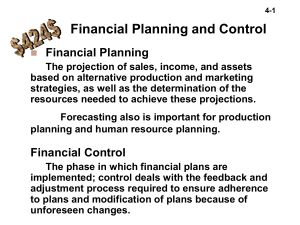

CHAPTER 17 Financial Planning and Forecasting

advertisement

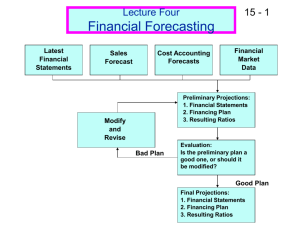

CHAPTER 17 Financial Planning and Forecasting Forecasting sales Projecting the assets and internally generated funds Projecting outside funds needed Deciding how to raise funds 17-1 Balance sheet (2002), in millions of dollars Cash & sec. Accounts rec. Inventories Total CA Net fixed assets Total assets $ 20 Accts. pay. & accruals 240 Notes payable 240 Total CL $ 500 L-T debt Common stock Retained 500 earnings $1,000 Total claims $ 100 100 $ 200 100 500 200 $1,000 17-2 Income statement (2002), in millions of dollars Sales Less: Var. costs (60%) Fixed costs EBIT Interest EBT Taxes (40%) Net income Dividends (30%) Add’n to RE $2,000.00 1,200.00 700.00 $ 100.00 16.00 $ 84.00 33.60 $ 50.40 $15.12 $35.28 17-3 Key ratios BEP Profit margin ROE DSO Inv. turnover F. A. turnover T. A. turnover Debt/assets TIE Current ratio Payout ratio NWC 10.00% 2.52% 7.20% 43.80 days 8.33x 4.00x 2.00x 30.00% 6.25x 2.50x 30.00% Industry Condition 20.00% Poor 4.00% ” 15.60% ” 32.00 days ” 11.00x ” 5.00x ” 2.50x ” 36.00% Good 9.40x Poor 3.00x ” 30.00% O. K. 17-4 Key assumptions Operating at full capacity in 2002. Each type of asset grows proportionally with sales. Payables and accruals grow proportionally with sales. 2002 profit margin (2.52%) and payout (30%) will be maintained. Sales are expected to increase by $500 million. (%DS = 25%) 17-5 Determining additional funds needed, using the AFN equation AFN = (A*/S0)ΔS – (L*/S0) ΔS – M(S1)(RR) = ($1,000/$2,000)($500) – ($100/$2,000)($500) – 0.0252($2,500)(0.7) = $180.9 million. 17-6 How shall AFN be raised? The payout ratio will remain at 30 percent (d = 30%; RR = 70%). No new common stock will be issued. Any external funds needed will be raised as debt, 50% notes payable and 50% L-T debt. 17-7 Forecasted Income Statement (2003) 2002 Sales Less: VC FC EBIT Interest EBT Taxes (40%) Net income $2,000 1,200 700 $ 100 16 $ 84 34 $ 50 Div. (30%) Add’n to RE $15 $35 Forecast Basis 2003 Forecast 1.25 0.60 0.35 $2,500 1,500 875 $ 125 16 $ 109 44 $ 65 $19 $46 17-8 Forecasted Balance Sheet (2003) Assets 2002 Cash Accts. rec. Inventories Total CA Net FA Total assets $ 20 240 240 $ 500 500 $1,000 Forecast Basis 0.01 0.12 0.12 0.25 2003 1st Pass $ 25 300 300 $ 625 625 $1,250 17-9 Forecasted Balance Sheet (2003) Liabilities and Equity 2002 AP/accruals Notes payable Total CL L-T debt Common stk. Ret.earnings Total claims $ 100 100 $ 200 100 500 200 $1,000 Forecast Basis 2003 1st Pass 0.05 $ 125 100 $ 225 100 500 246 $1,071 +46* * From income statement. 17-10 What is the additional financing needed (AFN)? Required increase in assets Spontaneous increase in liab. Increase in retained earnings Total AFN = = = = $ 250 $ 25 $ 46 $ 179 NWC must have the assets to generate forecasted sales. The balance sheet must balance, so we must raise $179 million externally. 17-11 How will the AFN be financed? Additional N/P Additional L-T debt 0.5 ($179) = $89.50 0.5 ($179) = $89.50 But this financing will add to interest expense, which will lower NI and retained earnings. We will generally ignore financing feedbacks. 17-12 Forecasted Balance Sheet (2003) Assets – 2nd pass 2003 1st Pass Cash Accts. rec. Inventories Total CA Net FA Total assets $ 25 300 300 $ 625 625 $1,250 AFN - 2003 2nd Pass $ 25 300 300 $ 625 625 $1,250 17-13 Forecasted Balance Sheet (2003) Liabilities and Equity – 2nd pass 2003 1st Pass AP/accruals Notes payable Total CL L-T debt Common stk. Ret.earnings Total claims $ 125 100 $ 225 100 500 246 $1,071 AFN +89.5 +89.5 - 2003 2nd Pass $ 125 190 $ 315 189 500 246 $1,250 * From income statement. 