CHAPTER 17 Financial Planning and Forecasting

advertisement

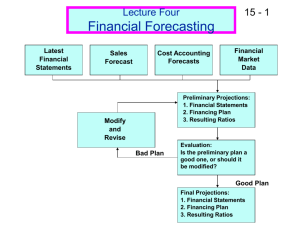

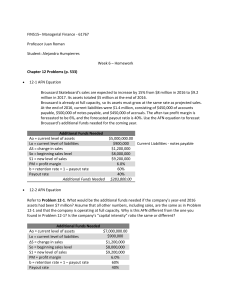

CHAPTER 17 Financial Planning and Forecasting Outline • AFN: Additional funds needed • Income statement: from sales to net income – – – – Sales COGS and Gross Margin Expense and Operating Margin Net income and EPS • Balance sheet: – Increased assets to support increased sales – Increased liability and equity to fund increased assets Key Assumptions in Preliminary Financial Forecast for NWC • Operating at full capacity in 2012. • Each type of asset grows proportionally with sales. • Payables and accruals grow proportionally with sales. • 2012 profit margin (2.52%) and payout (30%) will be maintained. • Sales are expected to increase by $500 million. (%DS = 25%) 17-3 Preliminary Financial Forecast: Balance Sheets (Assets) Cash and equivalents Accounts receivable Inventories Total current assets Net fixed assets Total assets 17-4 2012 $ 20 240 240 $ 500 500 $1,000 2013E $ 25 300 300 $ 625 625 $1,250 Preliminary Financial Forecast: Balance Sheets (Liabilities and Equity) A/P & accrued liabilities Notes payable Total current liabilities Long-term debt Common stock Retained earnings Total liabilities & equity 17-5 2012 $ 100 100 $ 200 100 500 200 $1,000 2013E $ 125 190 $ 315 190 500 245 $1,250 Preliminary Financial Forecast: Income Statements Sales Variable costs Fixed costs EBIT Interest EBT Taxes (40%) Net income Dividends (30% of NI) Addition to retained earnings 17-6 2012 $2,000.0 1,200.0 700.0 $ 100.0 16.0 $ 84.0 33.6 $ 50.4 2013E $2,500.0 1,500.0 875.0 $ 125.0 16.0 $ 109.0 43.6 $ 65.4 $15.12 $35.28 $19.62 $45.78 Key Financial Ratios Basic earning power Profit margin Return on equity Days sales outstanding Inventory turnover Fixed assets turnover Total assets turnover Debt/Assets Times interest earned Current ratio Payout ratio 17-7 2012 10.00% 2.52% 2013E 10.00% 2.62% Ind Avg 20.00% 4.00% Comment Poor Poor 7.20% 8.77% 15.60% Poor 43.8 days 8.33x 4.00x 2.00x 30.00% 6.25x 2.50x 30.00% 43.8 days 8.33x 4.00x 2.00x 40.40% 7.81x 1.99x 30.00% 32.0 days 11.00x 5.00x 2.50x 36.00% 9.40x 3.00x 30.00% Poor Poor Poor Poor OK Poor Poor OK Determining Additional Funds Needed Using the AFN Equation AFN = projected increase in assets-Spontaneous increase in liabilities-increase in retailed earnings (A0*/S0)DS – (L0*/S0)DS – M(S1)(1 – Payout) = ($1,000/$2,000)($500) – ($100/$2,000)($500) – 0.0252($2,500)(0.7)= $180.9 million Notes: ΔS –change in sales, M-Net Profit margin. A0*/S0: asset to sales ratio(capital intensity ratio), at full capacity, A0 is total assets. L0*: spontaneously generated liability An example-WMT 2014Jan Sales $500B Total asset $200 AP $35 AR $15 Profit margin 3% Payout 40% 2015Jan $550 3% 40% Determining Additional Funds Needed Using the AFN Equation AFN = projected increase in assets-Spontaneous increase in liabilities-increase in retailed earnings (A0*/S0)DS – (L0*/S0)DS – M(S1)(1 – Payout)=?