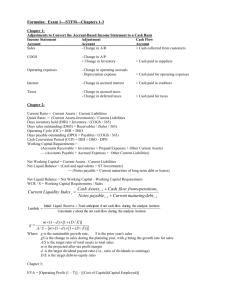

Chapter 16: Feb. 21 & 26

advertisement

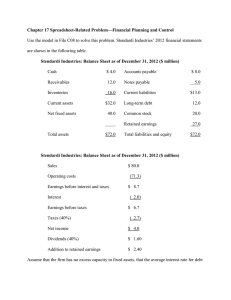

Financial Planning and Forecasting Forecast Sales Project the Assets Needed to Support Sales Project Internally Generated Funds Project Outside Funds Needed Decide How to Raise Funds See Effects of Plan on Ratios 2006 Sales 10,000,000 2006 Total Assets 8,000,000 Want to project 2007 financial statements based on a 30% increase in sales. Projected 2007 Sales 10,000,000(1.30) = $13,000,000 Assets Cash Receivables Inventory 2006 $ 500 $ 2,000 $ 1,500 Liabilities and Equity Accounts payable Accruals Notes payable Total Current Assets $ 4,000 Total Current Liabilities Long-term debt Net fixed assets $ 4,000 Common stock Retained earnings Total Assets $ 8,000 Total Liabilities and Equity 2006 $ 1,000 $ 500 $ 900 $ 2,400 $ 1,600 $ 1,700 $ 2,300 $ 8,000 Income Statement 2006 Sales 10000 Operating Expenses(72.5%) 7250 Operating Income 2750 Interest Expense 250 Income before taxes 2500 Taxes (40%) 1000 Net Income 1500 Dividends (30%) 450 Addition to Retained Earnings 1050 Known as percentage of sales approach. Zippy is operating at full capacity in 2006. Each type of asset grows proportionally with sales. Accounts payable and accruals grow proportionally with sales. 2006 profit margin (15%) and payout (30%) will be maintained. Sales are expected to increase by $3 million. (%S = 30%) Income Statement 2006 times = 2007 Proj Sales 10000 1.3 13000 Operating Expenses(72.5%) 7250 1.3 9425 Operating Income 2750 3575 Interest Expense 250 1.3 325 Income before taxes 2500 1.3 3250 Taxes (40%) 1000 1.3 1300 Net Income 1500 1.3 1950 Dividends (30%) 450 585 Addition to Retained Earnings 1050 1365 Assets Cash Receivables Inventory Total Current Assets Net fixed assets Total Assets 2006 times = 2007 Proj 500 1.3 650 2000 1.3 2600 1500 1.3 1950 4000 5200 4000 1.3 5200 8000 10400 Liabilities and Equity Accounts payable Accruals Notes payable Total Current Liabilities Long-term debt Common stock Retained earnings Total Liabilities and Equity 2006 1000 500 900 2400 1600 1700 2300 8000 times = 2007 Proj 1.3 1300 1.3 650 same 900 2850 same 1600 same 1700 +1365 3665 9815 Projected 2007 Assets 10,400 Projected 2007 Liab&Eq 9,815 Additional Financing Needed 585 Assume Zippy will raise 40% of additional financing needed through Notes Payable and the rest (60%) through Long-term Debt. Addition to Notes Payable 234 Addition to Long-term Debt 351 Liabilities and Equity Accounts payable Accruals Notes payable Total Current Liabilities Long-term debt Common stock Retained earnings Total Liabilities and Equity 2006 1000 500 900 2400 1600 1700 2300 8000 times = Proj2007 1.3 1300 1.3 650 + 234 = 1134 3084 + 351 = 1951 same 1700 + 1365 = 3665 10400 AFN = (A*/S)S - (L*/S)S - M(S1) (RR) RR = retention ratio = 1 – dividend payout AFN = ($8,000 / $10,000) ($3,000) - ($1,500 / $10,000) ($3,000) - 0.15($13,000) (1- 0.3) = $585. 