17-14 Why do the AFN equation and financial statement method have different results? Equation method assumes a constant profit margin, a constant dividend payout, and a constant capital structure. Financial statement method is more flexible. More important, it allows different items to grow at different rates. 17-15 Forecasted ratios (2003) BEP Profit margin ROE DSO (days) Inv. turnover F. A. turnover T. A. turnover D/A ratio TIE Current ratio Payout ratio 2002 2003(E) 10.00% 10.00% 2.52% 2.62% 7.20% 8.77% 43.80 43.80 8.33x 8.33x 4.00x 4.00x 2.00x 2.00x 30.00% 40.34% 6.25x 7.81x 2.50x 1.99x 30.00% 30.00% Industry 20.00% Poor 4.00% ” 15.60% ” 32.00 ” 11.00x ” 5.00x ” 2.50x ” 36.00% ” 9.40x ” 3.00x ” 30.00% O. K. 17-16 What was the net investment in operating capital? OC2003 = NOWC + Net FA = $625 - $125 + $625 = $1,125 OC2002 = $900 Net investment in OC = $1,125 - $900 = $225 17-17 How much free cash flow is expected to be generated in 2003? FCF = = = = = NOPAT – Net inv. in OC EBIT (1 – T) – Net inv. in OC $125 (0.6) – $225 $75 – $225 -$150. 17-18 Suppose fixed assets had only been operating at 75% of capacity in 2002 Additional sales could be supported with the existing level of assets. The maximum amount of sales that can be supported by the current level of assets is: Capacity sales = Actual sales / % of capacity = $2,000 / 0.75 = $2,667 Since this is less than 2003 forecasted sales, no additional assets are needed. 17-19 How would the excess capacity situation affect the 2003 AFN? The projected increase in fixed assets was $125, the AFN would decrease by $125. Since no new fixed assets will be needed, AFN will fall by $125, to AFN = $179 – $125 = $54. 17-20 If sales increased to $3,000 instead, what would be the fixed asset requirement? Target ratio = FA / Capacity sales = $500 / $2,667 = 18.75% Have enough FA for sales up to $2,667, but need FA for another $333 of sales ΔFA = 0.1875 ($333) = $62.4 17-21 How would excess capacity affect the forecasted ratios? Sales wouldn’t change but assets would be lower, so turnovers would be better. Less new debt, hence lower interest, so higher profits, EPS, ROE (when financing feedbacks were considered). Debt ratio, TIE would improve. 17-22 Forecasted ratios (2003) with projected 2003 sales of $2,500 BEP Profit margin ROE DSO (days) Inv. turnover F. A. turnover T. A. turnover D/A ratio TIE Current ratio % of 2002 Capacity 100% 75% 10.00% 11.11% 2.62% 2.62% 8.77% 8.77% 43.80 43.80 8.33x 8.33x 4.00x 5.00x 2.00x 2.22x 40.34% 33.71% 7.81x 7.81x 1.99x 2.48x Industry 20.00% 4.00% 15.60% 32.00 11.00x 5.00x 2.50x 36.00% 9.40x 3.00x 17-23 How is NWC managing its receivables and inventories? DSO is higher than the industry average, and inventory turnover is lower than the industry average. Improvements here would lower current assets, reduce capital requirements, and further improve profitability and other ratios. 17-24 How would the following items affect the AFN? Higher dividend payout ratio? Higher profit margin? Decrease AFN: Higher profits, more retained earnings. Higher capital intensity ratio? Increase AFN: Less retained earnings. Increase AFN: Need more assets for given sales. Pay suppliers in 60 days, rather than 30 days? Decrease AFN: Trade creditors supply more capital (i.e., L*/S0 increases). 17-25