Financial Planning & Forecasting: Global Entrepreneurial Management

advertisement

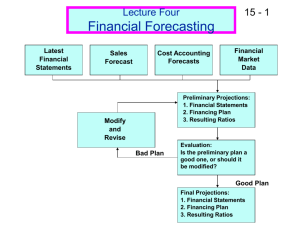

MASTER IN GLOBAL ENTREPRENEURIAL MANAGEMENT UNIT 4 - FINANCIAL PLANNING AND FORECASTING Professor: Francesc Prior Preliminary Financial Forecast: Balance Sheets (Assets) Cash and equivalents Accounts receivable Inventories Total current assets Net fixed assets Total assets 2008 $ 20 240 240 $ 500 500 $1,000 2009E $ 25 300 300 $ 625 625 $1,250 17-2 Preliminary Financial Forecast: Balance Sheets (Liabilities and Equity) Accts payable & accrued liab. Notes payable Total current liabilities Long-term debt Common stock Retained earnings Total liabilities & equity 2008 2009E $ 100 $ 125 100 190 200 315 100 190 500 500 200 245 $1,000 $1,250 17-3 Preliminary Financial Forecast: Income Statements Sales Less: Variable costs Fixed costs EBIT Interest EBT Taxes (40%) Net income Dividends (30% of NI) Addition to retained earnings 2008 $2,000.0 1,200.0 700.0 $ 100.0 16.0 $ 84.0 33.6 $ 50.4 $15.12 $35.28 2009E $2,500.0 1,500.0 875.0 $ 125.0 16.0 $ 109.0 43.6 $ 65.40 $19.62 $45.78 17-4 Key Financial Ratios Basic earning power Profit margin Return on equity Days sales outstanding Inventory turnover Fixed assets turnover Total assets turnover Debt/assets Times interest earned Current ratio Payout ratio 2008 10.00% 2.52% 2009E 10.00% 2.62% Ind Avg 20.00% 4.00% Comment Poor Poor 7.20% 8.77% 15.60% Poor 43.8 days 43.8 days 32.0 days 8.33x 8.33x 11.00x 4.00x 4.00x 5.00x 2.00x 2.00x 2.50x 30.00% 40.40% 36.00% 6.25x 7.81x 9.40x 2.50x 1.99x 3.00x 30.00% 30.00% 30.00% Poor Poor Poor Poor OK Poor Poor OK 17-5 Key Assumptions in Preliminary Financial Forecast for NWC ▪ ▪ Operating at full capacity in 2008. ▪ Payables and accruals grow proportionally with sales. ▪ ▪ Each type of asset grows proportionally with sales. 2008 profit margin (2.52%) and payout (30%) will be maintained. Sales are expected to increase by $500 million. (%DS = 25%) 17-6 Determining Additional Funds Needed Using the AFN Equation AFN = (A0*/S0)DS – (L0*/S0)DS – M(S1)(RR) = ($1,000/$2,000)($500) – ($100/$2,000)($500) – 0.0252($2,500)(0.7) = $180.9 million 17-7 Management’s Review of the Financial Forecast ▪ Consultation with some key managers has yielded the following revisions: ▪ Firm expects customers to pay quicker next year, ▪ ▪ thus reducing DSO to 34 days without affecting sales. A new facility will boost the firm’s net fixed assets to $700 million. New inventory system to increase the firm’s inventory turnover to 10x, without affecting sales. 17-8 Management’s Review of the Financial Forecast ▪ These changes will lead to adjustments in the firm’s assets and will have no effect on the firm’s liabilities and equity section of the balance sheet or its income statement. 17-9 Revised (Final) Financial Forecast: Balance Sheets (Assets) Cash and equivalents Accounts receivable Inventories Total current assets Net fixed assets Total assets 2008 $ 20 240 240 $ 500 500 $1,000 2009F $ 67 233 250 $ 550 700 $1,250 17-10 Key Financial Ratios – Final Forecast Basic earning power Profit margin Return on equity Days sales outstanding Inventory turnover Fixed assets turnover Total assets turnover Debt/assets Times interest earned Current ratio Payout ratio 2008 10.00% 2.52% 2009F 10.00% 2.62% Ind Avg 20.00% 4.00% Comment Poor Poor 7.20% 8.77% 15.60% Poor 43.8 days 34.0 days 32.0 days 8.33x 10.00x 11.00x 4.00x 3.57x 5.00x 2.00x 2.00x 2.50x 30.00% 40.40% 36.00% 6.25x 7.81x 9.40x 2.50x 1.98x 3.00x 30.00% 30.00% 30.00% OK OK Poor Poor OK Poor Poor OK 17-11 What was the net investment in capital? Capital2009 = NWC + Net FA = $625 − $125 + $625 = $1,125 Capital2008 = $900 Net investment in capital = $1,125 − $900 = $225 17-12 How much free cash flow is expected to be generated in 2009? FCF = = = = EBIT(1 – T) – Net investment in capital $125(0.6) – $225 $75 – $225 -$150 17-13 Suppose Fixed Assets Had Been Operating at Only 85% of Capacity in 2008 ▪ The maximum amount of sales that can be supported by the 2008 level of assets is: Capacity sales = Actual sales/% of capacity = $2,000/0.85 = $2,353 ▪ 2009 forecast sales exceed the capacity sales, so new fixed assets are required to support 2009 sales. 17-14 How can excess capacity affect the forecasted ratios? ▪ ▪ Sales wouldn’t change but assets would be lower, so turnovers would improve. Less new debt, hence lower interest and higher profits ▪ EPS, ROE, debt ratio, and TIE would improve. 17-15 How would the following items affect the AFN? ▪ Higher dividend payout ratio? ▪ Higher profit margin? ▪ Increase AFN: Less retained earnings. ▪ Decrease AFN: Higher profits, more retained earnings. ▪ Higher capital intensity ratio? ▪ Pay suppliers in 60 days, rather than 30 days? ▪ Increase AFN: Need more assets for given sales. ▪ Decrease AFN: Trade creditors supply more capital (i.e., L0*/S0 increases). 17-16