2006 Current 1.67 Quick 1.04 DSO 73.00 InvTurn debt/assets 6.67 50.0% Proj2007 Current 1.69 Quick 1.05 DSO 73.00 InvTurn debt/assets 6.67 48.4% FAT 2.50 FAT 2.50 TAT 1.25 TAT 1.25 ROA 18.8% ROA 18.8% ROE 37.5% ROE 36.3% Sales growth: higher growth leads to more AFN Capital Intensity Ratio (A/S): higher A/S leads to more AFN Spontaneous liabilities to sales ratio (L/S): higher ratio means more internal financing and less AFN Profit Margin (M): higher profit margin means higher net income and less AFN Retention Ratio: higher ratio means more retained earnings and less AFN Assume Zippy’s net fixed assets were operating at 80% capacity and current assets at 100% capacity in 2006. How would Zippy’s additional financing needed change? Need to know what level of sales Zippy’s existing net fixed assets can support or produce = Full Capacity Sales Full Capacity Sales (FCS) = Current Sales/% of Capacity Zippy’s 2006 Sales = 10,000 80% Capacity Full Capacity Sales = 10,000/0.8 = 12,500 Target FA Ratio = 2006 FA/ FCS 4000/12,500 = 0.32 = 32% Proj FA = 0.32(proj sales) = 0.32(13,000) = 4,160 Assets Cash Receivables Inventory Total Current Assets Net fixed assets Total Assets 2006 % of Sales Pro.Sales 500 5% 13000 2000 20% 13000 1500 15% 13000 4000 40% 13000 4000 32% 13000 8000 Proj2007 650 2600 1950 5200 4160 9360 Liabilities and Equity Accounts payable Accruals Notes payable Total Current Liabilities Long-term debt Common stock Retained earnings Total Liabilities and Equity 2006 1000 500 900 2400 1600 1700 2300 8000 Proj2007 1300 650 900 2850 1600 1700 3665 9815 -455 9360 % of Sales 10% 5% same 13000 13000 same same + 1365 = AFN Total New AFN is -455 This means Zippy can reduce debt to make the projected balance sheet balance or just add the surplus financing to the cash account. We have assumed a constant profit margin which means interest expense is assumed to increase proportionally with sales. A company’s financing decision may cause the actual interest expense to be higher or lower than this projection. If the additional financing decision causes interest expense to be higher, then even more financing will be needed. Instead of assuming individual assets will remain a constant percentage of sales, a company can modify their forecast by: using regression analysis to project individual asset accounts. using target financial ratios to project individual asset accounts. Zippy’s 2006 DSO is 73 days, they plan to improve their collection policy and lower their DSO to 60 days in 2007. What is their projected 2007 receivables (projected sales 13,000,000) and reduction in AFN vs. their current DSO? DSO = Receivables/(sales/365) Receivables = DSOx(sales/365) New Receivables projection = 60 x (13,000,000/365) = 2,136,986 Our “original” projection = 73 x (13,000,000/365) = 2,600,000 Reduction in projected receivables = 2,600,000 – 2,136,986 = 463,014 463,014 is also the reduction in AFN. Unless stated otherwise, all expenses are assumed to increase proportionally with sales, yielding the same profit margin At full capacity, all assets increase proportionally with sales Only accounts payable and accrued taxes and wages(accruals) increase proportionally with sales Forecasted Retained Earnings are added to the previous year’s b/s acct. 1 With financial statement forecast, AFN = projected total assets - projected liab&eq Proj. spontaneous assets and liabilities = last year’s ratio of each account to sales times forecasted sales AFN is plug amount that makes the balance sheet balance With AFN equation, AFN = projected change in assets - proj. change in liabilities - projected new retained earnings 2 If fixed assets are operating at less than 100% capacity, determine full capacity sales Full capacity sales = old sales/ % of capacity If projected sales < full capacity sales, no increase in fixed assets is needed If projected sales > full capacity sales, then proj. FA = old FA/Full capacity sales times projected sales 3