Interest Expense on Debt at Beginning of Year A Solution that Balances Accuracy and Complexity Will under-estimate interest expense if debt is added throughout the year instead of all on December 31. Base interest expense on beginning debt, but use a slightly higher interest rate. But doesn’t cause problem of circularity. Easy to implement Reasonably accurate 13 Step 3 – Forecast the Balance Sheet 14 Step 4 – Raising the Additional Funds Needed 15 16 Lecture 5– Financial Planning and Forecasting 2009 Income Statement (Millions of $) 2009 Balance Sheet(Millions of $) Cash & sec. Accounts rec. Inventories Total CA Net fixed assets Total assets $ Sales Less: COGS (87.2%) Dep costs EBIT Interest EBT Taxes (40%) +pr.div Net income 10 Accts. pay. & accruals $ 200 375 Notes payable 110 615 Total CL $ 310 $ 1000 L-T debt 754 Common +pr stk 170 Retained 1000 earnings 766 $2,000 Total Liabilities $2,000 Dividends (Com+Pr Add’n to RE $3,000.00 2616.00 100.00 $ 283.80 88.00 $ 195.80 82.30 $ 113.50 $57.50 $56.00 17 18 AFN (Additional Funds Needed): Key Assumptions Assets vs. Sales Operating at full capacity in 2009. Assets Each type of asset grows proportionally with sales. 2,200 Payables and accruals grow proportionally with sales. 2,000 Assets = 0..667sales ∆ Assets = (A*/S0)∆ ∆Sales = 0..667($300) = $200. 2009 profit margin ($113.5/$3,000 = 3.80%) and retention ratio (56/114) = .49 will be maintained. Sales are expected to increase by $300 million. 19 Sales 0 3,000 3,300 A*/S0 = $2,000/$3,000 = 0.667 = $2200/$3,300. 20 Lecture 5– Financial Planning and Forecasting If assets increase by $200 million, what is the AFN? Definitions of Variables in AFN A*/S0: assets required to support sales; called capital intensity ratio. AFN = (A*/S0)∆S - (L*/S0)∆S - M(S1)(RR) AFN = ($2,000/$3,000)($300) (0.667) ∆S: increase in sales. x $300 L*/S0: spontaneous liabilities ratio - ($200/$3,000)($300) M: profit margin (Net income/sales) - 0.0380($3,300)(0.49) = $118 million (0.067) RR: retention ratio; percent of net income not paid as dividend. x ($300) AFN = $118 million. 21 How Would Increases in Various Items Affect the AFN? 22 Implications of AFN Higher sales: If AFN is positive, then you must secure additional financing. Increases asset requirements, increases AFN. Higher dividend payout ratio: If AFN is negative, then you have more financing than is needed. Reduces funds available internally, increases AFN. Higher profit margin: Pay off debt. Increases funds available internally, decreases AFN. Buy back stock. Higher capital intensity ratio, A*/S0: Buy short-term investments. Increases asset requirements, increases AFN. Pay suppliers sooner: Decreases spontaneous liabilities, increases AFN. 23 24 Lecture 5– Financial Planning and Forecasting Economies of Scale What if Balance Sheet Ratios are Subject to Change We have so far assumed that ratios of both assets and liabilities to sales are constant over time 1,100 1,000 } Assets Sometimes this assumption is incorrect. Declining A/S Ratio Base Stock 0 Sales 2,000 2,500 $1,000/$2,000 = 0.5; $1,100/$2,500 = 0.44. Declining ratio shows economies of scale. Going from S = $0 to S = $2,000 requires $1,000 of assets. Next $500 of sales requires only $100 of assets. 25 26 What if 2009 fixed assets had been operated at 96% of capacity: Lumpy Assets – Buying Discrete Units Actual sales % of capacity Capacity sales = Assets 1,500 = 1,000 500 $3,000 = $3,125. 0.96 Target Fixed Assets/Sales = Actual Fixed Asset Full Capacity Sales = $1,000 $3,125 = 32% Sales 500 1,000 Thus, if sales increase to $3,300 fixed assets would only have to increase to 3,300 x .32 = $1,056 2,000 A/S changes if assets are lumpy. Generally will have excess capacity, but eventually a small ∆S leads to a large ∆A. 27 28 Lecture 5– Financial Planning and Forecasting Summary: How different factors affect the AFN forecast. Excess capacity: lowers AFN. Economies of scale: leads to less-thanproportional asset increases. Lumpy assets: leads to large periodic AFN requirements, recurring excess capacity. 29 30